XLM Price Forecast: Stellar primed for a 10% short-term upswing amid massive network expansion

- XLM price had a major 230% increase in 2021, reaching $0.411.

- The Stellar Development Foundation (SDF) has released the Quarterly Report for Q4 2020.

- The report shows several positive metrics in favor of Stellar.

Stellar had tremendous success in 2021, reaching a high of $0.411 after a massive 230% price explosion. The digital asset has outperformed several other coins, including Bitcoin, and could be poised to rise even higher amid positive metrics shown by the Stellar Development Foundation (SDF).

Stellar Q4 2020 was extremely successful

According to the most recent report released by the SDF, Stellar had a 3% increase in total accounts on the network, reaching 4.8 million. Additionally, the number of total payments grew by 26% and the number of average daily operations by 12.92%.

Stellar’s decentralized exchange saw even more success, with 138% higher average daily trading volume. The foundation has recently started tracking a new measure called Relevant Assets. The idea behind this metric is to track assets tethered to a real financial instrument, which should give a good indication of how well Stellar is adapting to global financial systems.

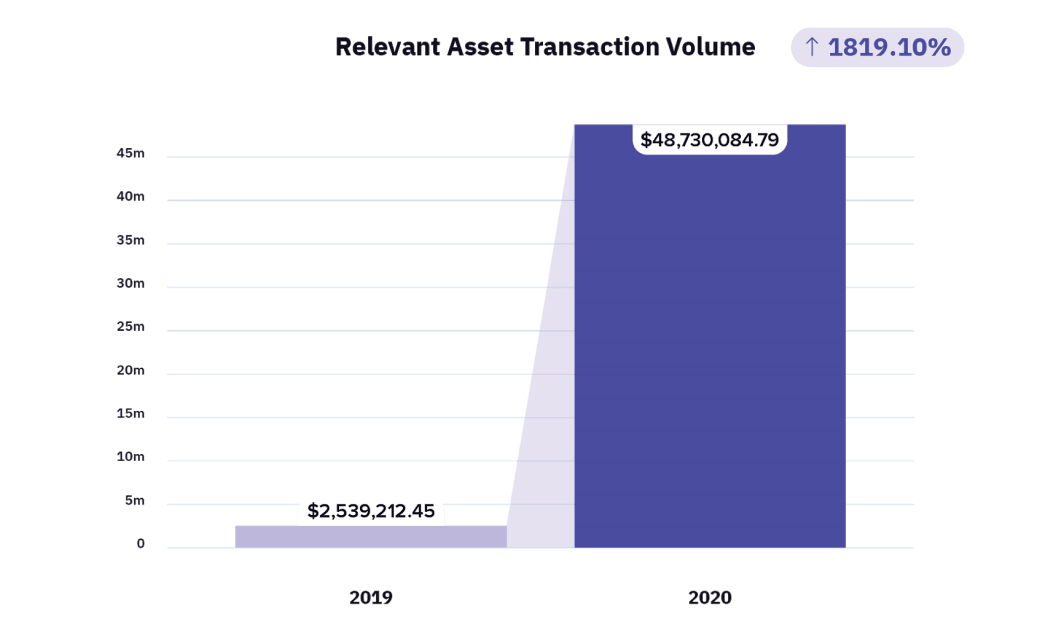

On-network transaction volume of relevant assets

The on-network transaction volume of relevant assets jumped from $2.5 million to $48.7 million in 2020. On top of all the positive metrics, Stellar also entered several partnerships with important players in the ecosystem like Centre Consortium to bring USDC, Coinbase’s stablecoin, to the Stellar Network.

The SDF policy team engaged with policymakers in the US and internationally on two issues of importance to the Stellar ecosystem: the regulation of stablecoins and tightening AML regulations for digital assets. SDF’s partnership with the World Economic Forum also provided the opportunity to showcase a Stellar use case in the first publication of the Global Future Council on Cryptocurrencies.

