Whales flock to Dogecoin as DOGE bulls trigger a 75% rally

- Dogecoin price breaks out of a falling wedge pattern, signaling a 75% ascent.

- The number of long-term holders of DOGE continues to skyrocket despite the lackluster performance in the second half of 2021.

- A weekly candlestick close below $0.11 will invalidate the bullish thesis.

Dogecoin price has been on a constant downtrend since its all-time high in May 2021. This setup is crucial since it was breached last week and shows no signs of slowing down.

Dogecoin price continues to make headway

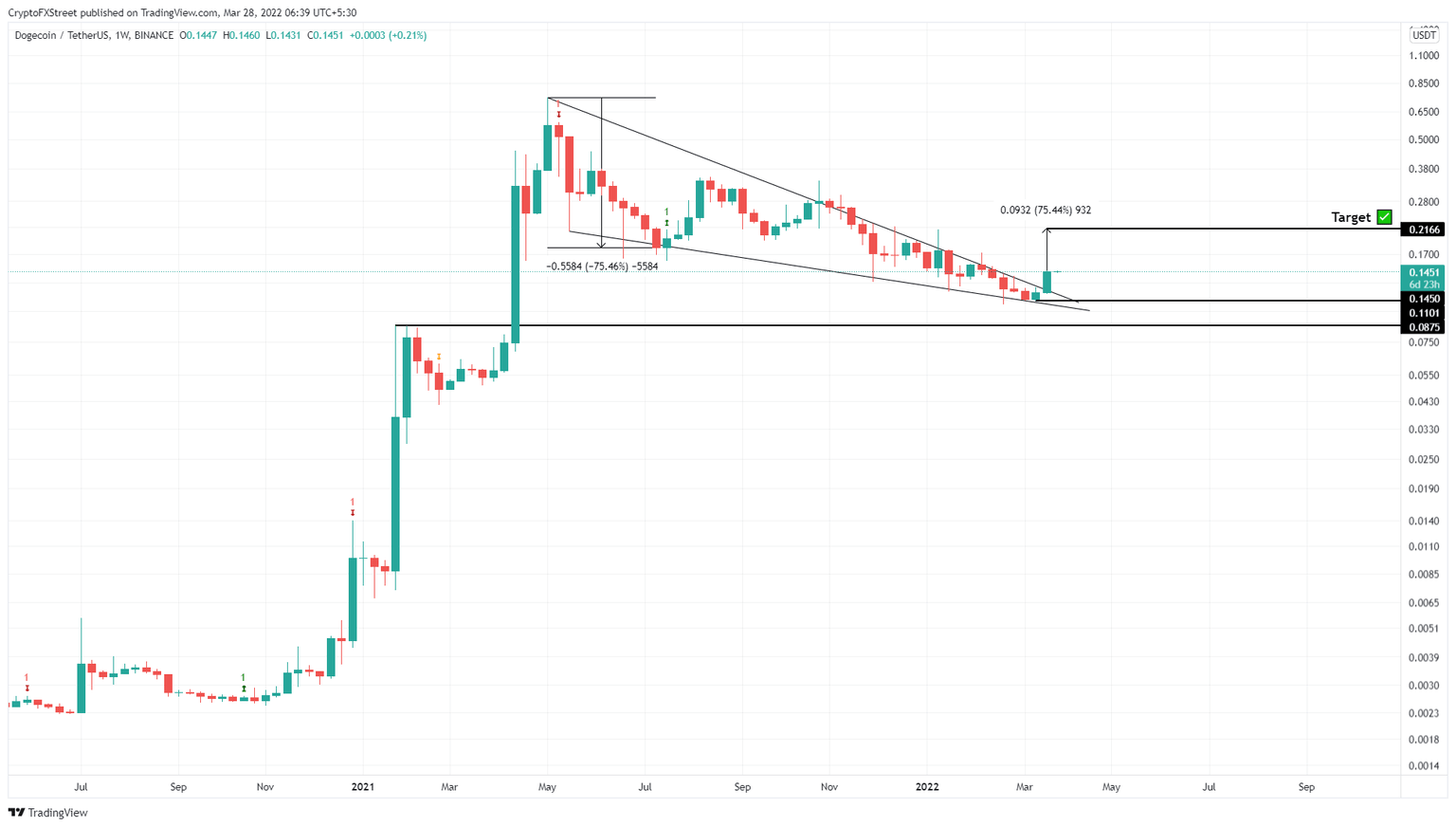

Dogecoin price set up four lower highs and five lower lows since May 3, 2021. Connecting these swing points using trend lines results in a falling wedge formation. The technical formation forecasts a 75% ascent to $0.216, obtained by adding the distance between the first swing high and low to the breakout point.

