ACB Stock Price: Aurora Cannabis inc has three (mostly coronavirus-related) reasons rise

- Coronavirus may cause people to stay more indoors, raising the demand for marijuana.

- Federal Reserve stimulus may lift markets, boosting ACB's prices.

- Tuesday's four-hour chart is pointing to a bounce in the short term.

Aurora Cannabis's share price has hit a new all-time low at C$1.75. The marijuana firm continues suffering from its unfavorable financial conditions which included a significant fall in revenues and impairment charges. After a tumultuous February – which also saw the exit of the CEO – investors and analysts are considering the next steps.

However, ACB has three reasons to rise:

1) Federal Reserve support: On the one hand, current conditions are worrying for the company and for the broader economy – as the coronavirus outbreak is causing high volatility in financial markets. Fear from the virus has an upside – the Federal Reserve is stepping in to provide monetary stimulus by cutting rates, potentially lifting all stocks.

2) Higher demand to get high: On the other hand, pot consumption continues also when people are forced to stay at home and avoid public spaces. As China has shown, the delivery economy ramped up its operations and people that stay at home continue consuming. The consumption of recreational drugs may rise if more people stay at home where they can use marijuana, while staying outside may curb demand.

3) Oversold conditions: So far, bargain-seekers have come and gone, only occasionally pushing ACB's price higher. Tuesday's chart is pointing to such an opportunity..

Aurora Cannabis Stock Price – Oversold

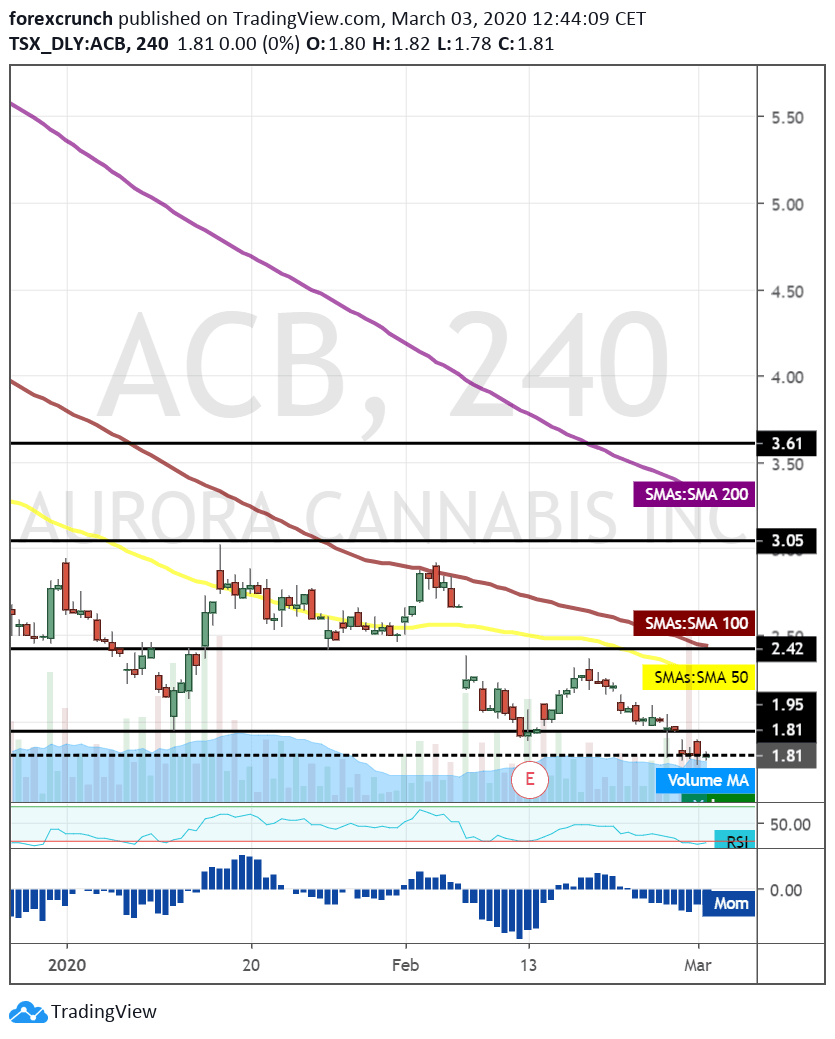

The Relative Strength Index on ACB's Toronto-traded four-hour chart is below 30, pointing to oversold conditions. This development implies a bounce from the lows, at least in the short term. Otherwise, momentum is to the downside and Aurora is trading below the 50, 100, and 200 Simple Moving Averages.

The fresh all-time low of C$1.75 is providing some support. 1.50 is the next downside level to watch. Resistance is at the previous trough of 1.90, followed by 2.40 which has been a clear separator of ranges. The next line to watch is 30.5, which looks distant now.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.