AI stocks sell off gathers pace, as China threatens US dominance

-

Chip markets get hit as risk sentiment seeps from the market.

-

But Deepseek could be good news for tech and the global economy.

-

FX and bond market not in panic mode so far.

-

The long-term view: A shift in the AI narrative could hit Nvidia and other chip makers, while other parts of the tech sector benefit.

US stocks are seeing the effects of a narrative shift on Monday. Its tech dominance is being challenged by China. The Deepseek R1 large language model, which gained global attention last week, is triggering an existential crisis for US tech. The focus is now on whether China can do it better, quicker and more cost effectively than the US, and if they could win the AI ‘race’.

This is triggering shock waves in US equity market, which are broadly lower, European stocks have also sold off. The Nasdaq is set to slump more than 3% on Monday, which would be the worst day for the US tech index since 2022, Nvidia is trading lower by 11% in the pre-market, which would be its largest ever decline in market cap.

In Europe, any stock that has links to the AI theme, such as ASML, the maker of machinery that is necessary to make chips, is down more than 7% and it is the worst performer on the Eurostoxx 50 index. Stock market action is telling us a few things:

-

China’s successful foray into AI may mean lower demand for Nvidia chips, especially its more expensive, newer chips.

-

Big tech earnings season this week will be interesting as Meta, Amazon and Microsoft are forced to defend their massive investment programs for AI and justify that the money is well spent. Essentially, these firms need to justify their large valuations, as the crown slips from the US tech giants.

-

Deepseek is a symbol of the wider threat China poses to US-based AI. It also threatens the entire AI eco system, including companies who are building out their AI capabilities, who may have overspent on Nvidia chips for no good reason. It also threatens energy companies, and Siemens Energy is the second worst performer on the German Dax index on Monday.

-

There are also longer-term concerns, if China can make models in a cheaper way, then that rocks the future of US AI firms, their pricing power and demand for their products.

