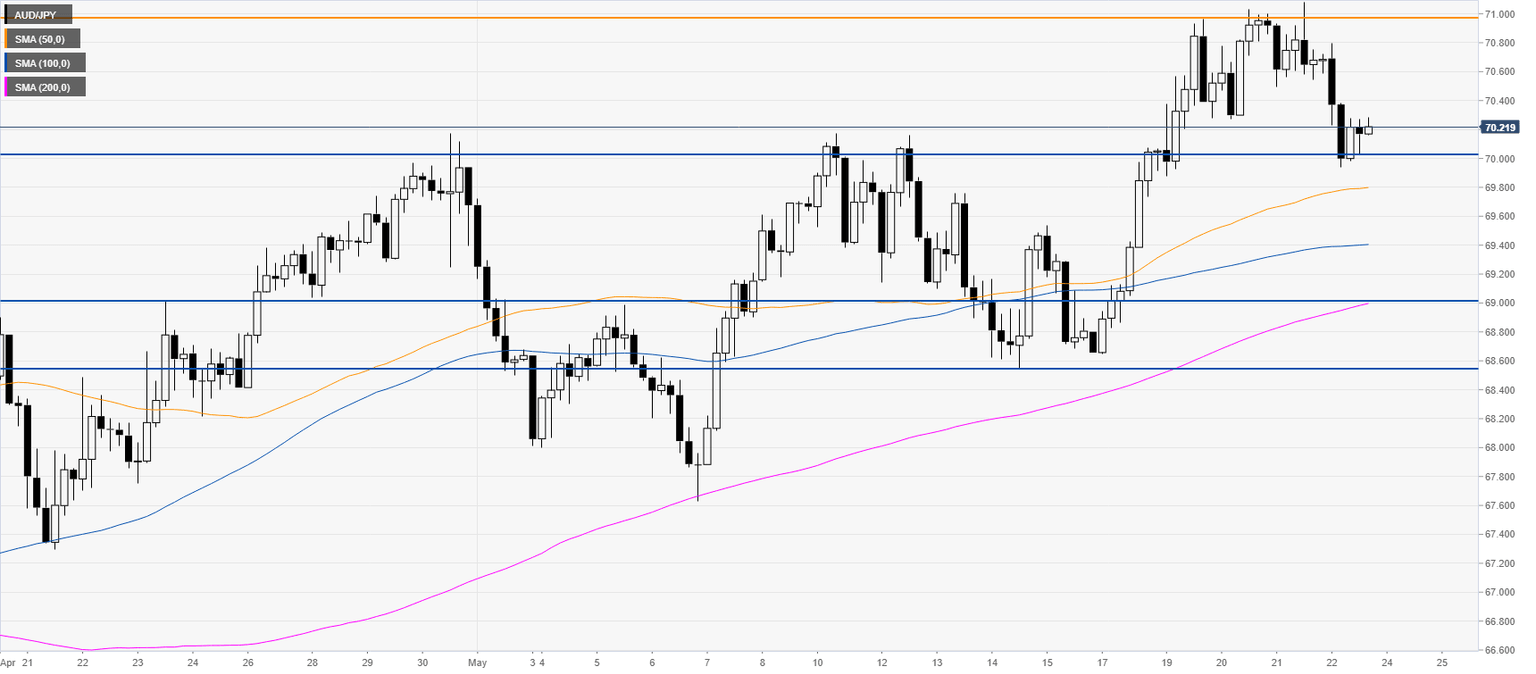

AUD/JPY Price Analysis: Aussie retreats to the 70.00 level vs. Japanese yen

- AUD/JPY is retreating after hitting 2.5-month highs earlier in the week.

- Support can be seen near the 70.00 and 69.00 figures.

AUD/JPY four-hour chart

Additional key levels

Author

Flavio Tosti

Independent Analyst