Weekly commentary on trending cryptos: Ethereum, Vine and Zora

- Ethereum, Vine and Zora are trending on Monday as the crypto market cap is back above $4 trillion.

- Bitcoin hovers under the $120,000 level, eyeing a retest of the all-time high.

- Crypto traders are bullish, fear and greed index shows market participants are “greedy.”

Bitcoin (BTC) is consolidating close to the $120,000 level, a key resistance for the king crypto on Monday. The largest cryptocurrency bounced back from Friday’s low of $114,723, and altcoins recovered alongside BTC.

Ethereum (ETH), Vine (VINE) and Zora (ZORA) are trending on Monday as well, according to data from crypto data tracker CoinGecko.

Ethereum, Vine and Zora are trending

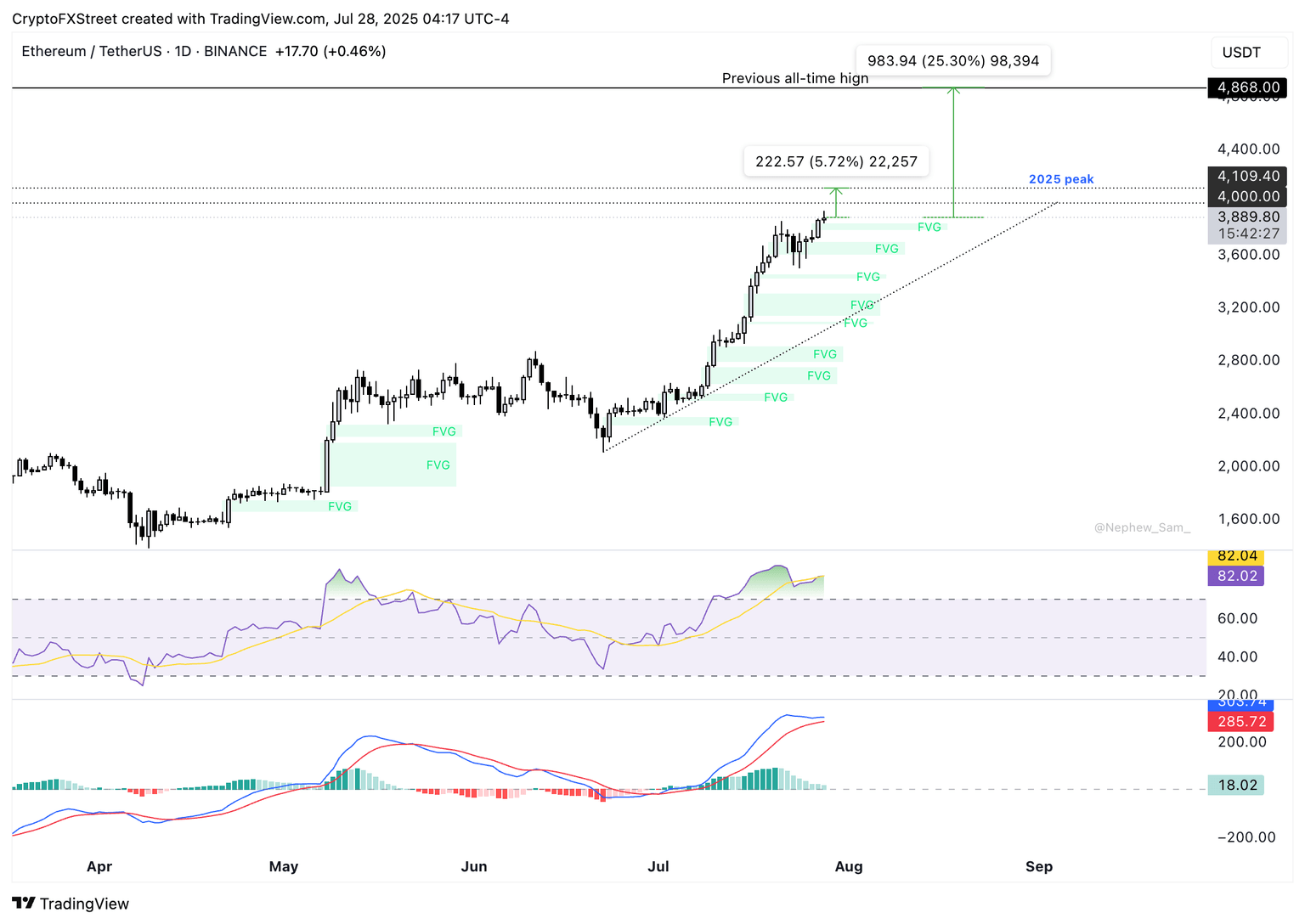

Ethereum is 25% away from its all-time high of $4,868, close to the $5,000 level. The largest altcoin is trending after a 60% rally in the past month. The second-largest crypto is rallying toward $4,000, a psychologically important level for the altcoin.

Ether is 5% away from its 2025 peak of $4,109. The Relative Strength Index (RSI) on the daily price chart reads 82, while that means Ethereum is likely overvalued, traders need to watch RSI closely for signs of reversal. If RSI slips under 70, it could generate a sell signal.

The Moving Average Convergence Divergence (MACD) flashes green histogram bars above the neutral line, meaning that there is an underlying positive momentum in Ethereum price trend.

