Are Caterpillar and Deere setting up to rally in 2023?

-

Caterpillar advanced 41.28% in the past three months and 19.16% year-to-date.

-

That’s ahead of the S&P 500’s gain of 2.47% in the past three months and its decline of 18.68% year-to-date.

-

Meanwhile, Deere is up 26.57% in the past three months and 29.76% year-to-date.

-

5 stocks we like better than Caterpillar.

You may think of equipment makers Caterpillar Inc. (NYSE:CAT) and Deere & Company (NYSE:DE) as literally moving slowly, but these heavy equipment stocks outran the S&P 500 throughout 2022 and pulled into a sprint to end the year.

Despite its name, Caterpillar hasn’t exactly been crawling. The stock advanced 41.28% in the past three months and 19.16% year-to-date. That’s quite a difference from the S&P 500’s gain of 2.47% in the past three months and its decline of 18.68% year-to-date.

Meanwhile, Deere is up 26.57% in the past three months and 29.76% year-to-date.

A comparison with the S&P 500 is apt, as both stocks are components of the large-cap domestic index.

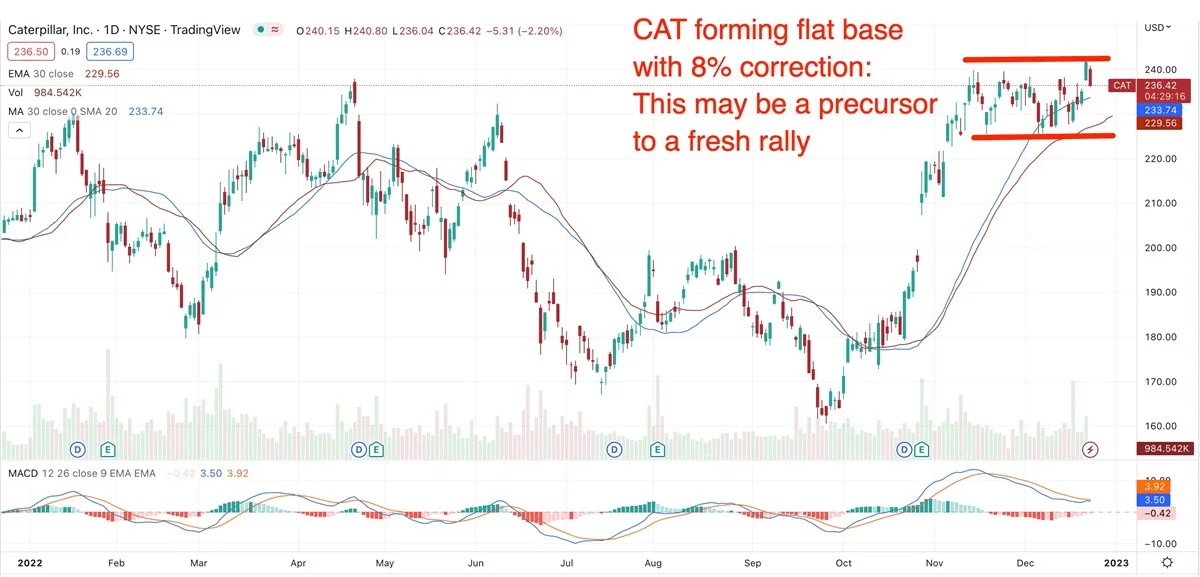

On Wednesday, Caterpillar cleared a buy point north of $239.85 in heavier-than-normal trading volume. The only company-specific news was the appointment of current vice president Lou Balmer-Millar as chief sustainability officer, which by itself isn’t likely to boost share prices.

However, the move underscores Caterpillar’s, as well as its industry’s, focus on technological advancement. For example, last week, the company said it would collaborate with longtime customer Luck Stone, the nation’s largest producer of crushed stone, to deploy autonomous technologies at a plant in Virginia.

Caterpillar already operates a fleet of autonomous trucks; the new partnership will expand that initiative into applications beyond mining. Caterpillar will implement its existing autonomous MineStar Command for Hauling system at a Luck Stone quarry, using a fleet of 777G trucks. The aim is to gather data on quarry operations to further develop the next generation of autonomous solutions specific to quarry and related applications.

The stock broke out of a constructive first-stage cup base in November. That base corrected 32% and undercut the previous structure low, which can often begin a setup for the next round of price gains.

