XRP and Bitcoin futures ignite July rally: Are pullbacks in sight?

XRP surges 30% after breaching the 2-31 supply zone; Bitcoin jumps 14%—bulls must defend key zones or risk a deeper retracement.

Introduction

July has started with explosive momentum in the crypto complex, led by XRP and Bitcoin futures. XRPPN2025 ripped through the 2-31 supply zone following a tight consolidation, rallying over 30% in just four trading days. BTCN2025 followed suit, blasting past its 108,535–109,995 supply zone to reach 123,615, marking a 14% gain over the same period. Such vertical moves often precede short‑term pullbacks before the next leg higher. Below, we outline the critical zones to watch for both instruments as bulls seek to extend the rally, while also identifying key support levels that, if lost, could invite deeper retracements.

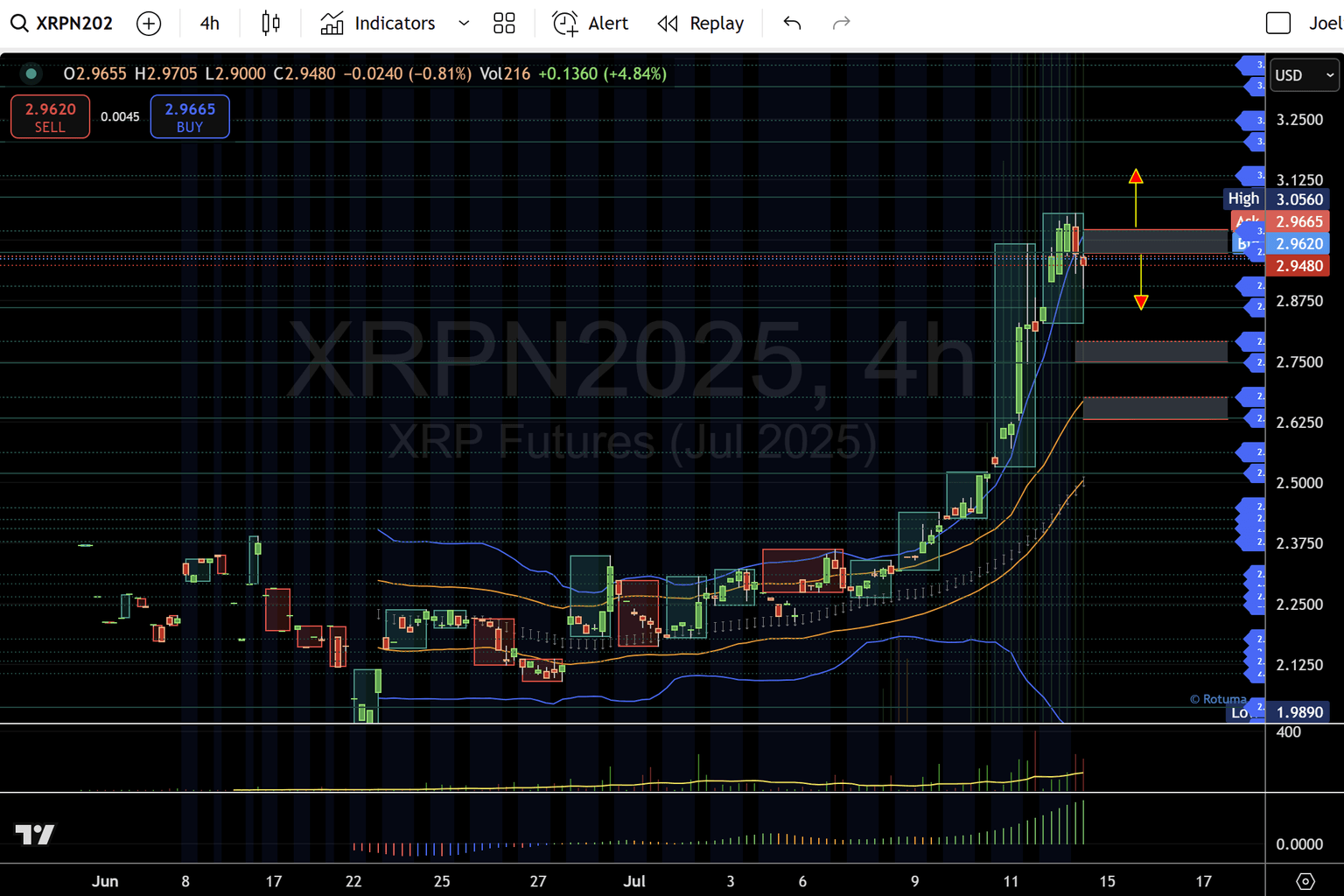

XRP futures (XRPPN2025) price action

- Breakout: Cleared the 2-31 supply zone decisively on July 11, confirming buyers’ strength.

- Gain: +30% from 2-31 to recent highs near 3-00.

- Volatility: Bollinger Bands expansion signals elevated volatility; a pullback toward the mid‑band is common after sharp moves.

XRP 4-hr price chart as of July 15 2025

Key levels to watch

Immediate resistance: 2-97–3-00. A clean break and hold above here targets 3-08–3-13 → 3-20–3-24.

Pullback support: 2-79–2-74. If 2-97–3-00 fails, look for buyers at this demand zone.

