XRP Price Prediction: Ripple bulls face extinction as profit-booking intensifies

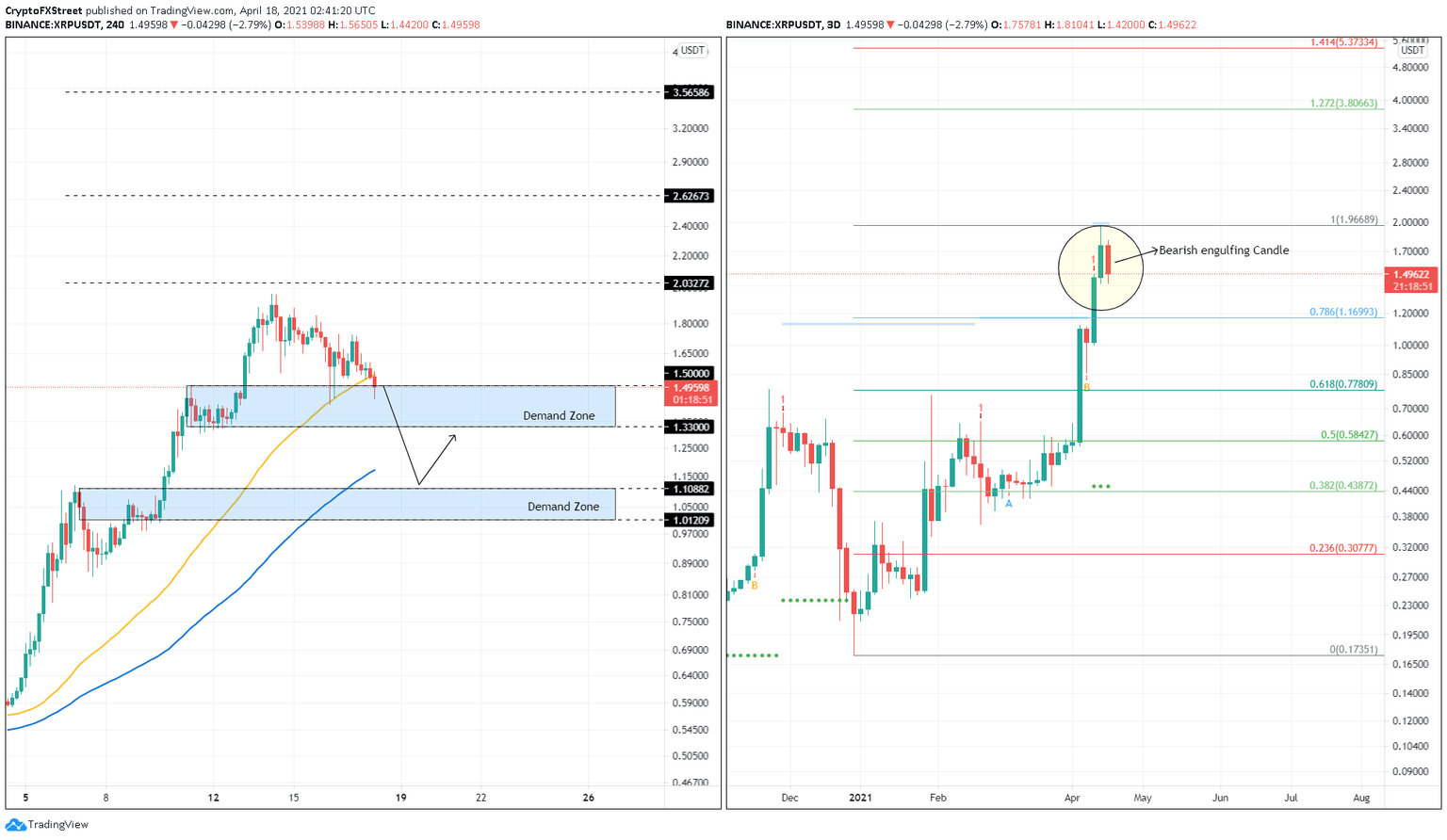

- XRP price is moving toward the immediate demand zone ranging from $1.33 to $1.50.

- This decline since April 14 suggests a weakening bullish momentum that could drive Ripple toward the next support area.

- A bounce from either of the zones seems plausible, but if sellers shatter $1.01, investors could expect an extended downtrend.

XRP price is slowly pulling back after setting up new yearly highs. As Ripple tries to establish a base, an accumulation could lead to the next leg up, but distribution, on the other hand, could evolve the correction into a crash.

XRP price prepares for the next volatile move

XRP price saw an explosive run-up from $0.63 to $1.96, which may have triggered market participants to book profits, leading to a slow downtrend. As seen on the 4-hour chart, Ripple is currently trading above the first demand zone that ranges from $1.33 to $1.50 but below the 50 four-hour Simple Moving Average (SMA).

A bounce from this level to retest the recently erected local top at $1.96 is possible but unlikely. On the 3-day chart, XRP price shows a bearish formation where the current red candlestick is engulfing more than 75% of the previous green candlestick’s body, suggesting lower prices to come.

This setup adds to the profit-booking thesis.

Hence, if the sell-off intensifies, XRP holders can expect a solid retracement to the lower demand area that stretches from $1.01 to $1.10.

All in all, XRP price looks bearish in the short-term and could test the 100 four-hour SMA at $1.16, which interestingly coincides with the 78.6% Fibonacci retracement level on the daily chart.

XRP/USDT 4-hour/3-day chart

On the other hand, if the buyers rescue XRP price from the first support barrier and produce a decisive close above $2.03, it would invalidate the bearish outlook. If this were to happen, a 30% upswing to $2.62 seems likely.

If the buyers persist, then bulls can target a new all-time high at $3.56.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.