XRP declines 2% as SEC vs. Ripple lawsuit advances, crypto exchange Uphold expresses support to RLUSD

- XRP trades at $0.5334 on Tuesday, down 2% on the day.

- Uphold supports Ripple’s stablecoin RLUSD, the crypto exchange comments on platform integration.

- XRP gears up for a nearly 7% decline in its price.

Ripple (XRP) lost nearly 2% of its value on Tuesday, October 22. The native token of the XRPLedger could extend its losses as XRP holders speculate the future of the altcoin, the Securities & Exchange Commission’s (SEC) lawsuit against Ripple and Ripple USD’s (RLUSD) utility and adoption among institutions.

Ripple made several announcements, such as listing official exchange partners and teasing the launch of the stablecoin with no fixed date, during the Swell 2024 event. Since then the focus has shifted to the SEC’s appeal against the final ruling in the Ripple lawsuit, the payment firm’s counter-appeal and Bitwise’s XRP ETF application.

Daily Digest Market Movers: Ripple’s latest developments weigh on XRP price

- SEC vs. Ripple lawsuit and the process of appeals, Ripple’s stablecoin RLUSD and related announcements, Bitwise’s XRP ETF application and Ripple co-founder Chris Larsen’s donation to Kamala Harris’ presidential campaign are the key market movers for the altcoin on Tuesday.

- SEC recently made its legal documents related to the appeal available online. The reveal assuages XRP holders’ concern regarding the altcoin’s legal clarity. The SEC has not raised questions about the nature of XRP as a non-security and the appeal is limited to the final ruling in the SEC vs. Ripple lawsuit.

- At Ripple Swell 2024, its annual flagship event, the firm made a series of announcements, including a list of exchange partners and their role, as well as plans for the stablecoin.

- While no launch date was fixed for Ripple USD, Uphold and other strategic exchange partners have supported the altcoin and announced its integration with their platforms.

UPHOLD NEVER DELISTED #XRP AND THEY WILL LAUNCH @RIPPLE´S $RLUSD ➡️ "WE HAVE A LARGE CONTIGENCY OF #XRP HOLDERS SINCE WE NEVER DELISTED." @UpholdInc

— XRP DROPZ (@DROPZXRP) October 22, 2024

➡️ STABLECOINS ARE "THE KILLER USE CASE" FOR UTILITY AND CRYPTO

SOURCE @ThinkingCrypto1: https://t.co/TK5GdF7VS8 https://t.co/D02B4PMv2j pic.twitter.com/mDTgRXOZ0S

- Ripple’s stablecoin will open doors to XRP utility as well. The native token of the XRP Ledger is likely to see a boost in its adoption and note a positive impact, according to Ripple President Monica Long.

- Bitwise’s XRP ETF application could see progress following the US presidential election outcome. Nate Geraci, President of the ETF Store, says that Solana and XRP ETFs look unlikely under a Kamala Harris presidency.