Secondary support: 2-62–2-58. Confluence of VWAP/mid-BB and prior volume node; last line before neutral territory.

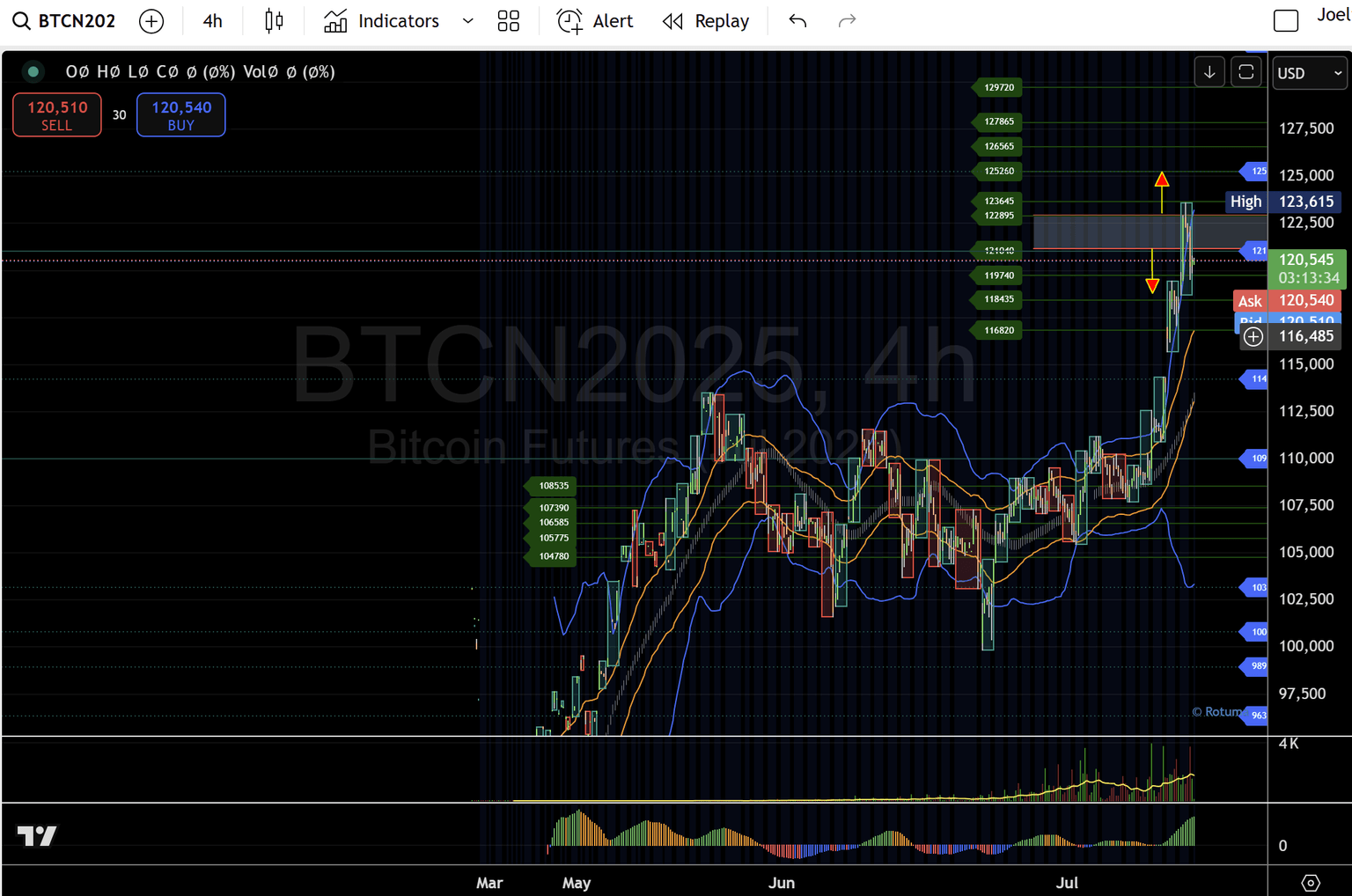

Bitcoin futures (BTCN2025) price action

- Breakout: Overran the 108,535–109,995 supply zone between July 9–10, accelerating toward 123,615.

- Gain: +14% in four sessions, with strong volume confirming the move.

- Trend context: The steep ascent has stretched RSI into overbought territory on the 4‑hour chart, often preceding consolidation.

Bitcoin July Futures as of July 15 2025

Key levels to watch

Immediate resistance: 121,040–122,895. Bulls must reclaim and stay above here to target 125,260 → 126,565 → 127,865.

Pullback support: 119,740–118,435. Failure to hold 121,040–122,895 may see a retest of this zone.

Secondary support: 116,820. The next buffer, aligning with the 20‑period EMA on the 4‑hour and prior structure.

What’s next?

- Bullish thesis: A sustained breakout above the highlighted supply zones will pave the way for fresh multi‑month highs.

- Bearish risk: Failure to defend the breakout zones could trigger a swift retracement into the demand areas, where buyers will need to step in to keep the uptrend intact.

This analysis is for informational purposes only and does not constitute financial advice. Trading cryptocurrencies carries significant risk, and you should conduct your research or consult a licensed professional before making any trading decisions.

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.