Why LUNA 2.0 price is due for a 45% sell-off

- LUNA 2.0 price is likely to crash 45% again after a recent run-up.

- Sidelined buyers will get a chance to accumulate the token at the sweep of the range low at $3.50.

- A four-hour candlestick close above $10.20 will invalidate the bearish thesis.

LUNA 2.0 price looks to be consolidating above the range’s midpoint, indicating a lack of volatility. This price action has come after a recent explosive move above the upper limit, suggesting that investors are booking profits.

LUNA 2.0 price due for more losses

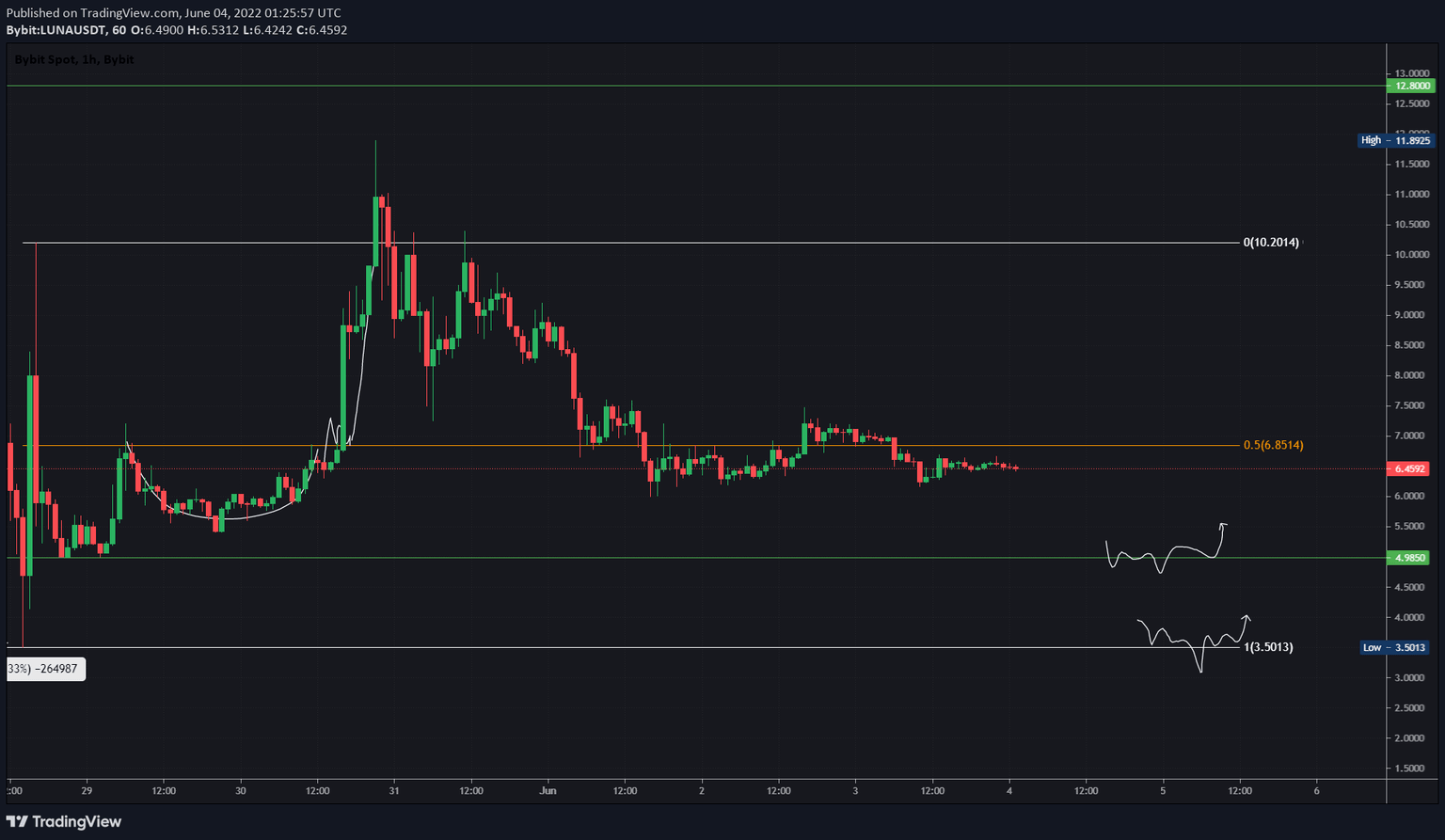

LUNA 2.0 price set a range, extending from $3.50 to $10.20 and has been trading within this range. After forming base at $4.98 on May 28, the altcoin exploded by 137% to sweep the range high at $10.20.

While this move was impressive profit-taking from investors led to a 42% decline that pushed the LUNA 2.0 price down to the range’s midpoint at $6.85. As the newly launched reboot of LUNA grapples with this level, the chances of a decline seem to be more.

Since the range high was swept recently, investors can expect a sweep of the range low at $3.50 soon. This downtrend will allow bulls a chance at recovery around the $4.98 support level. A failure here would further plummet the LUNA 2.0 price to $3.50.

In total, this decline would constitute a 45% loss and is likely where the downside is capped for LUNA 2.0 price.

LUNA/USDT 1-hour chart

While things are leaning bearish for LUNA 2.0 price, a quick uptrend in Bitcoin price could quickly change the sentiment. In such a case, if LUNA 2.0 price produces a four-hour candlestick close above $10.20 and flips it into a support level it will invalidate the bearish thesis.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.