After that, Caterpillar began forming a flat base that corrected 8%. That’s the base the stock cleared on Wednesday. Shares gapped down at the open Thursday, as the broader market also pulled back. Even so, Caterpillar is showing technical strength as a market-beating stock that is well-positioned for a potential rally in the not-so-distant future.

At long last, infrastructure spending boost?

A factor that could boost Caterpillar and Deere is the highly touted infrastructure bill. While investors and especially media pundits have been anticipating for more than a year to see certain sectors take off due to infrastructure spending, those expectations may finally come to fruition in 2023.

As municipalities set their fiscal 2023 budgets, more items pertaining to infrastructure spending will result in projects that could require heavy equipment.

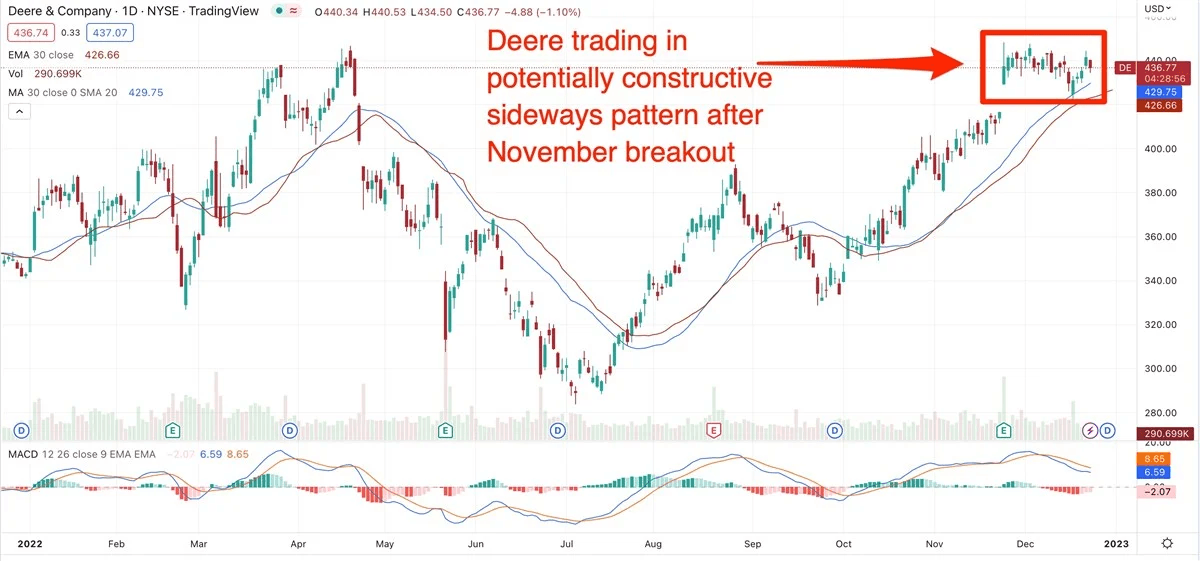

On November 8, Deere cleared a cup-with-handle base with a buy point just above $402. Shares traveled higher along their 10-day moving average until gapping up 5% on November 23, following the company’s better-than-expected fourth-quarter earnings report.

Increased outlook for 2023

In the fourth quarter, the company earned $7.44 per share on revenue of $15.5 billion, increases of 81% and 37%, respectively.

Deere also leaped on its increased fiscal 2023 outlook, which also exceeded analysts’ views. The company now sees earnings increasing 11.4%, to $25.92 per share, up from previous forecasts.

Analysts expect the company to earn $27.86 per share in fiscal 2023, which would be a gain of 20%. In 2024, it may rise another 5% to $29.24 per share.

In the report, CEO John May specifically addressed the potential of increased infrastructure spending. “Deere is looking forward to another strong year in 2023 based on positive farm fundamentals and fleet dynamics, as well as an increased investment in infrastructure," he said in a statement.

Deere has been trading in a sideways pattern since its November gap higher. That’s a good sign, as it indicates investors are holding shares and supporting the price at a particular level. A sideways or flat pattern is often a setup for a further rally, as the stock takes a breather while investors hold onto prior gains.

Author

Jacob Wolinsky

ValueWalk

Jacob Wolinsky is the founder of ValueWalk, a popular investment site. Prior to founding ValueWalk, Jacob worked as an equity analyst for value research firm and as a freelance writer. He lives in Passaic New Jersey with his wife and four children.