ETH/USDT daily price chart | Source: TradingView

A market correction could send Ethereum to collect liquidity at the lower boundary of a bullish Fair Value Gap (FVG) on its daily price chart at $3,600. Ether could sweep liquidity at this level before another leg up.

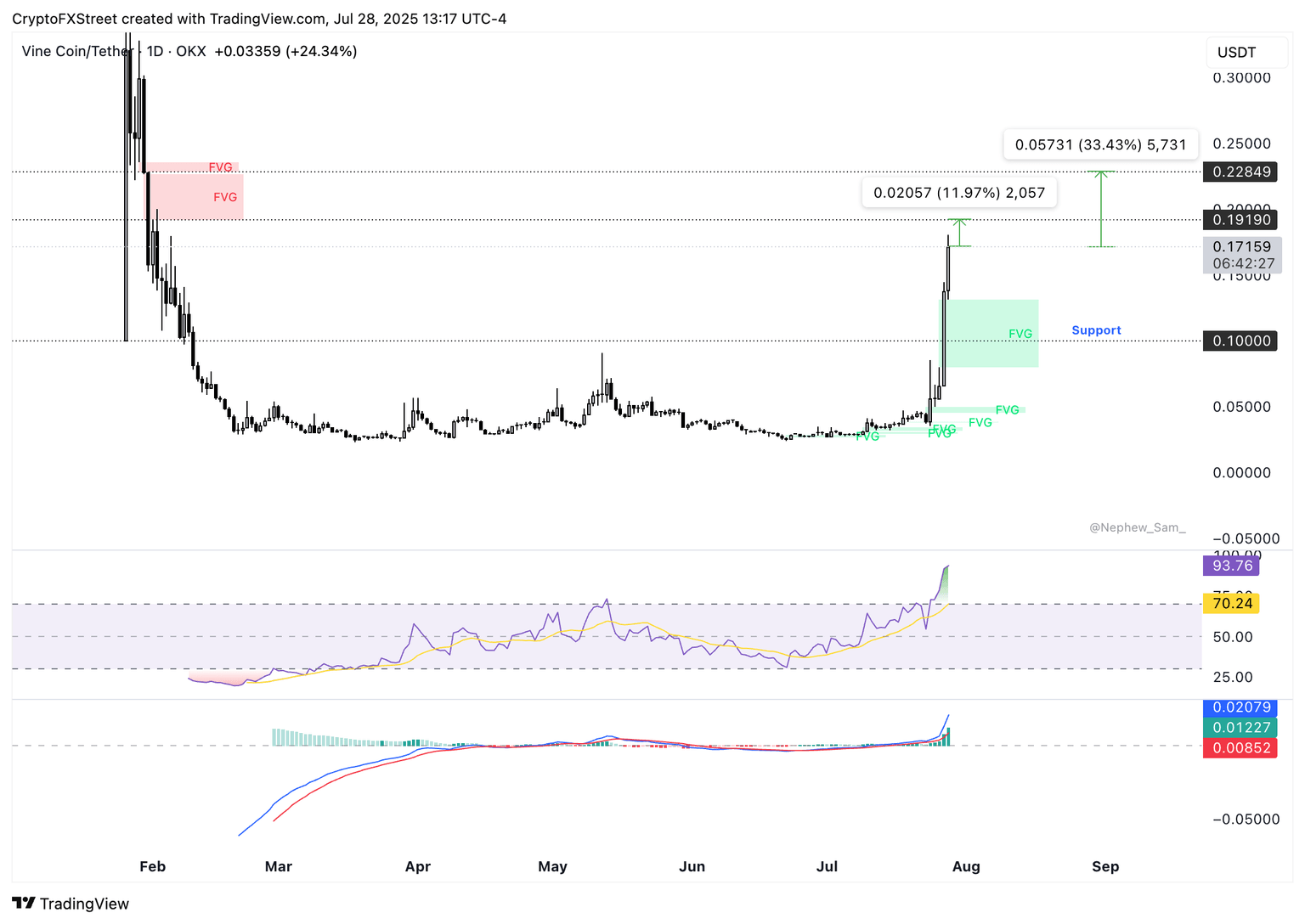

VINE has added 248% to its value in the last week and over 8% on the day. The Solana-based meme token is associated with a video-sharing platform, and the demand for the token is catalyzing gains in VINE.

VINE/USDT daily price chart | Source: TradingView

ZORA rallied 300% in the last seven days, and the token started erasing its gains on Monday. ZORA is down nearly 5% on Monday. The native crypto of the Zora blockchain on Ethereum Layer 2 supports monetization for creators.

ZORA currently trades at $0.0809, and the token is down 23% from its all-time high of $0.1050. If ZORA price slips lower, the Layer 2 token could sweep liquidity at two key support levels, $0.0700 and $0.0550.

The RSI and MACD support a bullish thesis in ZORA, so the token could therefore retest its all-time high, unless the trend reverses.

ZORA/USDT daily price chart | Source: TradingView

The crypto Fear and Greed Index, a sentiment tracker that measures the bullish/ bearish sentiment among traders on a scale from 0 to 100, reads 75. This reading means traders remain “greedy” or bullish, similar to last week.

As market participants remain bullish on crypto, traders are anticipating the arrival of an altcoin season. Read more about it here.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.