Where does Ethereum go after all-time high of $4,943?

Ethereum (ETH) tumbled at the start of the week after briefly touching a new milestone over the weekend. On Monday, the world’s second-largest cryptocurrency fell 8% to $4,431.60, according to CoinGecko.

Only a day earlier, it had climbed to a record high of approximately $4,946, surpassing the peak reached on Friday. This marks its first all-time high since 2021.

Ethereum Chart Source: TradingView

Meanwhile, Bitcoin (BTC) also weakened. It slipped 2% down to $110,531.00, its lowest level since July. The leading cryptocurrency had notched a recent record of $124,496 on Aug. 13. This shows the sharp retracement across the digital asset market.

ETH retreats after surging to new all-time high

Last week’s surge was fueled by comments from Federal Reserve Chair Jerome Powell, who suggested rate cuts could start as early as September. The signal lifted risk appetite across global markets, sending cryptocurrencies sharply higher.

However, the upswing was quickly met with heavy liquidations. According to CoinGlass, over $245 million in long ether positions and $175 million in long bitcoin trades were erased within just 24 hours.

In the meantime, Ethereum has been outpacing Bitcoin for weeks. This is as a result of regulations, rising demand for tokenization projects, and corporate accumulation.

Firms such as Bitmine, SharpLink, and ETHZilla have added Ethereum to their treasuries.

The latest fund flow also points to a shifting market trend, with ETH ETFs pulling in $341 million in inflows on Friday, marking their second straight day of gains and led by Fidelity’s FETH fund, according to SoSoValue.

By contrast, bitcoin ETFs saw their sixth straight day of outflows, led by BlackRock’s IBIT, while others posted only modest inflows. For the week ending Aug. 22, ETH products recorded $237M in net outflows, their first since May, while Bitcoin ETFs shed over $1B.

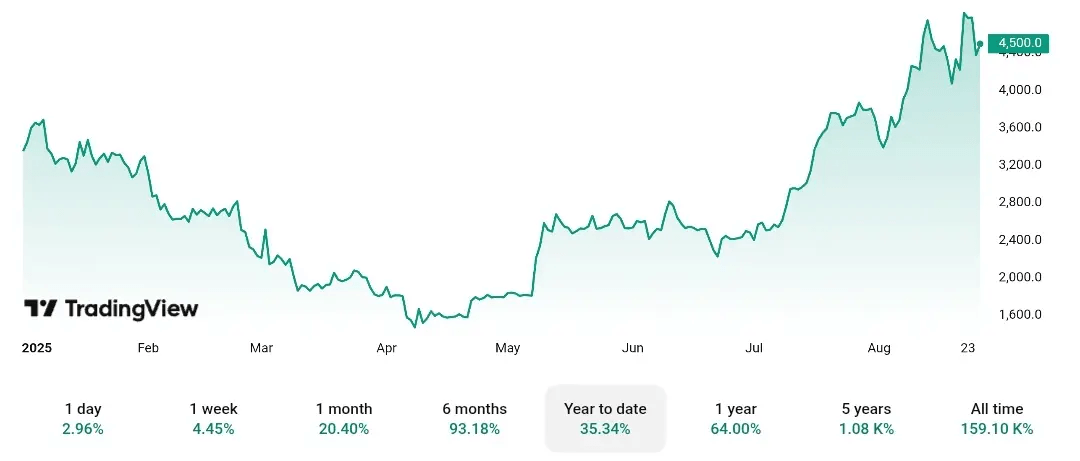

Despite the market pullback, ETH currently remains one of the best-performing major assets in 2025. As of writing time, Ethereum is up about 35.34% year-to-date, compared to Bitcoin’s 17.57% gain.

Ethereum Yearly Chart Source: TradingView

Could Ethereum Really Hit $10k to $20k with Rising Market Momentum?

Market speculators say the latest downturn could be temporary, with on-chain data pointing to further upside.

Popular analyst Gert van Lagen noted on X Monday that Ether’s long-term holder NUPL has entered the “belief-denial” green zone, a stage often seen before major price rallies.

Technically, ETH has confirmed a bullish megaphone pattern on weekly charts with a target near $10,000, said crypto strategist Jelle.

Source: Jelle on X

Fellow analyst Mickybull Crypto projects the token could trade between $7,000 and $11,000 this cycle, while others see a possible move to $12,000 or higher in 2025 if ETF inflows persist and rate cuts arrive as expected.

For now, ETH is currently trading at $4,463 with $38.6 billion in intraday volume, stabilizing after a historic weekend surge. The next move, whether a pause before new highs or a broader pullback, will depend on macro trends, ETF activity, and sustained institutional demand.

Author

Jacob Wolinsky

ValueWalk

Jacob Wolinsky is the founder of ValueWalk, a popular investment site. Prior to founding ValueWalk, Jacob worked as an equity analyst for value research firm and as a freelance writer. He lives in Passaic New Jersey with his wife and four children.