Stellar price is on the verge of a significant move

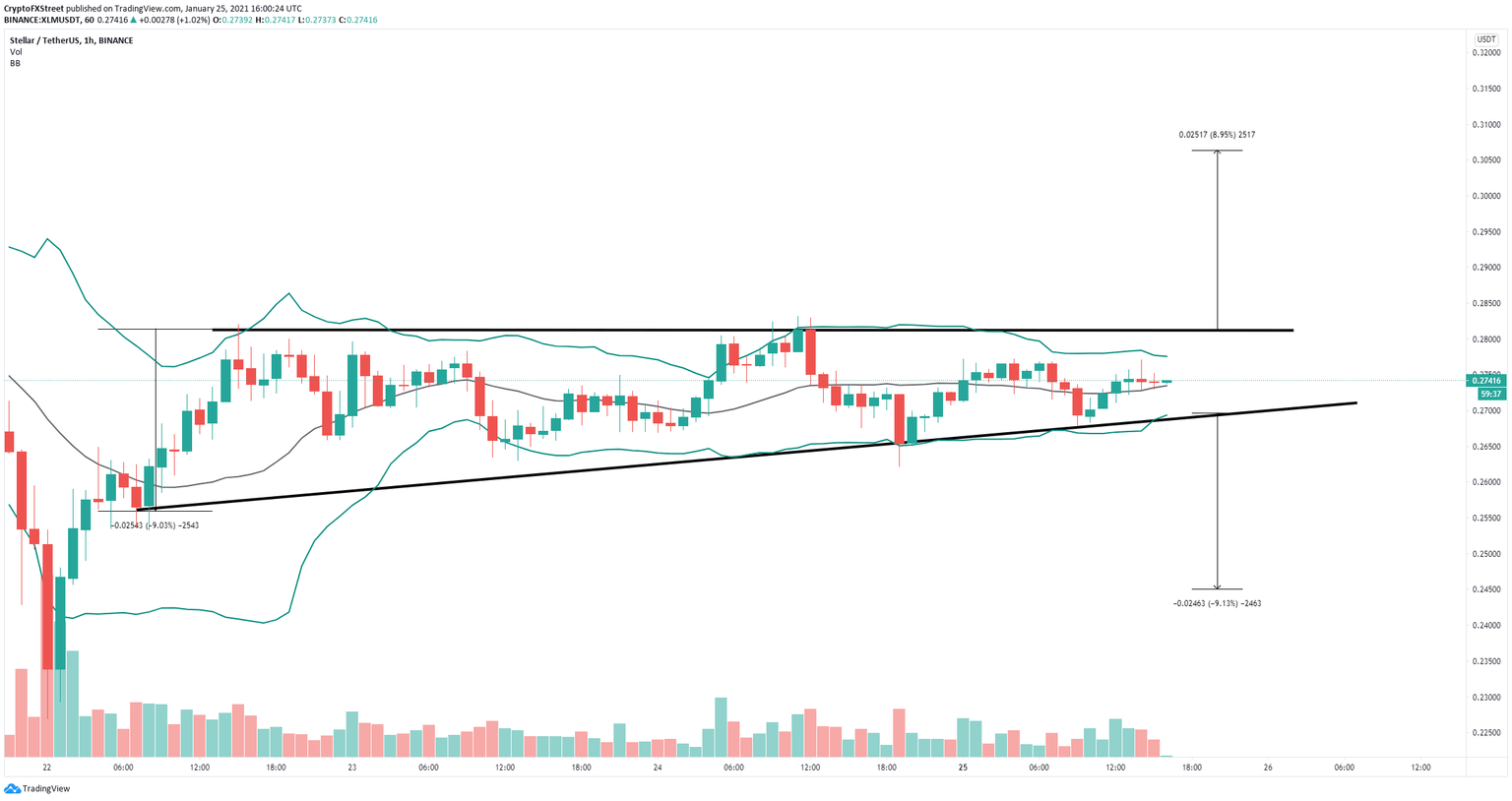

Stellar has established an ascending triangle pattern on the hourly chart, which could be close to a breakout or breakdown. The Bollinger Bands have been squeezing significantly over the past 24 hours, indicating that a potential big move is underway.

XLM/USD 1-hour chart

Cracking the critical resistance level at $0.281 would push Stellar price up to $0.306. On the other hand, failure to hold the $0.27 support level, which coincides with the lower Bollinger band, would send Stellar down to $0.245.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.