Why Crypto.com price is suddenly so bullish

- Crypto.com price has breached several vital resistance levels.

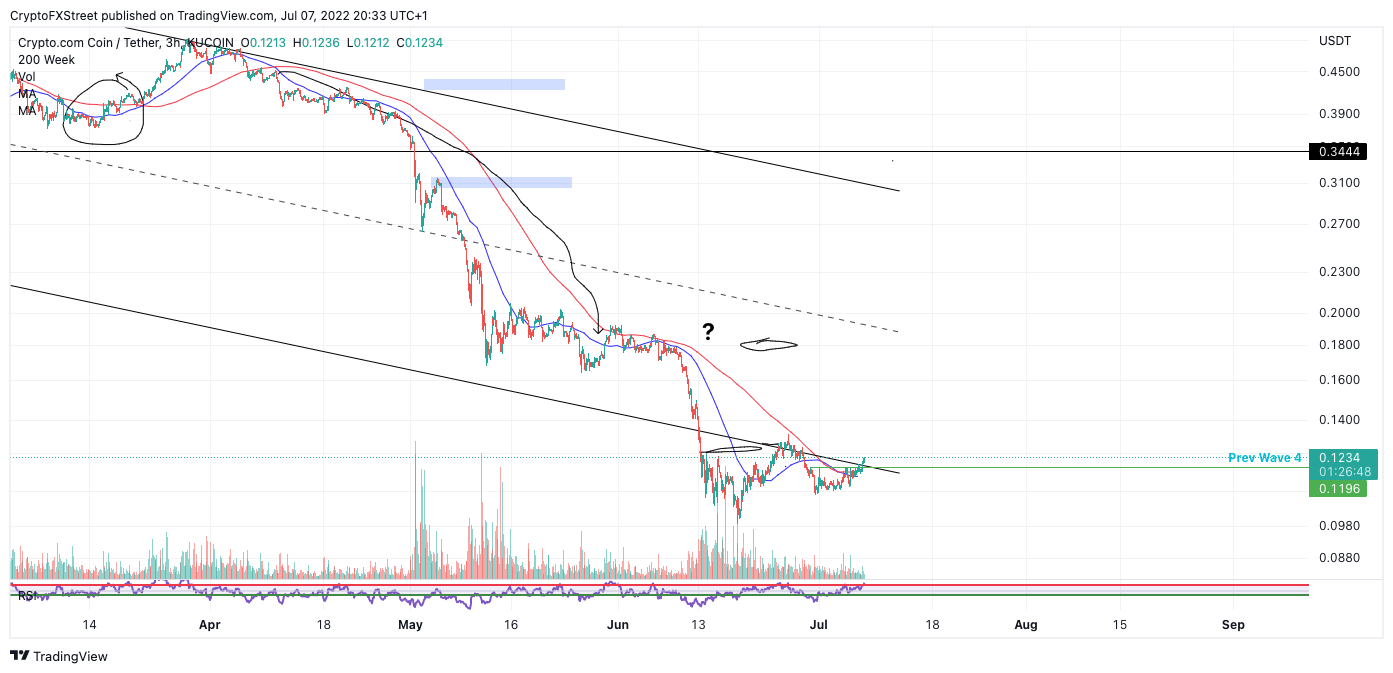

- CRO price is back above the weekly descending trend channel.

- Invalidation of the uptrend is a breach below $0.10.

Crypto.com price shows trend-rallying signals to begin the month of July. Placing a short-term bullish trade is justifiable for these reasons.

Crypto.com price is on the move

Crypto.com price could awaken bulls to meet at the table as a bullish engulfing candle has recently breached through the $0.11 barrier, long subdued by a descending parallel channel. The parallel channel from November 2020 has played a significant role in previous trend changes for the notorious Ethereum-based exchange token.

Crypto.com price currently trades at $0.1231. An 8- and 21-day simple moving average (SMA) currently compresses just below the current price action, which is a confounding signal for an imminent bull run. Elliot wave enthusiasts may also appreciate the bulls recently breaking through a previous wave four pattern at the $0.12 barrier.

CRO/USDT 3-Hour Chart

If market conditions are genuinely bullish, the bulls should have no problem breaching through the $0.14 barrier. A FOMO rally could then ensue towards $0.17 If the bulls can produce enough volume.

Invalidation for the bullish thesis is a breach below $0.10. If the bears' breach this level, consider the uptrend scenario. The bears could produce a decline targeting $0.09, resulting in a 25% decrease from the current Crypto.com price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.