XRP transactions cannot be blocked, Ripple's CTO explains why

- David Schwartz explains why Ripple network is secure.

- XRP/USD bulls may face stiff resistance on approach to $0.2350.

Ripple's XRP, now the third-largest digital asset with the current market value of $10.0 billion has lost 3% in recent 24 hours. The coin bottomed at $0.2280 during early Asian hours and recovered to $0.2300 by the time of writing. The coin has been moving in sync with the global cryptocurrency market, driven by strong bearish sentiments amid growing volatility.

No one can interfere with XRP transactions

Ripple is often accused to centralization and the ability to interfere with the network operations. However, the chief executive officer of Ripple and one of the original architects of XRP ledger, David Schwartz, denied the accusations and explained why such interference was theoretically possible, but practically hardly achievable.

Answering the question on Quora, he wrote:

There is currently no way to stop valid transactions from executing. Because the network is decentralized, nothing stops someone from writing code that blocks transactions currently considered valid and trying to convince people to run that code. It would take convincing a majority to run that code to stop those transactions.

XRP/USD: technical picture

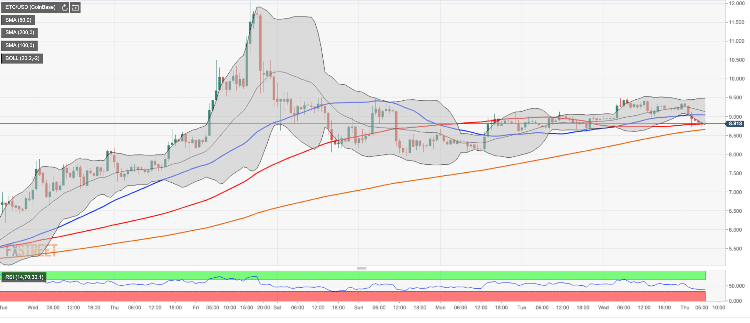

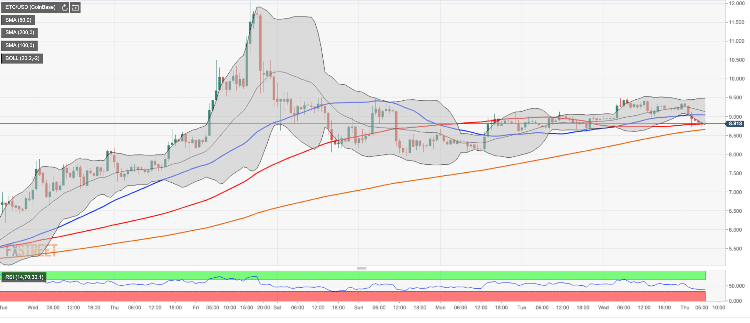

XRP/USD validated the support of $0.2280 twice during early Asian hours, which means this area may serve as a reversal point. However, we will need to see a sustainable move above $0.2300 for the upside to gain traction and take the price towards the local resistance of $0.2350 created by a confluence of SMA50, SMA100 and SMA200 on 1-hour chart. Considering the importance of technical indicators clustered around this area, it will be a hard nut to crack for XRP bulls. Once it is out of the way, $0.2400 will come into focus. This resistance is reinforced by the upper line of the 1-hour Bollinger Band and the upper boundary of the previous short-term consolidation range.

On the downside, the initial support is created by the intraday low of $0.2280 and January 20 low at $0.2240. Once it is cleared, the sell-off is likely to gain traction with the next focus on psychological $0.2200 reinforced by the middle line of the daily Bollinger Band. The critical support is created by SMA50 daily at $0.2100.

XRP/USD, 1-hour chart

Author

Tanya Abrosimova

Independent Analyst