VeChain Price Prediction: VET holds above massive demand barrier that may propel it to higher highs

- VeChain price hovers at a critical demand barrier, hinting at a surge if the support level holds.

- Other high-interest levels remain intact despite the recent correction suggesting that VET is ready to take off.

VeChain price corrected 35% within 24 hours, owing to its correlation with Bitcoin. While its VET’s resurgence since the drop shows signs of lingering buying pressure, on-chain metrics show the most critical support level underneath it is still intact.

VeChain price may resume uptrend if critical support holds

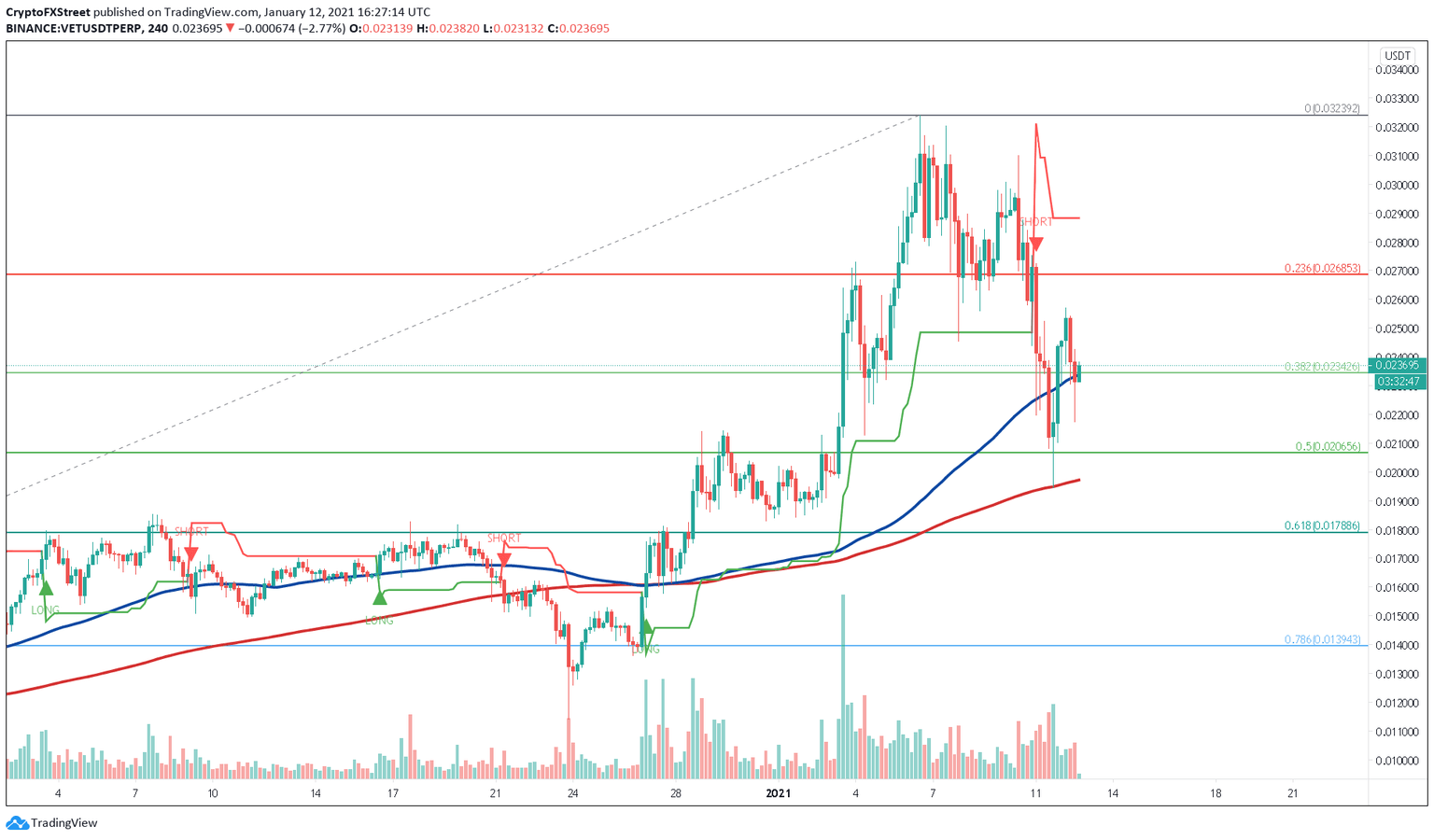

VET is currently trading at $0.0236 after dipping towards the 200-MA at $0.0194 on the 4-hour chart. Buyers have managed to nullify the recent drop and push this cryptocurrency above the 100-MA, which coincides with the 38.2% Fibonacci level.

