XRP price confirms strong short signal but bears fail to follow through

- XRP price confirmed the most sought-after short entry condition within the Ichimoku Kinko Hyo system on Sunday.

- Monday’s price action is retesting the breakout from below the Ichimoku Cloud.

- Significant downside potential ahead if bears remain in control.

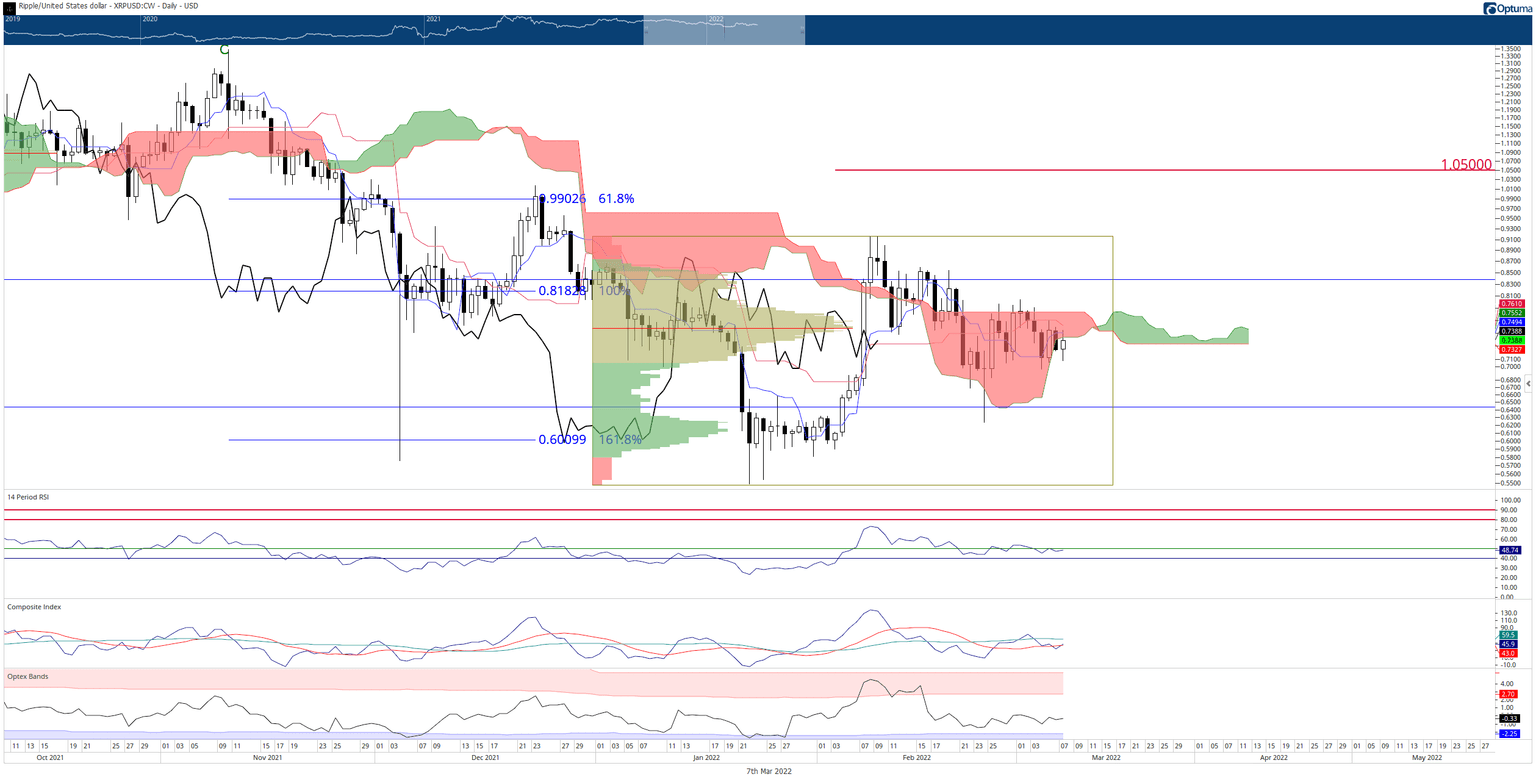

XRP price action shows a confirmed Ideal Bearish Ichimoku Breakout on the daily chart. However, bears failed to follow through, which may be due to some stubborn bullish pressure preventing a move lower. As a result, bullish conviction is now being tested, and so far, it appears to be waning.

XRP price positioned for bears to drive Ripple down to $0.65

XRP price shows bulls are currently in temporary control during the Monday trade session. While the daily open is above the close, bulls need to close XRP price at or above $0.745 to return price inside the Ichimoku Cloud. Failure to do so would confirm that the breakout below the Ichimoku Cloud was an honest break, giving bears the signal that selling pressure is likely to return and in earnest.

The first projected target for short-sellers is likely the logarithmic 50% Fibonacci retracement of the most recent major swing high of $1.96 to the low of the weekly strong bar of $0.22 – which is at $0.64. If $0.64 fails as support, then the next support level for XRP price doesn’t appear until the 61.8% Fibonacci retracement at $0.49.

If bulls want to overcome the near-term bearish outlook, they’ll need to complete an Ideal Bullish Ichimoku Breakout. Unfortunately, that is a difficult goal for bulls to achieve because not only does XRP price need to close above the Ichimoku Cloud, the Chikou Span needs to close above the candlesticks and be in open space – a close at $0.85 is the minimum price level to confirm an Ideal Bullish Ichimoku Breakout.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.