APVO Stock Price and Quote: Aptevo Therapeutics Inc extends its gains on leukemia remission results

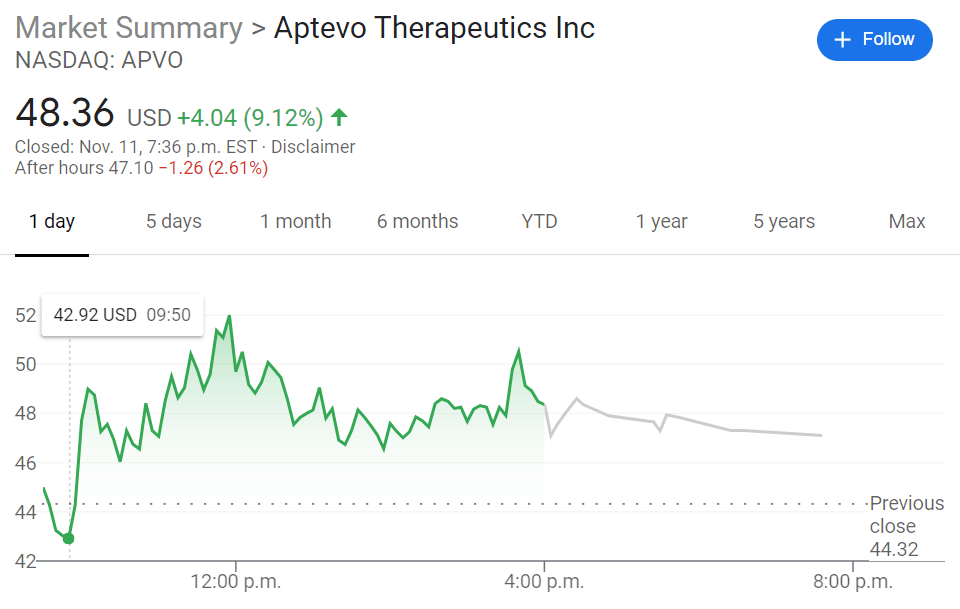

- NASDAQ:APVO surged another 9.12% on Wednesday amidst a NASDAQ tech rally.

- Aptevo’s stock has rocketed over 550% during the last week.

- Aptevo reported its second patient in leukemia remission from its Phase 1 clinical trials.

NASDAQ:APVO has certainly had an eventful week as a stock that has remained somewhat dormant over the past year has suddenly shot up around 550% over the past seven days. Shares gained a further 9.12% on Wednesday to close the most recent trading session at $48.36. To give investors an idea of how much this stock has risen, the 50-day moving average sits at $11.25 and the 200-day moving average is at an even lower $8.26.

The current clinical trials are for its candidate titled APVO436, which is a treatment for patients with acute myeloid leukemia and myelodysplastic syndrome or MDS. While it is a rare form of cancer, the treatment up to this point has been even more difficult to find, so the news of APVO436 success is revolutionary for the oncology field. Two remissions from the same clinical study cohort in the same week are incredibly promising and the increased interest from investors is definitely understandable. Even if there are only two remissions in the entire study, it may be enough for APVO436 to thrive in a market with very few treatments for these types of diseases.

APVO Stock Forecast

With the entire world waiting for COVID-119 vaccine, investors in small-cap biotech stocks have been playing this game for years. Even with the sudden spike in the stock price, the market cap of Aptevo is still only $156 million, which shows how much more room this stock has to run. Given the perfect conditions for APVO436 to succeed in the oncology field, early investors may have found a true diamond in the rough.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet