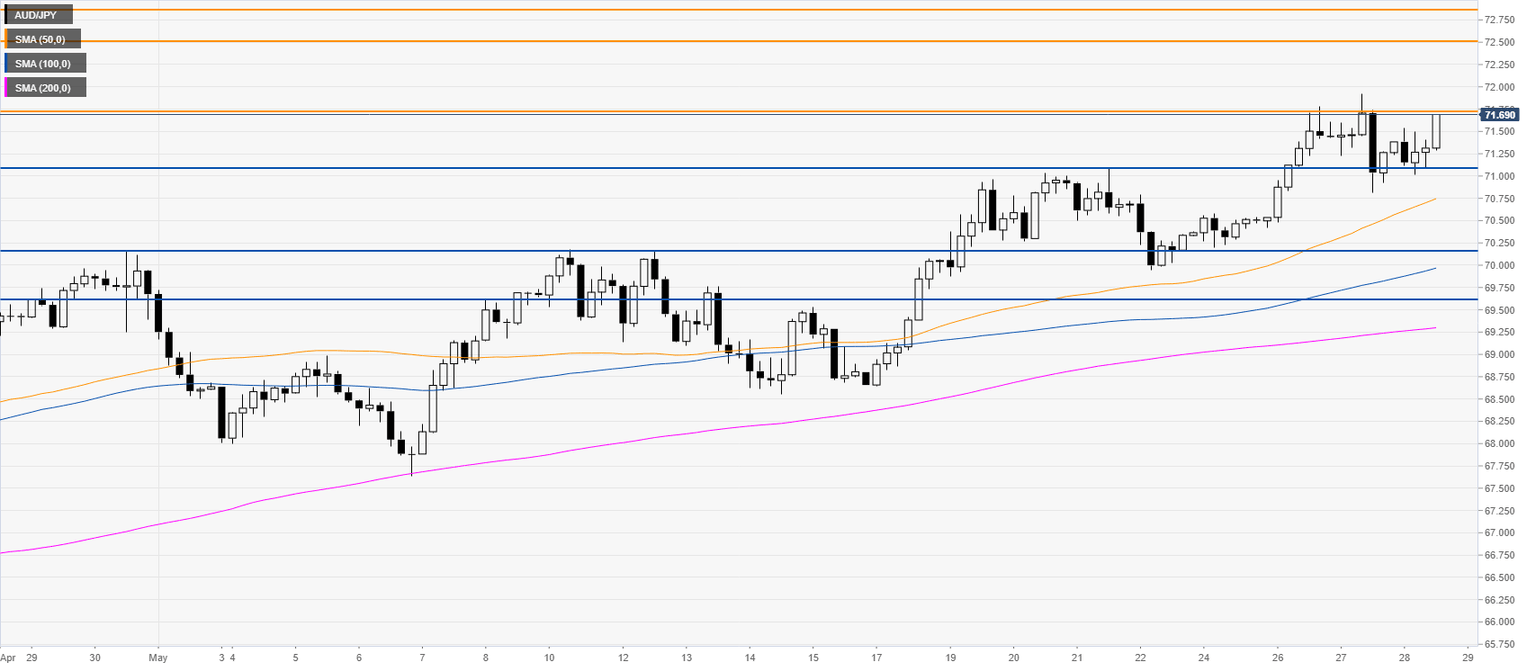

AUD/JPY Price Analysis: Aussie trading in 12-week highs vs. Japanese yen

- AUD/JPY is trading in 12-week highs as the risk-on mood in Wall Street stays intact.

- The level to beat for buyers is the 71.75 resistance.

AUD/JPY four-hour chart

Additional key levels

Author

Flavio Tosti

Independent Analyst