Vitalik Buterin ups X activity in August, posts more than last 18 months

Ethereum co-founder Vitalik Buterin has drastically increased his activity on X, posting more in the last month than the 18 months prior after criticism he had abandoned the platform.

Across all of August, Buterin posted or replied about Ether ETH $2,343, the Ethereum blockchain, and other topics at least 158 times, as trader and conomist Alex Krüger pointed out in a Sept. 12 X post.

In comparison, from January to July, he posted 44 posts and posted just 13 times in all of 2023.

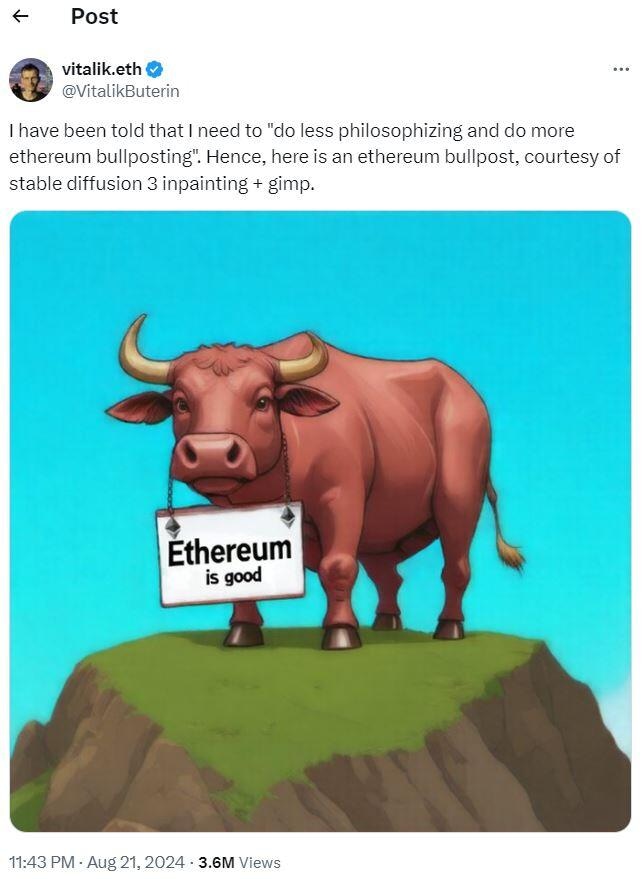

Buterin wrote in an Aug. 20 X post that he was told to "do less philosophizing and do more Ethereum bullposting.”

Source: Vitalik Buterin

Buterin was criticized and accused of abandoning X for the smaller Farcaster platform, with largely follower accounts, including by “Autism Capital,” who called for Buterin to return to X and push Ethereum.

In a reply to Elon Musk, Autism Capital speculated that Buterin left X for Farcaster because it allowed him to engage with a smaller group of like-minded peers with less scrutiny.

Source: Autism Capital

Buterin’s increased X activity has continued into September, with more than 30 posts or replies up to Sept. 13, with posts suggesting that the community should begin ramping up the pressure on L2s without adequate decentralization protocols.

In July, Solana surpassed Ethereum in weekly total fees for the first time, clocking approximately $25 million in revenue versus Ethereum’s $21 million.

At the same time, Buterin transferred about $10 million worth of his Ether holdings to wallets associated with crypto exchanges in August and Arkham Intelligence data showed Buterin’s address had outflows of around 422,000 ETH (worth $993 million) since 2015.

The transfers led to speculation that Buterin has been selling his Ether holdings to realize profits, which he denied, saying he has never sold his Ether holdings for profit, only to support various projects that he thinks are valuable.

The price of Ether is currently sitting at $2,350 and has been unable to close above $2,500 since Sept. 2.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.