AUD/JPY Price Analysis: Bearish-flag in the daily chart targets the 200-DMA

- AUD/JPY extends its losses to four straight days.

- Pure market sentiment plays had been the main driver of the AUD/JPY.

- AUD/JPY’s break below 91.00 would exacerbate a dive toward the 200-DMA.

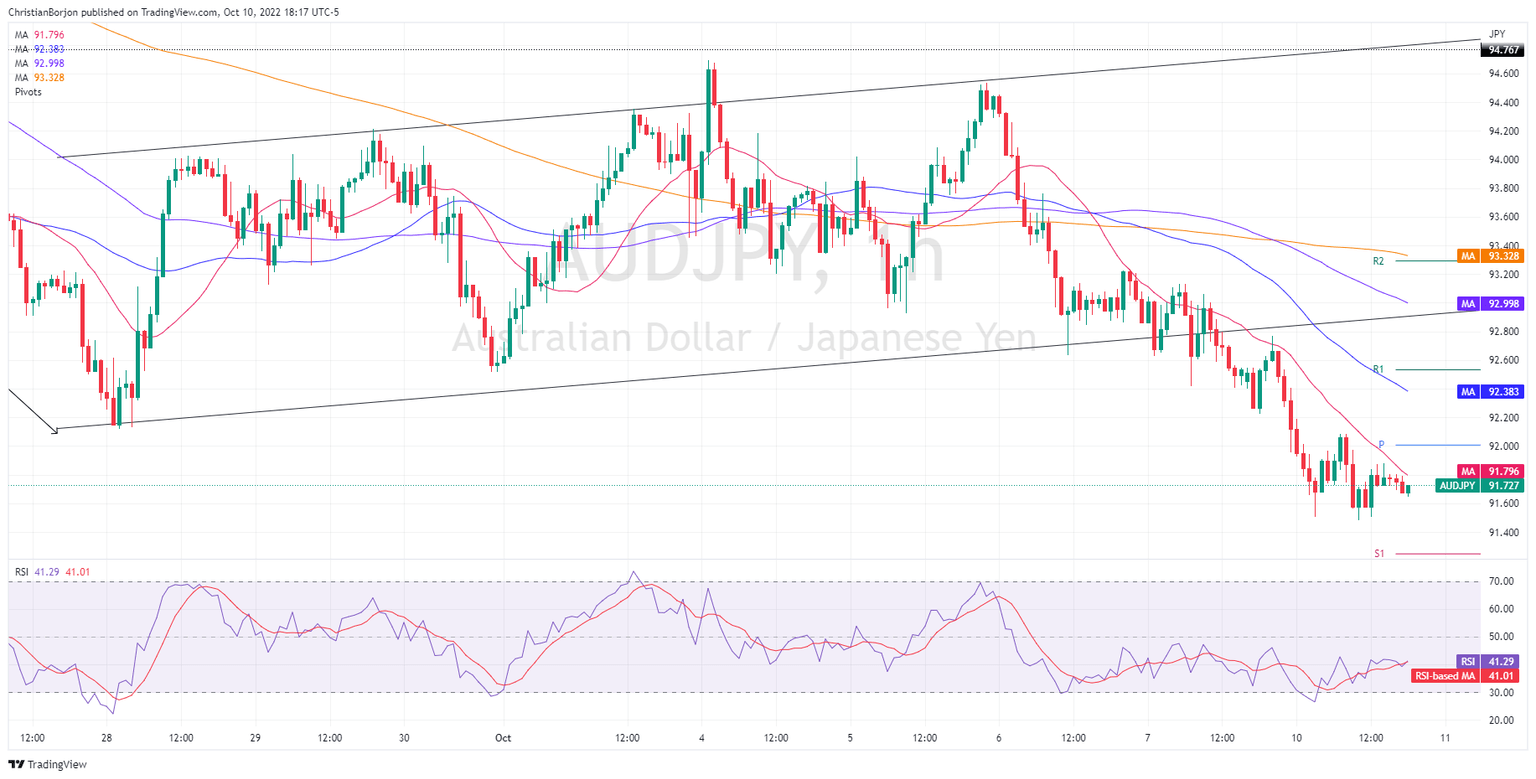

The AUD/JPY falls as the Asian Pacific session begins, breaking below the bottom-trendline of a bearish flag, opening the door for a drop to the 200-day EMA at 90.67, which would be a fresh two-month low. At the time of writing, the AUD/JPY is trading at 91.73, below its opening price, by 0.02%.

AUD/JPY Price Forecast

The AUD/JPY it’s usually a cross-currency pair subject to market sentiment. As reflected by the daily chart, price action illustrates three straight days of losses, meaning that risk aversion had been the main driver, weighing on the cross. As above-mentioned, the AUD/JPY broke downwards, as suggested by the bearish flag, which targets the 200-day EMA. On its way south, the AUD/JPY first support would be the 91.00 figure, followed by the 200-day EMA at 90.67. If AUD/JPY sellers gather momentum, a fall toward 90.00 is on the cards.

The AUD/JPY one-hour time frame is downward biased due to the cross staying below the 20-EMA. It should be noted that the Relative Strength Index (RSI remained steady below the 50-midline in bearish territory and got into oversold territory around yesterday’s trading session. Nevertheless, unless buyers step in and clear key resistance around 91.79 (20-day EMA), that would pave the way toward the daily pivot at 92.00. If that scenario plays out, the AUD/JPY next potential supply zone would be the 50-EMA at 92.38, followed by the R1 daily pivot at 92.54.

On the flip side, the AUD/JPY’s first support would be October’s 10 daily low at 91.48, followed by the S1 daily pivot at 91.24, followed by the 91.00 figure.

AUD/JPY Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.