XRP price fated to consolidate as investors ditch Ripple for volatile altcoins

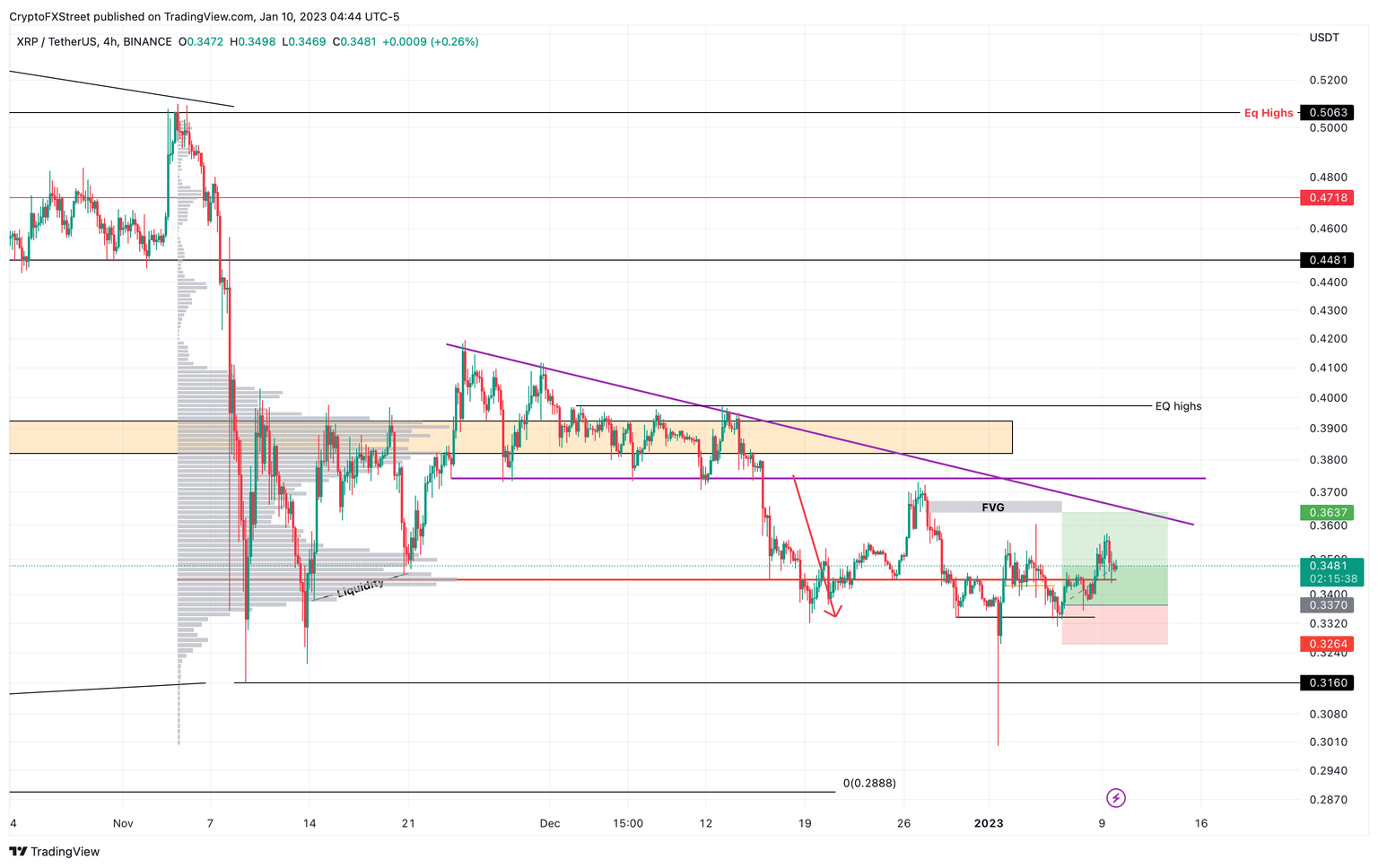

- XRP price continues to trade below the declining trend line connecting the string of lower highs formed since November 25, 2022.

- Although unlikely, Ripple bulls might attempt a retest of $0.363 before triggering a quick correction.

- Invalidation of the bullish thesis will occur if the remittance token produces a lower low below $0.333.

XRP price has been stagnating in the same region for quite some time and shows no signs of breaking out. This development is likely to continue while other altcoins have more than doubled in price in the last 10 days. Regardless, investors need to be cautious as a market reversal is likely on the cards for Ripple.

XRP price at wits’ end

XRP price has been producing lower highs since November 25, 2022, denoting a persistent downtrend. More recently, the remittance token slipped below a stable support level at $0.374.

Despite various attempts at breaking above it Ripple has so far failed. The last attempt saw XRP price retest the hurdle on December 27, 2022, but since then Ripple bears have taken control. After falling back and tagging the $0.333 support level thrice in January, the remittance token attempted another run-up, which fell short after a 6% rally.

If influential market mover Bitcoin’s price continues to hold up, there is a chance XRP price might attempt to squeeze out some bullish momentum in sympathy, resulting in a retest of the declining trend line mentioned above at $0.363. In a highly bullish but unlikely case, XRP price could retest the $0.374 hurdle.

XRP/USDT 4-hour chart

Since the outlook for XRP price is not optimistic, investors need to be cautious with opening late long positions. A sudden uptick in selling pressure from Bitcoin could trigger a sell-off for altcoins.

A breakdown of the market structure by producing a four-hour candlestick close below $0.333 will create a lower low and invalidate the bullish outlook. In such a case, XRP price could revisit the $0.316 support level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.