Yearn Finance hits overbought conditions with YFI at risk of a 20% correction

- Yearn Finance price posts a spectacular 103% gain in just five trading days.

- Oscillators values indicate significant overbought levels have been reached.

- Technical breakout within the Ichimoku system could push YFI higher before any selling pressure occurs.

Yearn Finance price has undoubtedly been one of the biggest surprises of the cryptocurrency space over the past two years. Easily one of the best performers of 2020 and 2021, sentiment and attraction for YFI waned after the May 2021 selling. As a result, six months of consolidation may be coming to an end.

Yearn Finance price gains over $19,000 since November 15, triggering massive overbought conditions

Yearn Finance price action has been almost singular in its performance over the last five trading days. The results of that spike have generated some significant overbought warning signals in all three of the oscillators.

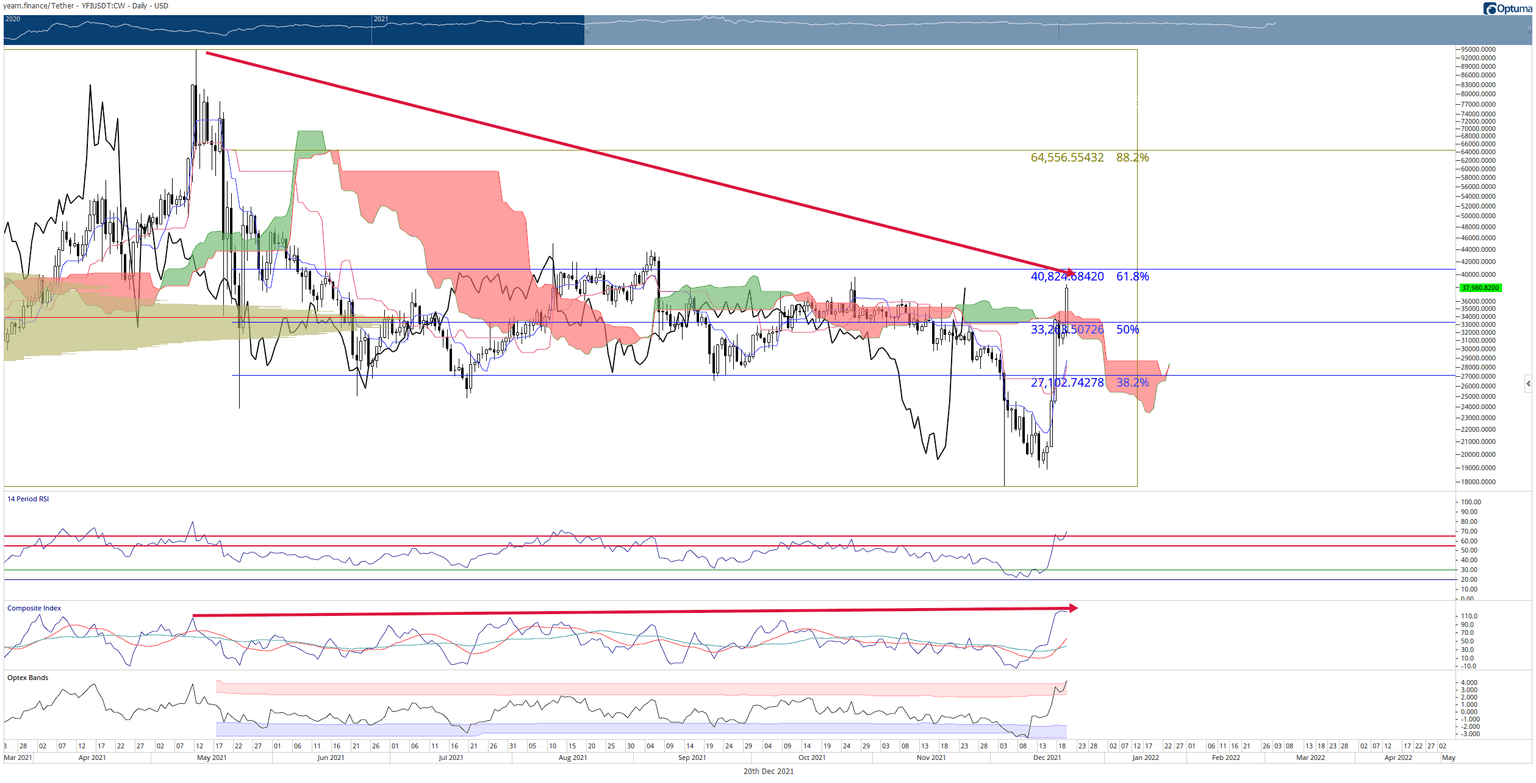

The YFI price spike has put the Relative Strength Index above the last overbought level in a bear market (65), creating an extreme overbought level or the beginning of a transition from a bear market to a bull market. In addition, the Composite Index has printed a new all-time high while also printing hidden bearish divergence between the two peaks of the prior highest high on May 11 to today. Finally, the Optex Bands have reached into extreme overbought territory and have printed a new all-time high as well.

Speculators will raise the most crucial question: Is YFI overbought, or is it positioning for another drive higher? From an Ichimoku perspective, if Yearn Finance can close above $35,600, YFI will have completed all conditions needed for an Ideal Bullish Ichimoku Breakout entry. This would be a massively bullish event as the last time Yearn Finance completed that entry criteria was on April 4.

YFI/USDT Daily Ichimoku Chart

Key resistance levels to watch in the near future are the 61.8% Fibonacci retracement at $40,825 and the 88.2% Fibonacci retracement at $64,556. If bulls cannot close Yearn Finance price at or above the 61.8% Fibonacci retracement, a return to the $30,000 value area is likely.

To maintain a bullish outlook, bulls will need to keep Yearn Finance price at a level where the daily close and the Chikou Span are above the Cloud – no lower than $35,500.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.