What to expect after Cardano’s 10% rally this weekend

- Cardano price has rallied 10% over the weekend.

- An influx of volume accompanies the recent uptrend.

- Invalidation of the bearish trend is a breach below $0.33.

Cardano price has rallied impressively in the last few days. Key levels have been defined to gauge the strength of the move.

Cardano price pumps

Cardano price has rallied in applaudable fashion to end the third week of October. Since the start of the week, ADA, the self-proclaimed Ethereum killer token, lost 10% of its market value. Over the weekend, the bulls have managed to reconquer nearly all of the losses as a strong bullish rally ensues.

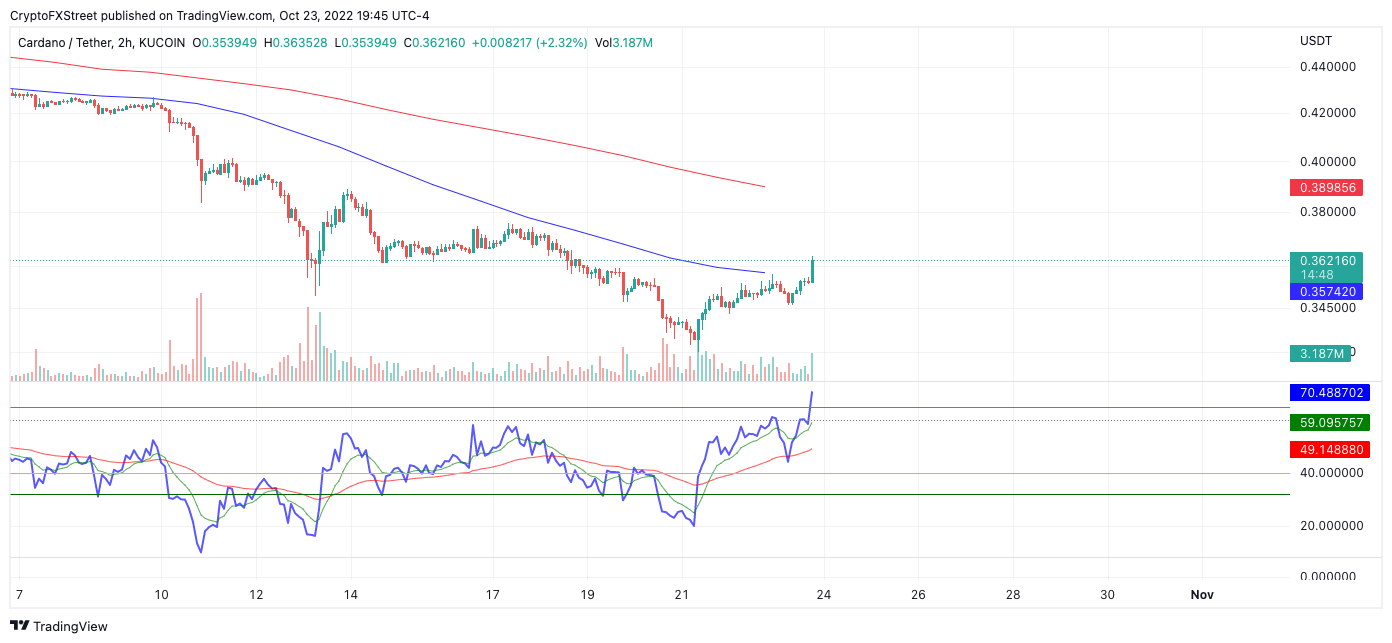

Cardano price currently auctions at $0.3619.the rally north has breached the 8-day exponential moving average. The Relative strength index has rallied into over-bought, hinting at bullish confidence. Most importantly, the volume amidst the current ascension has produced a classic ramping pattern in favor of the bulls.

ADA USDT 3-Hour Chart

If market conditions persist, a rally toward the 21-day simple moving average stands a fair chance of occurring. Such a move would result in an additional 8% increase in price.

The uptrend scenario depends on the recently established swing lows at $0.33 remaining untagged. If the bears tag the invalidation point, the entire uptrend would be void. The ADA price would likely continue falling south towards $0.230 and potentially $0.25, resulting in up to a 30% decline.

In the following video, our analysts deep dive into the price action of Cardano, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.