XRP gains amidst rising inflows to Ripple funds, traders digest SEC appeal

- XRP funds see rise in capital inflows from institutions last week, according to CoinShares digital asset fund flow report.

- SEC appeal and 1 billion token unlock are other key market movers for the altcoin.

- XRP trades at $0.5430, gaining nearly 2% on Monday.

Ripple (XRP) price on Monday is being influenced by the token unlock on October 1, XRP fund flows and sentiment among crypto market participants. XRP gains nearly 2% on the day, the altcoin trades above key support at $0.5200.

Daily Digest Market Movers: XRP funds sees rise in capital inflow

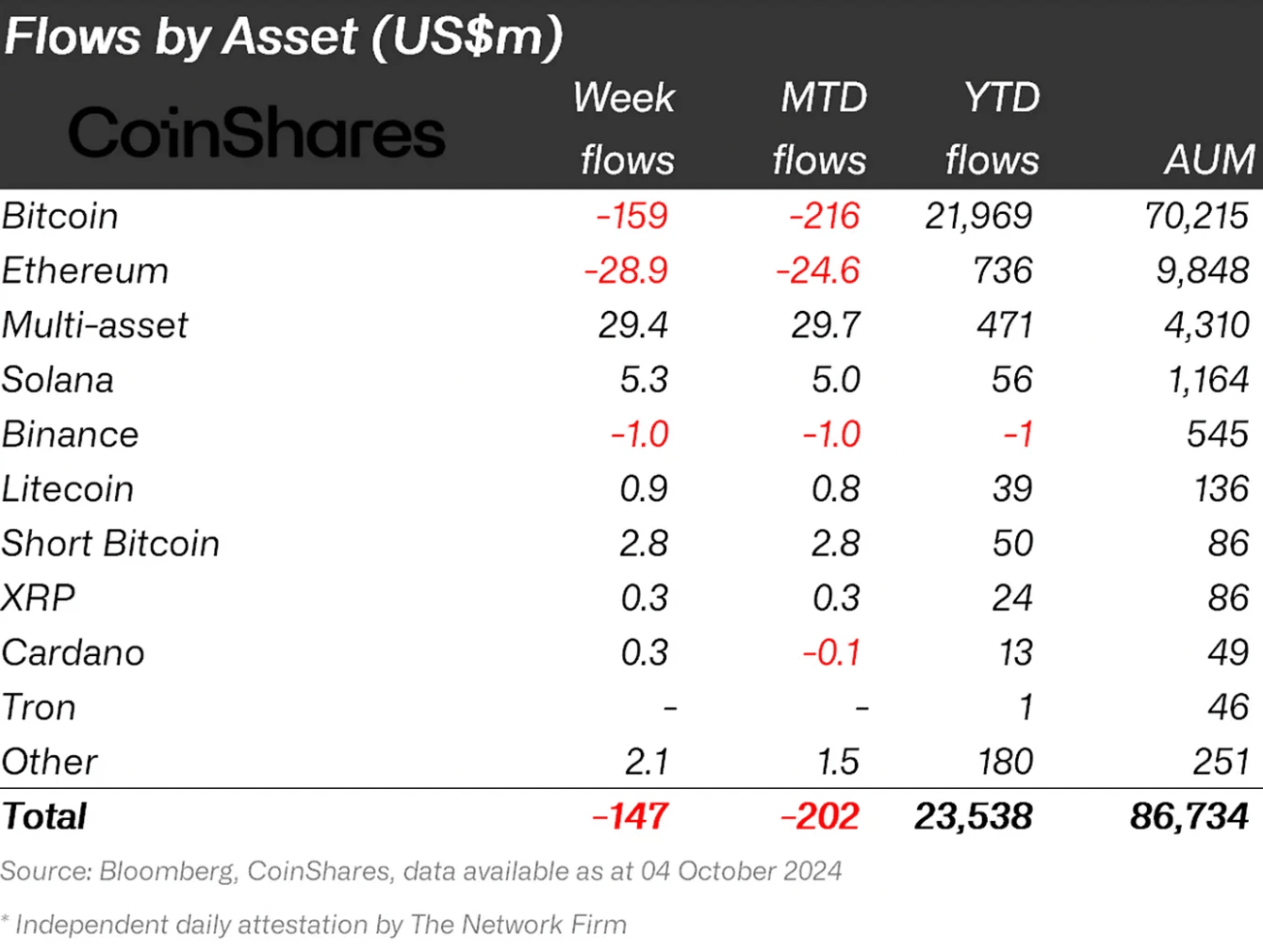

- CoinShares Digital Asset Flows Report shows XRP-based funds received $300,000 in capital inflows last week.

- In the same time frame, the two largest assets by market capitalization noted negative flows: Bitcoin recorded a $159 million in outflows, and Ethereum funds lost $28.9 million.

Fund flows by asset

- The rising capital inflows to XRP is indicative of demand among institutional investors.

- XRP traders are watching the developments in the Securities & Exchange Commission’s (SEC) lawsuit appeal against the payment remittance firm.

- The SEC appealed against the final ruling, which imposed a $125 million fine on Ripple for the institutional sale of XRP tokens.

- Another factor influencing the asset is the 1 billion XRP token unlock, part of a scheduled token release by the payment firm. The release of a large volume of XRP tokens during each unlock negatively influences the asset’s price.

Technical analysis: XRP could extend losses by another 7%

Ripple started its multi-month downward trend in July 2023, post the top of $0.9380. The altcoin is likely to extend losses by 7% and sweep liquidity at $0.5026, a key support level for XRP. This level coincides with the September 6 low.

The red histogram bars on the Moving Average Convergence Divergence (MACD) indicator signal an underlying negative momentum in XRP price.

XRP/USDT daily chart

If there is a daily candlestick close above the 200-day Exponential Moving Average at $0.5548, it could invalidate the bearish thesis. XRP could then attempt a recovery to $0.6000, the October 2 high and a psychologically important price level for the altcoin.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.