Now, the bulls must defend this support level to prevent VeChain from printing a lower low.

VET/USDT 4-hour chart

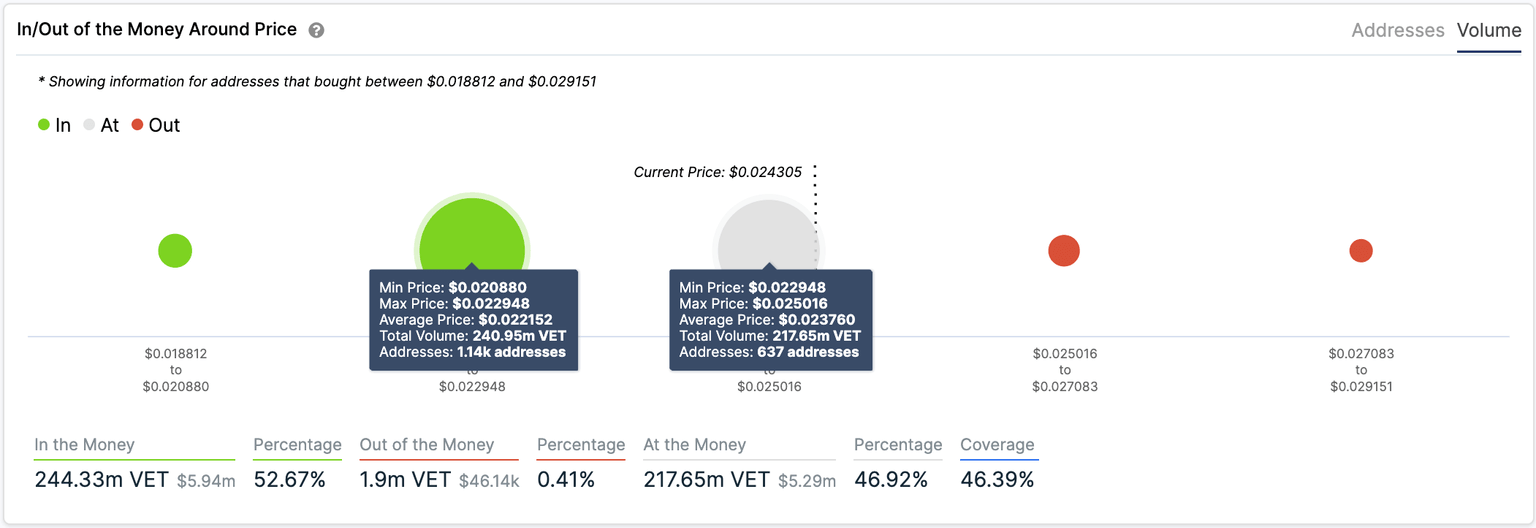

IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model suggests that the $0.0236 level is a significant interest area. Here, nearly 640 addresses had previously purchased more than 217 million VET.

Such a massive demand wall may have the strength to contain falling prices at bay in the event of a sell-off.

But if VeChain manages to break through it, there is another support hurdle at $0.0222, according to the IOMAP cohorts. Approximately 1,140 addresses bought 240 million VET around this price level, adding an extra level of strength to the $0.0236 support.

VET IOMAP

Given the importance of the underlying support and the lack of resistance ahead, the odds seem to favor the bulls. A spike in buy orders around the current price levels could see VeChain rebound and retest the recent high of $0.0324.

Nonetheless, slicing through the $0.0236 support could be catastrophic for the bulls since it could push VeChain price towards $0.0179.

Author

FXStreet Team

FXStreet