Will Polygon partnering with Warner Music to launch a web3 music platform push up MATIC price?

- Polygon joined hands with platform builder LGND.io and Warner Music Group in a multi-year partnership.

- The web3 music platform will be designed to support NFTs from any blockchain in a proprietary player.

- MATIC price needs support from buyers to induce a bullish pressure and kick-start a run up toward $0.9743.

Polygon is one of the foremost blockchains in the smart contract and Decentralized Finance (DeFi) space. It is also a leader on the Non-Fungible Token (NFT) front, which is what the Warner Music Group will be leveraging to develop the first-of-its-kind music platform.

Polygon X Warner Music Group

In an announcement on Tuesday, Warner Music Group stated that the platform LGND Music will officially launch in January 2023. Formed in partnership with LGND.io, an e-commerce and interactive platform builder, the platform will leverage Polygon for its blockchain needs.

As per the announcement, the launch of the platform will be accompanied by a collaboration with Spinnin Records, a Warner Music Group label. LGND Music is targeted to be an NFT and digital collectible platform that will support digital collectibles from any blockchain in a “proprietary player”. Justifying the choice of Polygon as the base blockchain, the announcement read,

“To ensure a seamless experience for users, the platform will be built on Polygon, offering lower gas fees and faster transactions in an open, permissionless, and sustainable environment.”

The announcement from the Warner Music Group came at a time when NFTs are suffering terribly, with sales plunging to a 17-month low. As reported by FXStreet, the month of November recorded only $414 million in NFT sales, figures which were last seen in June 2021.

MATIC price is looking at a hike

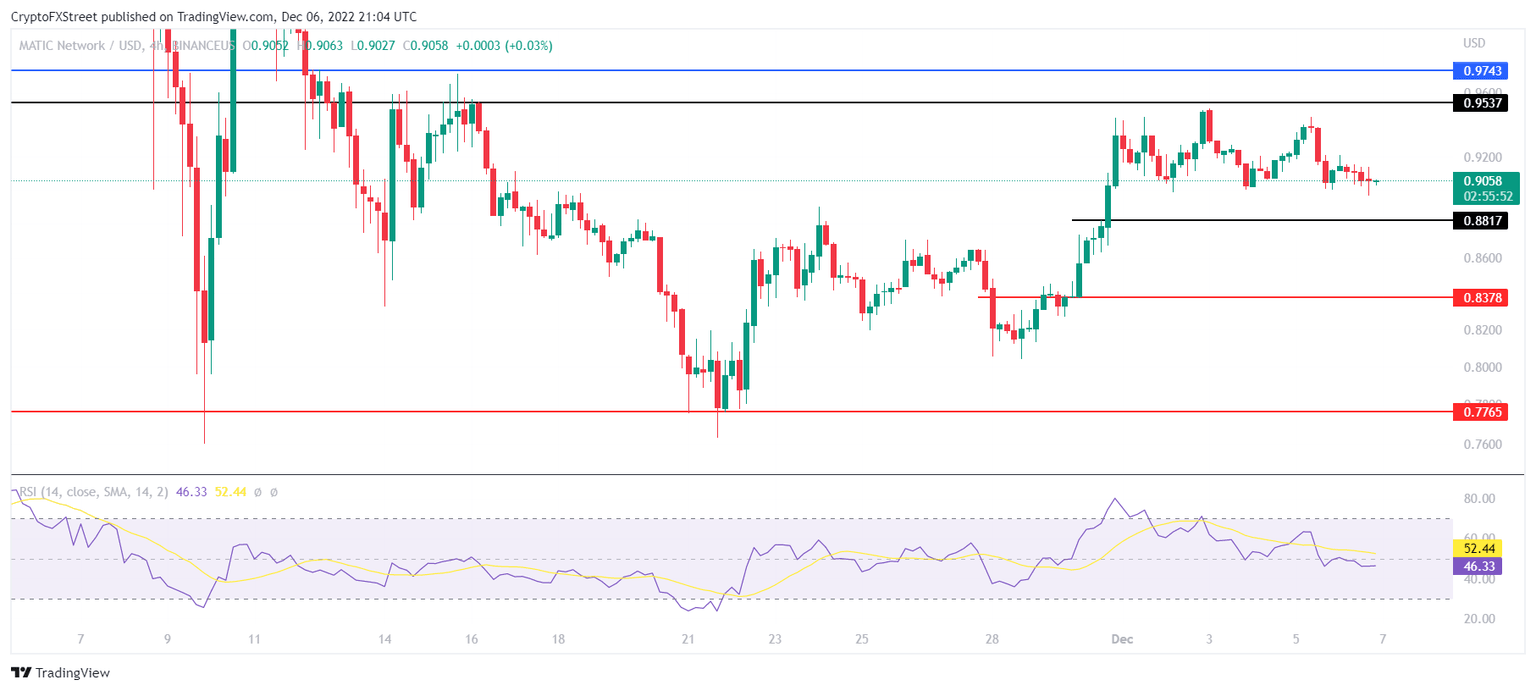

Even if the announcement bears no impact on NFT sales, it could affect the MATIC price, which is currently at $0.9059. If bullish pressure rises, the altcoin could climb the chart to tag its critical resistance at $0.9537.

A daily close above it would enable MATIC price to initiate a run up toward $0.9743. Flipping this level into a support floor would provide the cryptocurrency with the boost it needs to engage in a recovery rally.

MATIC/USD 4-hour chart

However, if the price decline and MATIC price falls through the support level at $0.8817, it could end up tagging $0.8378. A daily candlestick close below this critical support would invalidate the bullish thesis, resulting in the price falling to $0.7765, constituting a 14% crash.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.