AMD Share Price and News: AMD edges higher on tech strength and NVIDIA sympathy

- NASDAQ:AMD added 0.25% on Thursday, as a late sell off pared earlier gains.

- NVIDIA pops after its earnings report and receives several Wall Street upgrades.

- Intel’s CEO is on the lookout for acquisition targets as the chip industry looks for consolidation.

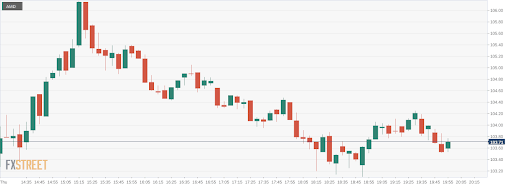

NASDAQ:AMD showed another day of strength despite falling alongside the broader markets into the closing bell. On Thursday, shares of AMD gained 0.25% to close the trading session at $103.70. AMD was off to a hot start on Thursday as the stock traded as high as $106.18 at one point, before paring most of its gains by the end of the day. Still, the short-term chart for AMD still looks bullish, as the recent pullback was expected following its red-hot streak in early late July and early August.

AMD rival NVIDIA (NASDAQ:NVDA) reported its second quarter earnings on Wednesday, and shares popped on Thursday in response. NVIDIA narrowly beat on earnings per share and revenues in the quarter, but exhibited a 68% year over year rise in revenues with its gaming and data center segments doing much of the heavy lifting. Wall Street seems to agree as several analysts upgraded NVIDIA’s price target, with Rosenblatt issuing a street high target of $300 per share.

AMD stock price

AMD’s other rival Intel (NASDAQ:INTC) is aggressively trying to make up ground it has lost to both AMD and NVIDIA. In a recent interview, Intel CEO Pat Gelsigner stated that the company is looking for more mergers and acquisitions to consolidate the chip industry. Intel was rumored to be making an offer for GlobalFoundries a few months back, but nothing has come and yesterday GlobalFoundries confidentially filed for a U.S. IPO. Perhaps Intel is still going to attempt an offer at the company, but it’s clear that it has other names in its crosshairs for potential acquisition. Don’t be surprised if AMD and NVIDIA are both in the hunt for acquisitions as well.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet