XLM Price Forecast: Stellar primed for a 60% bull rally as institutional demand skyrockets

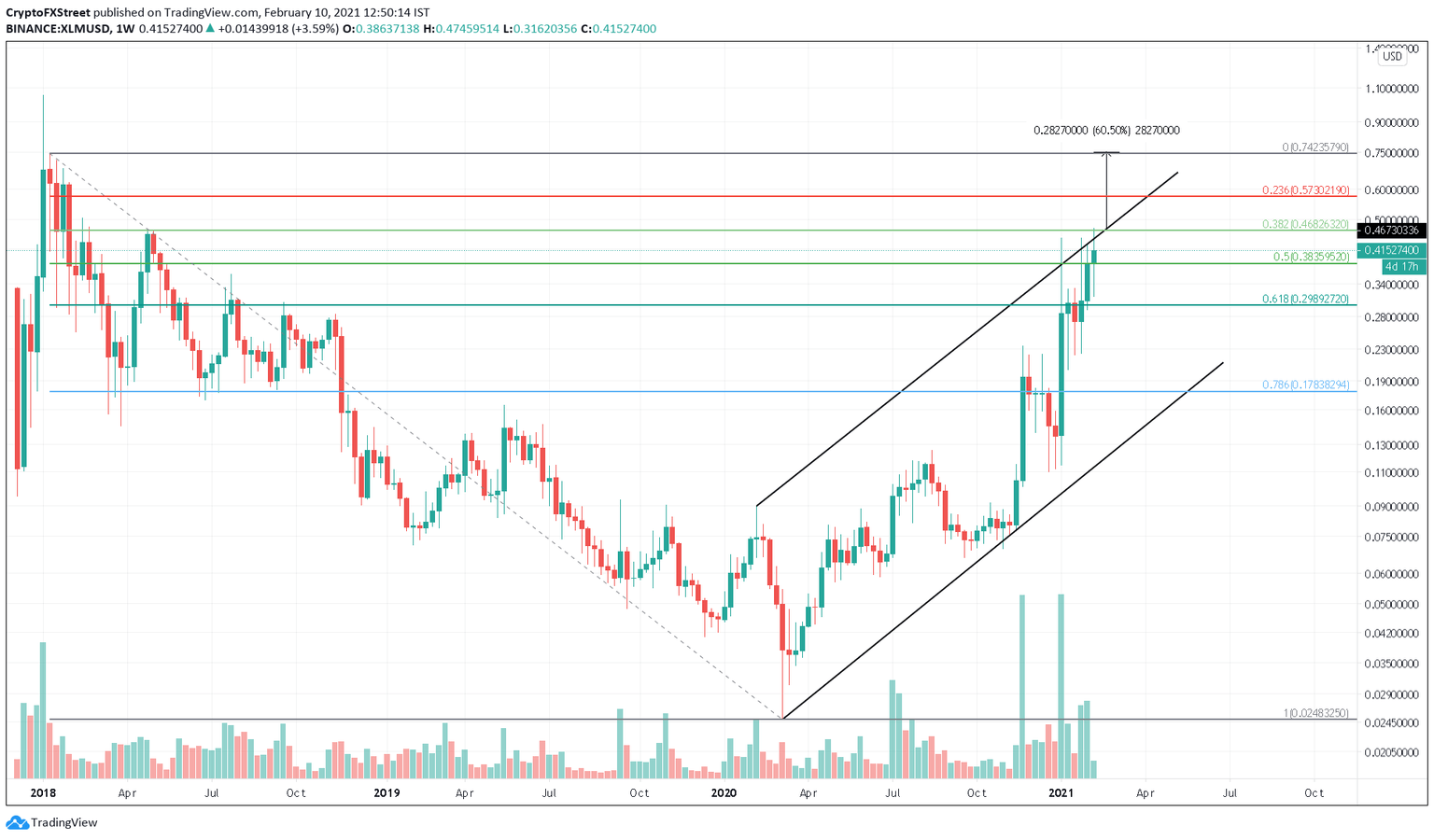

- XLM price faces stiff resistance at $0.45, which matches with the 38.2% Fibonacci retracement level.

- A weekly close above this supply barrier signals a breakout from an ascending parallel channel.

- Growing institutional demand suggests a massive spike in Stellar price soon.

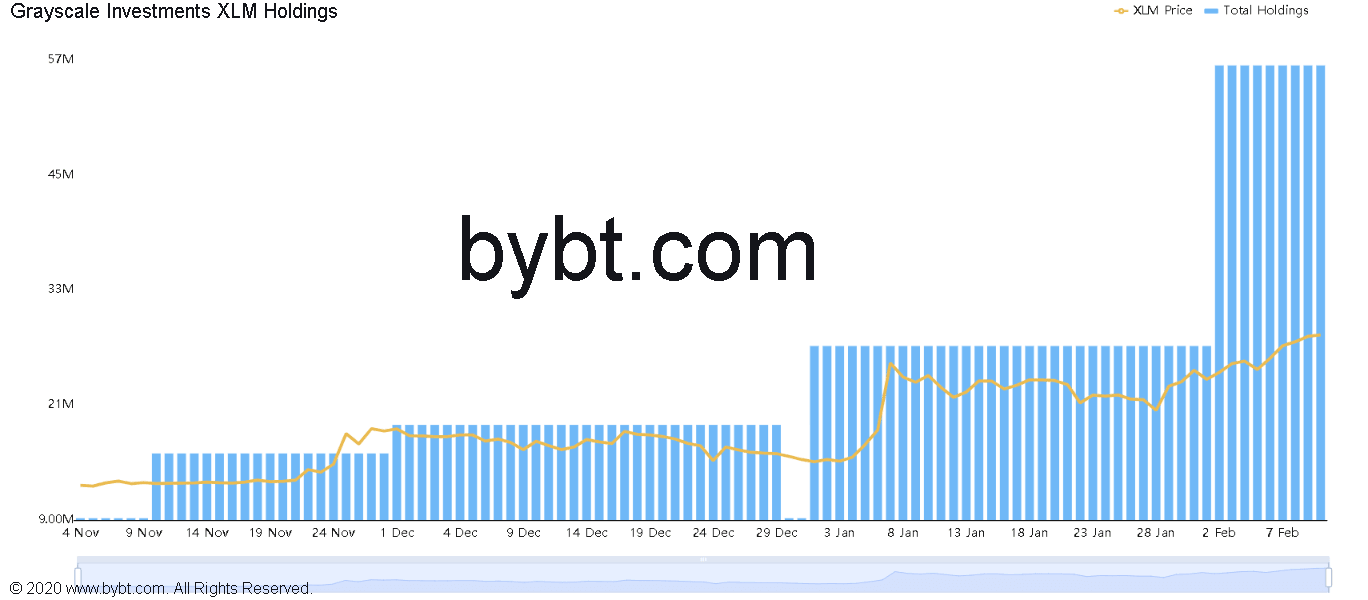

XLM price saw a 255% increase since the start of 2021. The rally could extend as Grayscale has begun accumulating a massive number of the Stellar tokens around the current price levels.

XLM price primed for another leg-up

XLM price has been consolidating in an ascending parallel channel for almost a year. Now, Stellar seems to be tapping the channel's upper trendline at $0.45.

XLM/USD 1-week chart

A spike in buying pressure around the current levels that pushes XLM price above the 38.2% Fibonacci retracement level at $0.45 could trigger FOMO among investors. If this were to happen Stellar may jump another 60% to hit a target of $0.75.

Ripple's setback is Stellar's boon

The US Securities and Exchange Commission’s lawsuit against Ripple triggered a massive liquidity exodus from its native token XRP. While some of this capital has been distributed around many cryptocurrencies, a lot has landed on XLM boosting its bullish momentum.

For instance, Grayscale is hoping to fill the void of its institutional portfolio with XLM, as it also happens to be a remittance token. The asset management company has amassed more than 29 million Stellar tokens over the past month, which represent a 107% increase in its holdings.

The sudden spike in buying pressure by Grayscale could be a sign of rising institutional demand, which could set the stage for an impressive bull run.

XLM held by Grayscale chart

Regardless, the bullish thesis will be invalidated if XLM price breaks below the $0.38 support instead. Breaking through this barrier could trigger a 30% sell-off sending Stellar down to $0.30 or lower.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.