Yearn.Finance Price Analysis: YFI looks ready to rebound, but on-chain metrics suggest upswing will be short-lived

- Yearn.Finance price faces a strong resistance barrier at $25,000 but several indicators have turned bullish.

- On-chain metrics suggest that the bounce could be short-lived.

YFI is trading inside a daily uptrend after establishing a higher high at $31,780. Bulls need to hold a significant support level at $18,228 to post a higher low and continue with the uptrend.

Yearn.Finance price aims for a short-term bounce

On the 4-hour chart, the TD Sequential indicator has presented a buy signal in the form of a red nine candle. Similarly, it also posted the same call on the 12-hour chart, giving more credence to both signals.

YFI/USD 4-hour and 12-hour charts

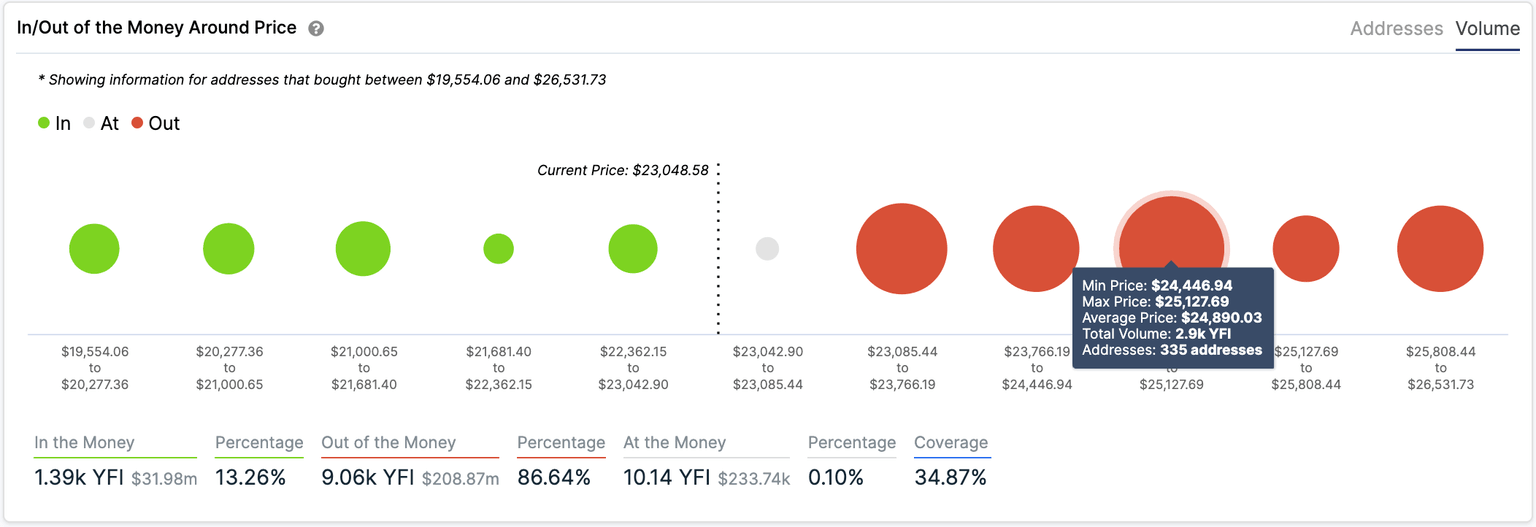

One of the most important supply barriers sits at $25,000, as seen in the In/Out of the Money Around Price (IOMAP) chart. Validation of the two buy signals could push Yearn.Finance price up to this point.

YFI IOMAP chart

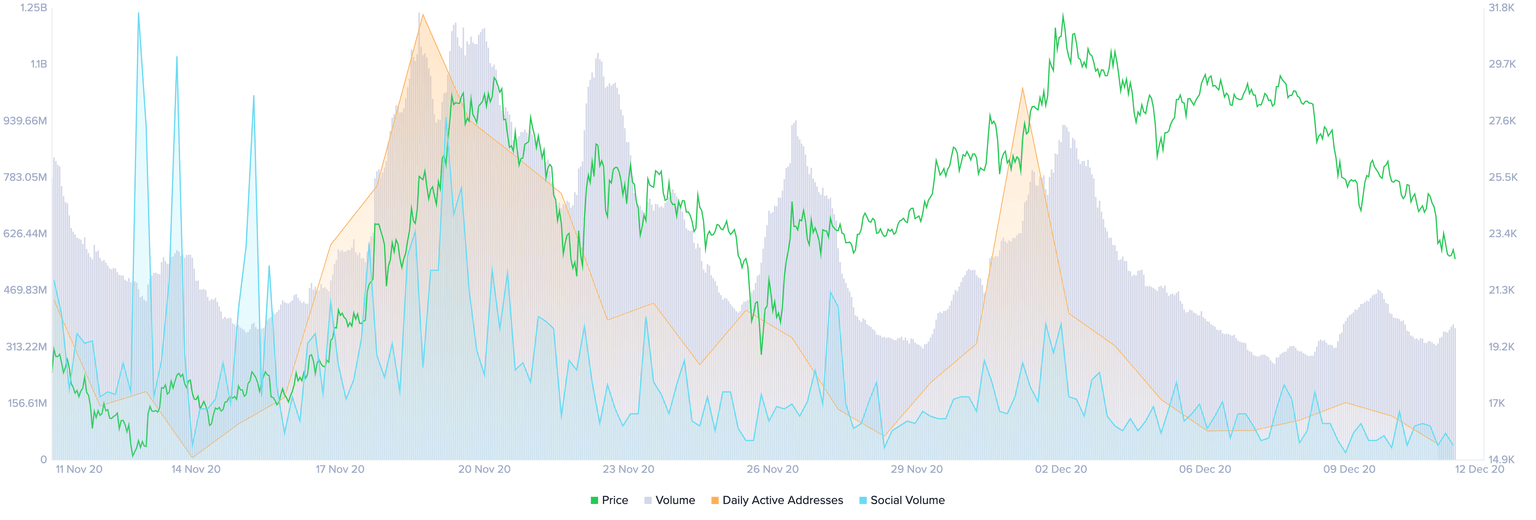

However, several on-chain metrics have turned significantly bearish. The on-chain volume has decreased substantially over the past three weeks, which indicates that interest in the digital asset is fading away.

YFI on-chain metrics chart

Additionally, the number of daily active addresses and social volume has decreased notably too. This could precede a steeper decline of the digital asset despite the bullish signs mentioned above. On top of that, the IOMAP chart shows very little support on the way down until $19,554.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

-637432984879837457.png&w=1536&q=95)