Yearn.Finance price is breaking out as bulls aim to push YFI towards $24,000

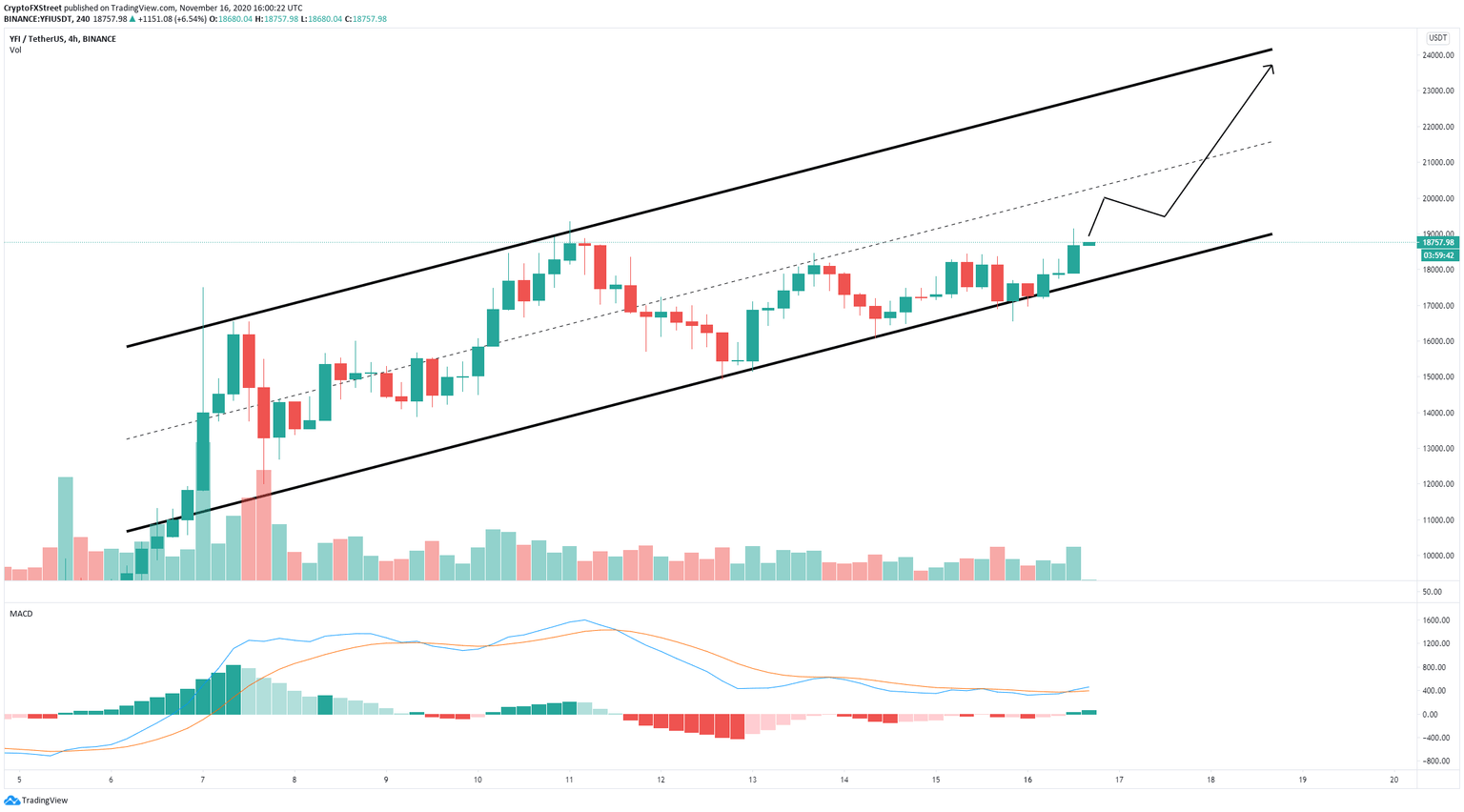

- YFI price is contained inside an ascending parallel channel formed on the 4-hour chart.

- The digital asset seems to be aiming for $24,000 as bullish momentum picks up.

YFI is bounded inside an ascending parallel channel and has just defended the lower trendline bouncing off towards $19,000. The momentum is shifting back in favor of the bulls which are aiming for $24,000.

YFI needs to hold a critical support level to see $24,000

Despite the bounce on November 16 from the lower boundary of the ascending parallel channel, bulls still need to make sure to hold this level. The next price target could be $20,000 which is the middle of the pattern.

YFI/USD 4-hour chart

If YFI price experiences a small retrace after hitting $20,000, it would be considered healthy and a continuation of the bull move. The next price target after the pullback would be the top of the pattern at $24,000. Additionally, the MACD also turned bullish for the first time since November 10, indicating that the bounce has good strength behind it.

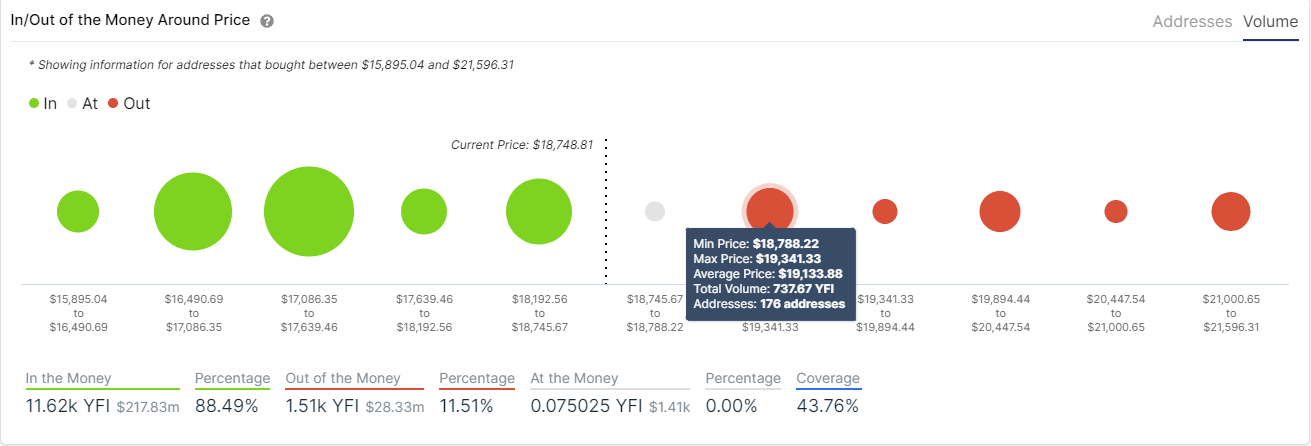

YFI IOMAP chart

The In/Out of the Money Around Price chart only shows a mildly strong resistance area between $18,788 and $19,341 but a lot of support on the way down capable of absorbing a lot of selling pressure in the short-term.

If YFI price can’t climb above the resistance level at $19,000 or gets strongly rejected from the middle trendline of the pattern at $20,000, bears could target the lower trendline at $17,800 again, and potentially $17,000 looking at the IOMAP chart.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.