Why the CRO price is suddenly so bearish again

- Crypto.com price fell 17% in one week.

- CRO price loses support from both 8- and 21-day simple moving averages.

- Invalidation of the bearish thesis is a breach above $0.1408.

CRO price has fallen in free fall fashion, targeting $0.09 in the short term.

CRO price hints at further decline

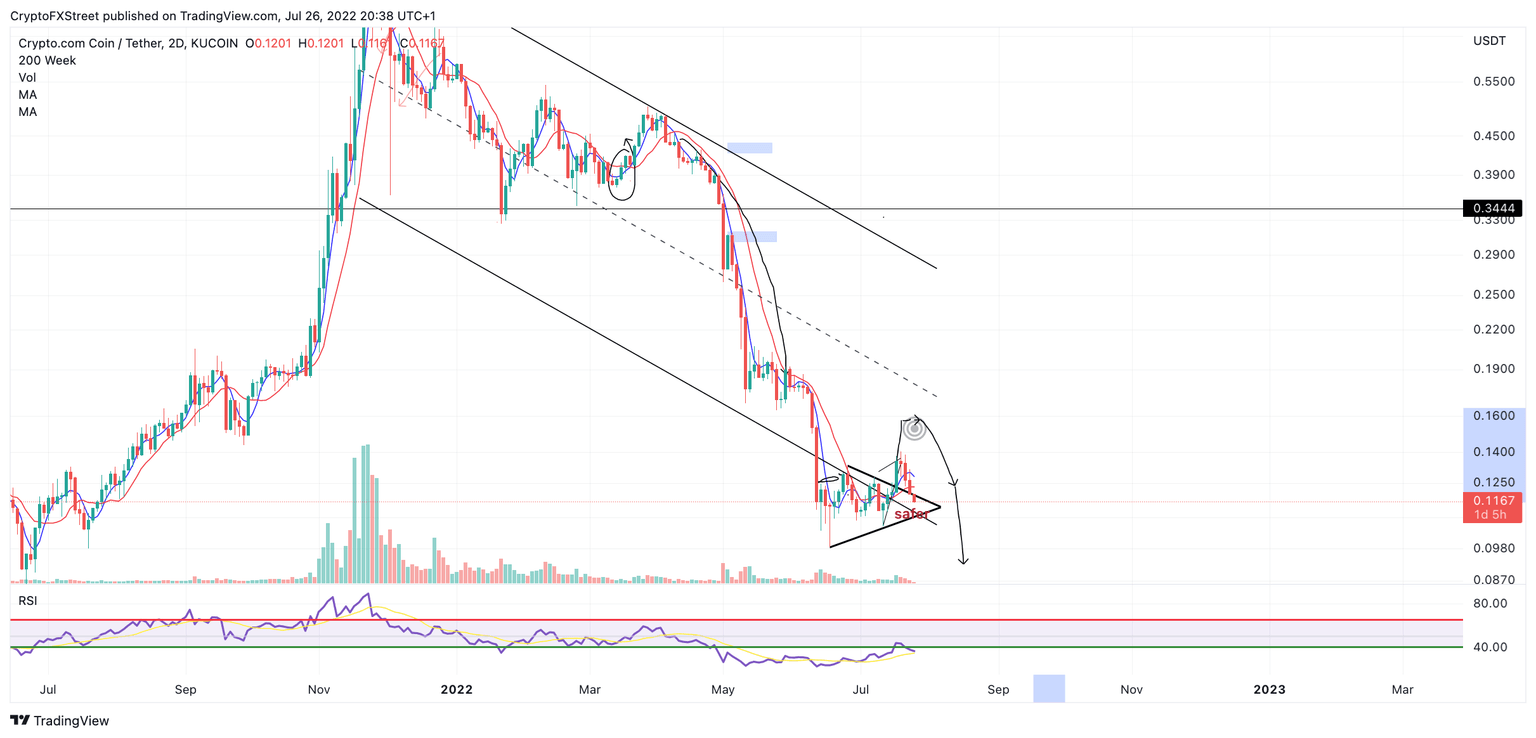

CRO price currently trades at $0.1165. On Monday, July 26, the Crypto.com price lost support from both the 8- and 21-day simple moving averages. If market conditions persist, a fall towards $0.09 will likely occur in the coming days.

CRO price provides subtle bearish confluence as the Relative Strength Index has been rejected from entering the bullish support zone on daily time frames. Nonetheless, the CRO price has been in a severe downturn since April, and bullish opportunities have only been thought of as quick countertrend plays. The potential for a reversal is still possible, and we will update subscribers if any immediate changes take place.

CRO/USD 2-Day Chart

The safest invalidation of the bearish thesis is a breach above $0.1408. If the invalidation level were to get breached, a rally towards $0.16 could occur, resulting in a 40% increase from the current Crypto.com price.

In the following video, our analysts deep dive into the recent price action of CRO analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.