-

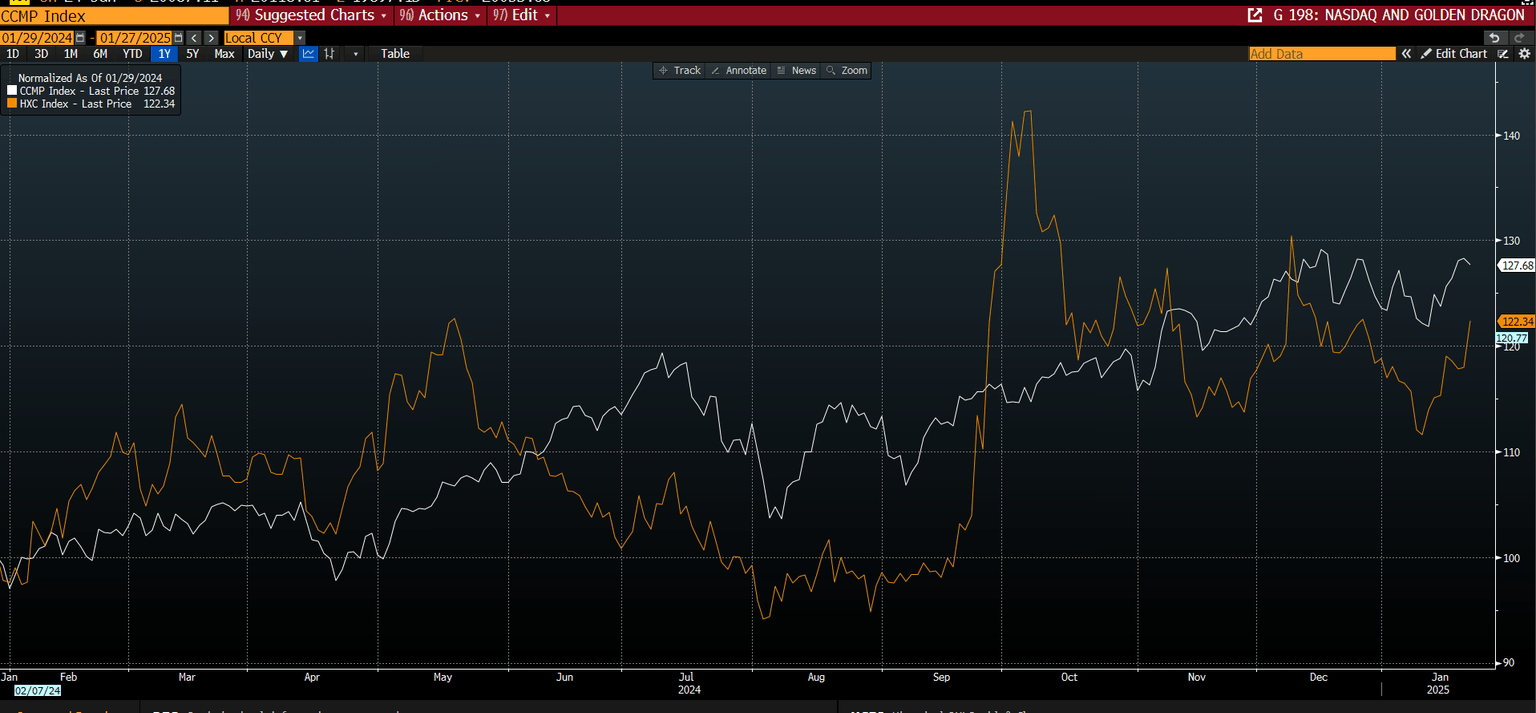

This could be reflected in the Nasdaq’s ‘golden dragon’ index, which includes US listed Chinese tech firms. It has underperformed the Nasdaq in recent months, but this gap could be narrowed as investors’ focus is likely to shift Eastwards after the unveiling of Deepseek’s capabilities.

Right now, the market is focused on punishing the US. The sharp decline in US AI stocks’ on Monday, suggest that the ‘US dominance premium’ will be permanently removed from the US tech giants. If China is catching up quickly to the US in the AI race, then the economics of AI will be turned on its head. It could also have a geopolitical impact since China could be the first superpower to gain super intelligence. Donald Trump’s reaction to today’s stock market sell off could also be a market-moving event.

Deepseek: a natural step in the evolution of AI

However, if we take a step back, there is a more optimistic view. All industrial revolutions evolve. Back in the first industrial revolution, the Watt Steam Engine, which is considered the most important invention, was made more efficient over the years. The first steam pump was invented in 1698, However, within 14 years there were more powerful pumps available and by 1778, a condenser had been introduced that made the steam engine more energy efficient and fit for purpose. The AI revolution is on a shorter timeline, but the same principals exist. AI products will evolve that will further progress the whole mission.

At this early stage, it is impossible to know exactly how Deepseek will change the AI landscape, but there is huge demand for AI capabilities around the world, by making the tech cheaper, this could lead to greater penetration.

Why DeepSeek is not all bad news, and could be positive for tech stocks, and the global economy

This means that today’s sell off could be an overreaction. If AI can run on less advanced chips, then it opens the door to stronger growth over a shorter time frame. This may be bad news for AI’s hardware producers like Nvidia, but surely it is good news for the hyper-scalers, like Microsoft, Meta and the cloud companies? This is reflected in the performance of the Magnificent 7 at the start of this week. Nvidia is the weakest performer, and is down 11% in the pre-market, Meta is down just over 1.7% in the pre-market, and Microsoft is lower by more than 3%. Below we list some of the reasons to be optimistic:

-

If chips get cheaper or the hyper-scalers need less of them to make their AI infused products, then there could be benefits for equities, including for some of Nvidia’s 773 customers. Its biggest customers include Microsoft, who spends 40% of its capex with Nvidia, Meta, Super Micro Computer, Alphabet, Amazon Dell and Tesla.

-

If AI products are cheaper than initially thought, this is good news for the global economy. Stock markets love nothing less than greater economic efficiency for a lower price, so this could be the narrative shift that is needed to broaden out the stock market rally.

-

If AI products are less energy intensive, this might weigh on the share price of utility firms like Siemens Energy, however, it could be good for global inflation down the line. This may be why energy prices are weaker across the board on Monday.

-

The sharp sell off in stocks has boosted global bonds, and yields are lower across the board. This move may be faded as we move through the week, especially if we get a broad recovery in stock markets. However, it takes the pressure off debt laden governments for another week.

Global financial markets not in panic mode for now

In the short term, the sharp sell off in equities is leading to a rally in traditional safe havens including government bonds. The 10-year US Treasury yield is down 8 bps so far on Monday. While the stock market sell off is likely boosting the bond market, other factors could also be at play, including the weak China PMI data and falling US inflation expectations. Interestingly, gold is not acting as a safe haven on Monday, which could be a sign that the selloff in stocks has already gone too far too fast, and may end up concentrated in just one sector of the market, namely chip stocks. Thus, a recovery could be on the cards for later this week.

The FX market is also acting as a haven, however, there is not panic in the FX market right now, which also suggests that the stock market is too pessimistic about the Deepseek news. The yen and the Swissie are, unsurprisingly, the best performers in the G10 FX space on Monday, however, the euro and the pound are also stronger vs, the dollar today, which suggests that something other than haven flows is at play in the G10 FX space.

The stock market has had a strong reaction to the Deepseek news, and this could change the narrative around the AI trading theme, with long term consequences for some companies. It may also lead to a reassessment of the US exceptionalism theory, which could help the broader, global stock market to rally and to play catch up with their US peers.

Chart 1: Nasdaq and golden dragon index, normalized to show how they have moved together in the past 12 months.

Author

Kathleen Brooks

XTB UK

Kathleen has nearly 15 years’ experience working with some of the leading retail trading and investment companies in the City of London.