Caveats to Dogecoin price action and what to expect

- Dogecoin price has rallied 15% in less than 48 hours signaling the start of an uptrend.

- Investors can expect DOGE to rally 40% and retest $0.19 if bulls produce a higher low.

- A daily candlestick close below $0.109 will invalidate the bullish thesis.

Dogecoin price action is a reflection of bullish resurgence and signals the possibility of continuing the uptrend. A higher low is necessary for bulls to take complete control and propel DOGE higher.

Dogecoin price kick-starts an uptrend

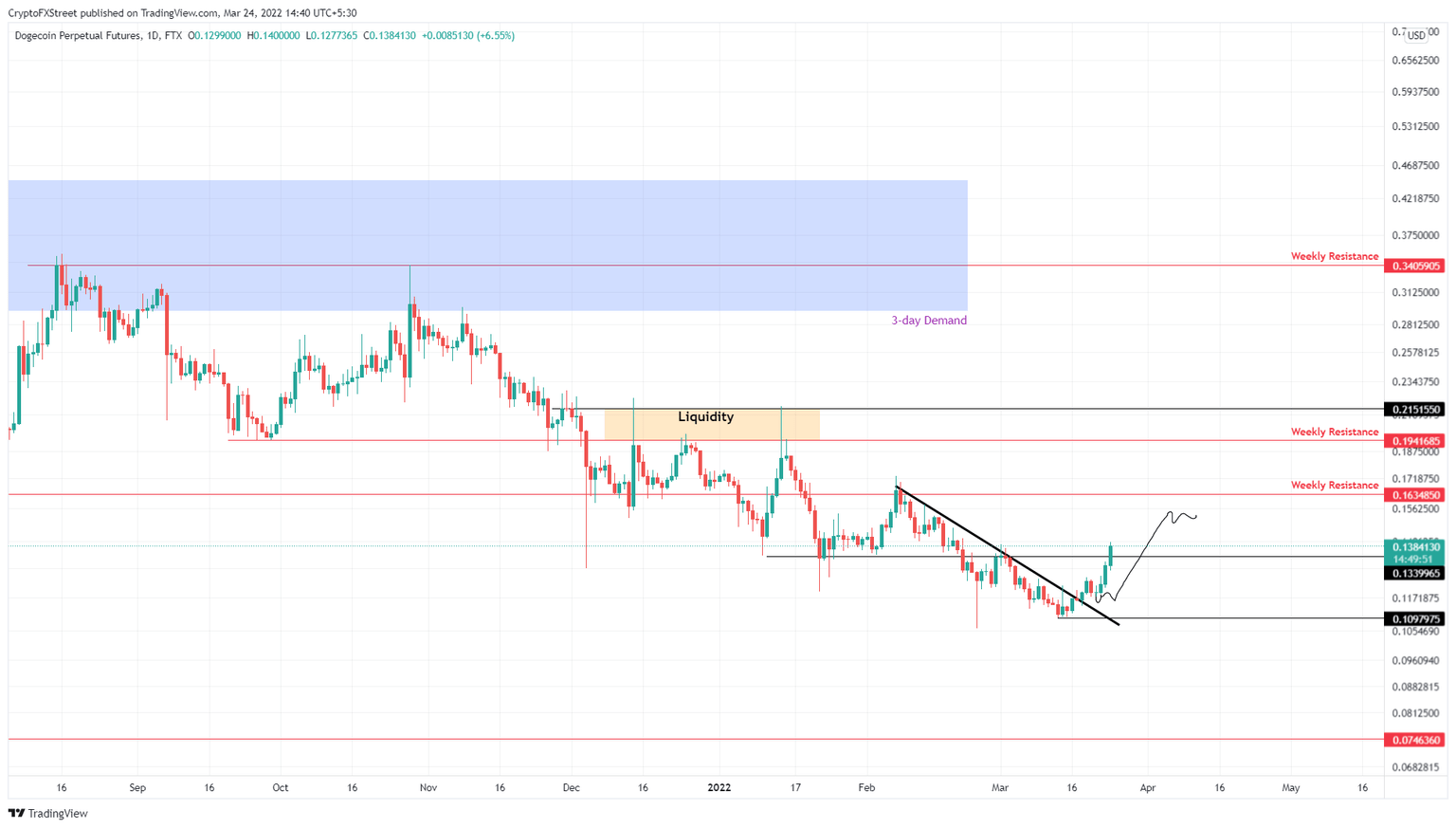

Dogecoin price embarked on a mini downtrend, starting February 8 that shed roughly 30% before forming a base around $0.109. The swing highs of this correction can be connected using trend lines.

On March 18, DOGE breached the trend line, signaling an end of this mini downtrend and the start of an uptrend. Although the Dogecoin price stumbled along the way, it has rallied 20% since the breakout and is currently grappling with the $0.134 blockade.

Interested investors can enter a long position after a successful flip of $0.134 into a support level.

While the uptrend so far has been nothing short of impressive, this move could be vital to triggering an uptrend if DOGE produces a higher high above $0.163. This key resistance barrier supported Dogecoin price action from crashing for nearly nine months. Hence, flipping this hurdle into a support floor will be a major trend change favoring bulls.

Interested investors can wait for a confirmation of the uptrend to arrive after DOGE produces a higher low

DOGE/USDT 1-day chart

Regardless of the bullish outlook, a tell-tale sign of collapsing bullish momentum is if Dogecoin price cannot produce a higher low.

Additionally, a daily candlestick close below $0.109 will invalidate the bullish thesis for Dogecoin price. In such a case, DOGE could crash 32% and revisit the $0.074 support level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.