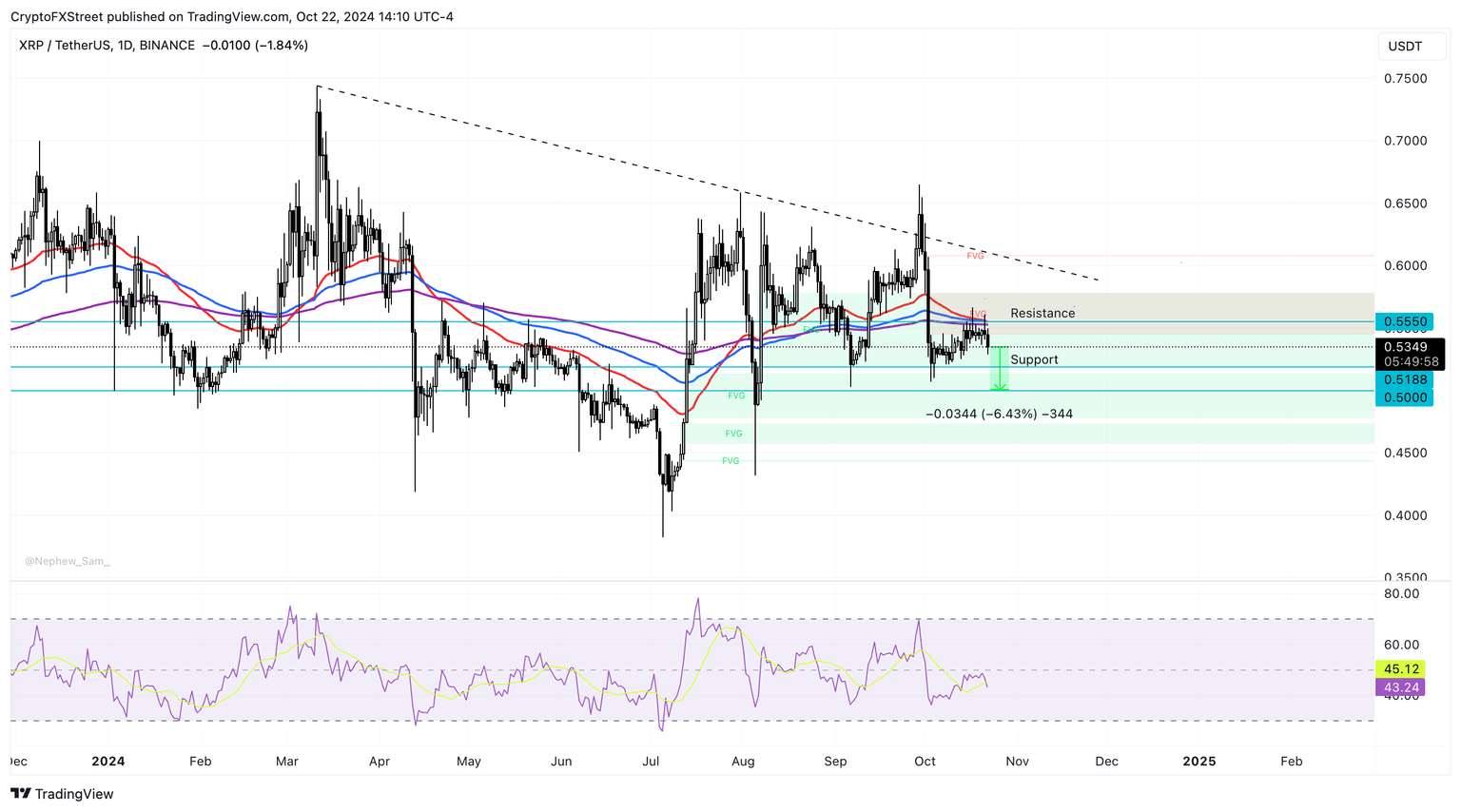

Technical analysis: XRP risks nearly 7% drop

Ripple has been in a downward trend since its March 11 top of $0.7440. The altcoin could extend losses and sweep liquidity at the psychologically important $0.50 level. This level lies within an imbalance zone, between $0.4780 and $0.5136, on the XRP/USDT daily price chart.

XRP, therefore, risks nearly 7% (6.43%) decline in its price. The altcoin could find support at $0.5138, the August 6 high for the altcoin.

The Relative Strength Index (RSI) reads 43. This is under the neutral level at 50, but the RSI is sloping downwards, consistent with negative momentum in a token’s price trend.

XRP/USDT daily price chart

A daily candlestick close above the $0.6000 level, an important resistance level for the altcoin, could invalidate the bearish thesis. XRP could test resistance at the lower boundary of an imbalance zone at $0.6069.

SEC vs Ripple lawsuit FAQs

It depends on the transaction, according to a court ruling released on July 14, 2023: For institutional investors or over-the-counter sales, XRP is a security. For retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services and other platforms, XRP is not a security.

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token. While the judge ruled that programmatic sales aren’t considered securities, sales of XRP tokens to institutional investors are indeed investment contracts. In this last case, Ripple did breach the US securities law and had to pay a $125 million civil fine.

The ruling offers a partial win for both Ripple and the SEC, depending on what one looks at. Ripple gets a big win over the fact that programmatic sales aren’t considered securities, and this could bode well for the broader crypto sector as most of the assets eyed by the SEC’s crackdown are handled by decentralized entities that sold their tokens mostly to retail investors via exchange platforms, experts say. Still, the ruling doesn’t help much to answer the key question of what makes a digital asset a security, so it isn’t clear yet if this lawsuit will set precedent for other open cases that affect dozens of digital assets. Topics such as which is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional and programmatic sales persist.

The SEC has stepped up its enforcement actions toward the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating the US Securities law. The SEC claims that the majority of crypto assets are securities and thus subject to strict regulation. While defendants can use parts of Ripple’s ruling in their favor, the SEC can also find reasons in it to keep its current strategy of regulation by enforcement.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.