Interestingly, the Dogecoin price breached the falling wedge’s upper trend line on March 21, at $0.123. Since then, DOGE has rallied 21% and has already started the week green, indicating more gains in the near future.

DOGE/USDT 1-day chart

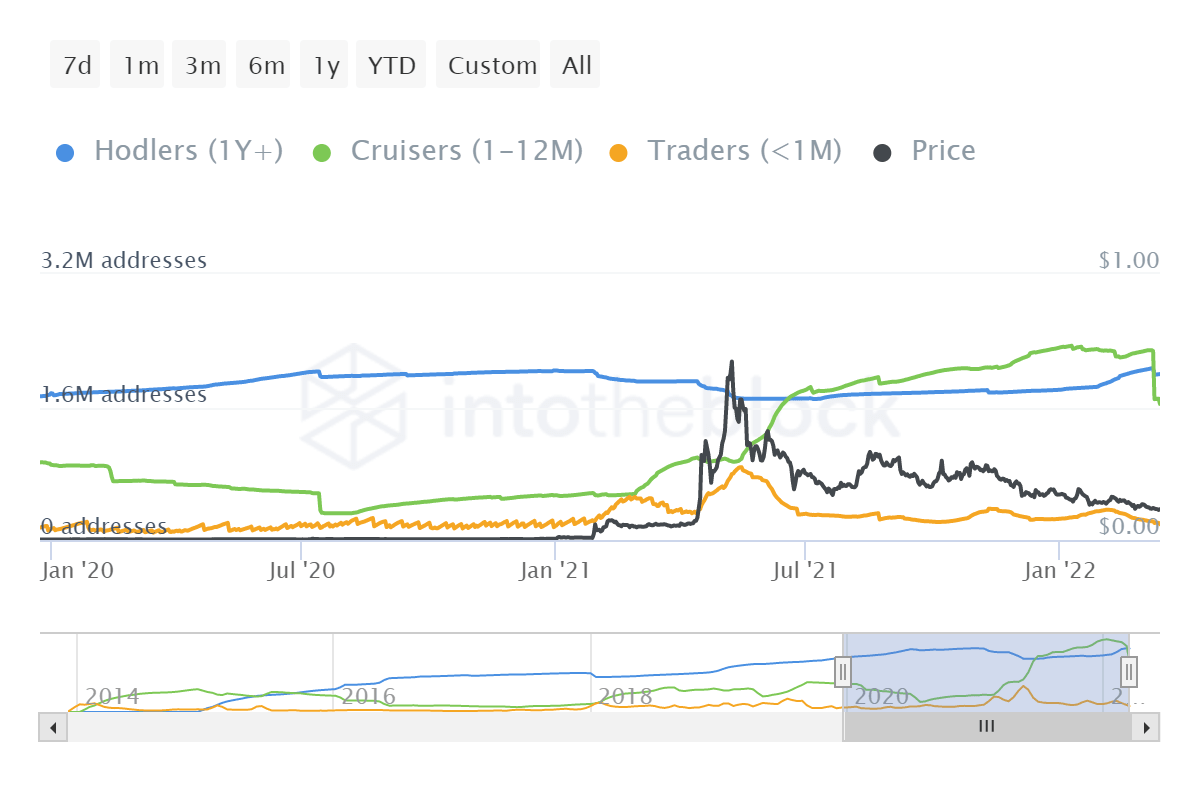

While things are looking up from a technical perspective the number of long-term investors or holders that hold DOGE for more than a year, seems to have been increasing despite the lackluster performance of Dogecoin price for the better part of 2021.

The number of such investors has increased from 1.7 million addresses to 2 million since 2020, indicating a 17% uptick and an interest from these holders at the current price levels.

Interestingly, the cruisers that often hold DOGE for less than a year have also skyrocketed from 1.92 million in March 2021 to 2.05 million in March 2022. However, between March 9 and March 28, a large chunk of these investors seem to have exited their positions and the number has dropped to 1.64 million.

DOGE addresses by time held.

Regardless of the massively bullish outlook for Dogecoin price, a bearish outlook awaits, if DOGE undoes the last week’s gains.

A weekly candlestick close below $0.11 will invalidate the bullish thesis for Dogecoin price. This development would open the path for DOGE to explore lower levels such as $0.087, where buyers might step in and cauterize the wound.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.