VeChain Price Prediction: VET sweeps lows in preparation for 63% advance

- VeChain price has broken out of an ascending triangle pattern but lacks momentum.

- A decisive flip of the supply zone extending from $0.127 to $0.142 into demand will signal the start of an uptrend.

- The technical pattern projects a 63% bull rally to $0.235 for VET.

VeChain price is consolidating inside a bullish technical formation, suggesting a massive rally shortly. Although VET broke out of the pattern, the buyers are not backing this move.

VeChain price eyes higher highs

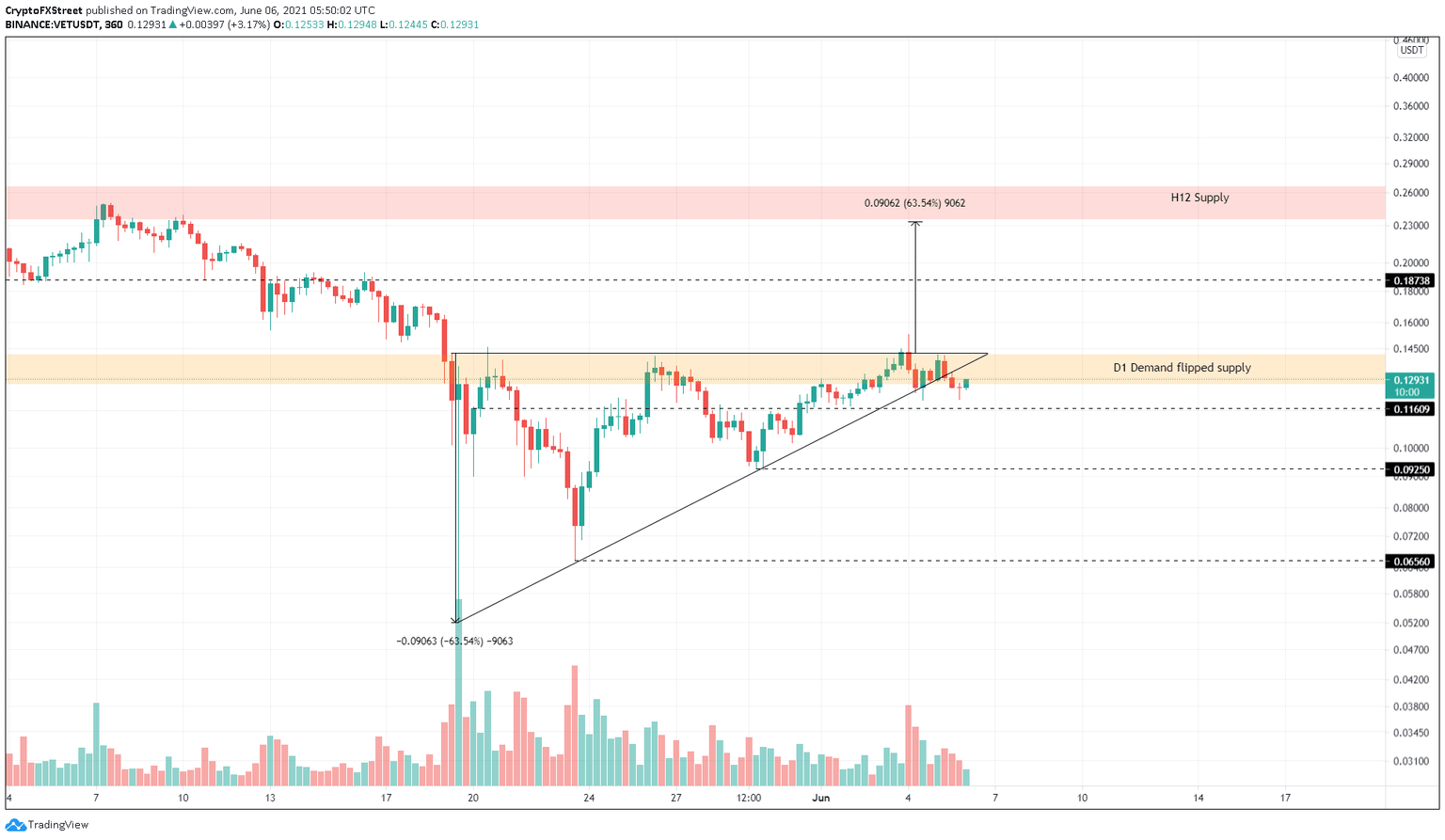

VeChain price has been on a consolidation streak since May 19. In this range-bound phase, VET has set up four equal highs around $0.142 while creating four higher lows. If these swing points are connected using trend lines, an ascending triangle forms.

This setup is a bullish pattern that projects a 63% upswing to $0.235, obtained by adding the distance between the equal highs and the first swing low to the breakout point at $0.142.

Although VeChain price breached the triangle’s hypotenuse on June 5, it is not a bearish sign. Often, a breakout from a bullish pattern sweeps the local lows before rallying higher.

However, investors should wait for a 6-hour candlestick close above $0.142 to confirm the start of an uptrend.

If such a move were to happen, Vechain price has the potential to surge 30% to the interim resistance level at $0.187. Following the breach of this barrier, market participants can expect VET to rally another 26% to tag the lower boundary of a supply zone that extends from $0.235 to $0.266.

VET/USDT 6-hour chart

On the flip side, if VeChain price falls below 0.116 for an extended period, investors should exercise caution. A breakdown of the local low at $0.0925 will invalidate the bullish outlook and result in a 30% sell-off to $0.066.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.