VeChain Price Forecast: VET remains bullish despite crypto market slump

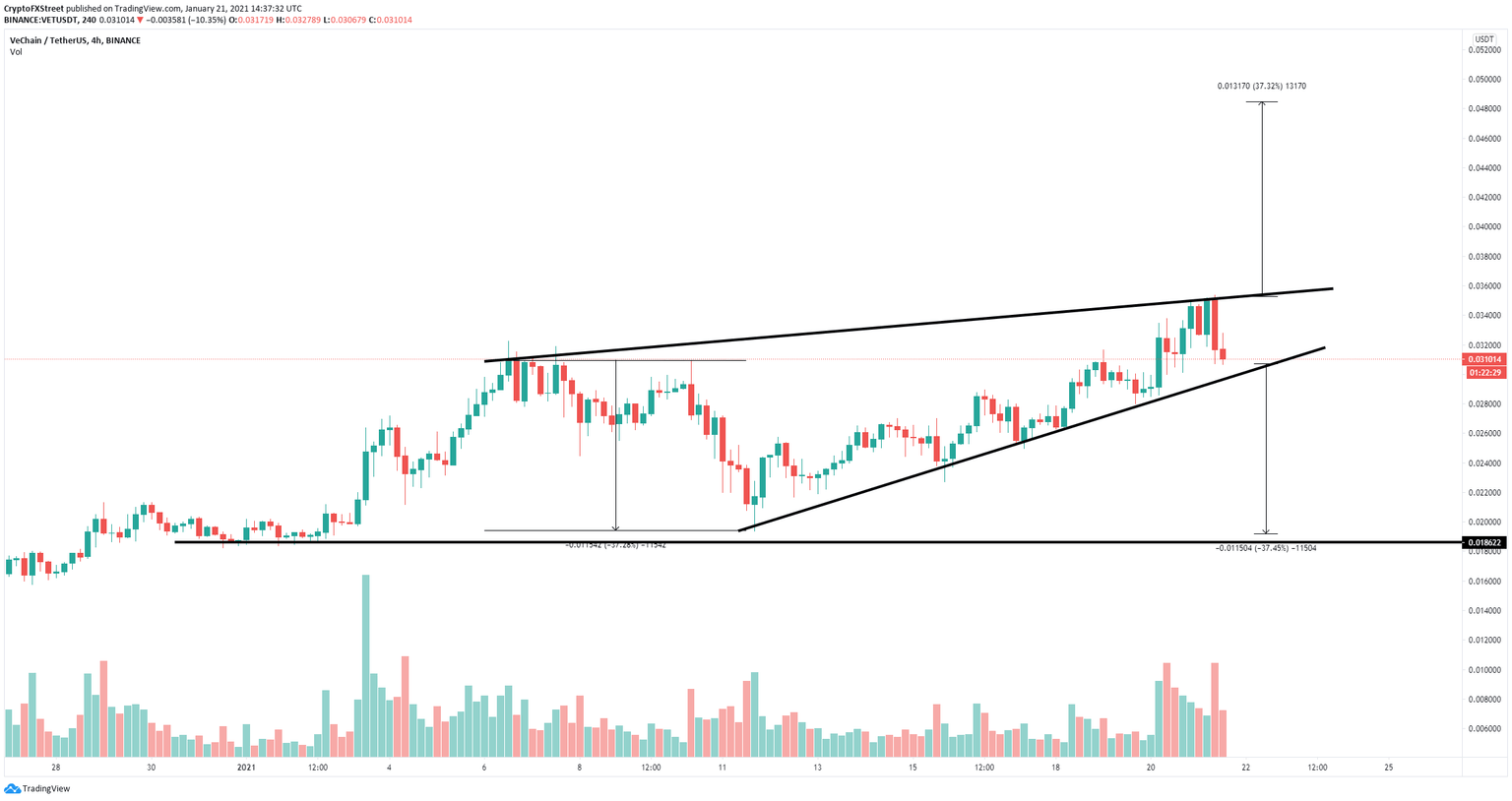

- Vechain price remains bounded inside an ascending wedge pattern on the 4-hour chart.

- The digital asset hasn’t lost its uptrend despite the crypto market recent sell-off.

In the past 24 hours, close to $100 billion was wiped from the total market capitalization of the crypto industry. However, Vechain is one of the few coins that have managed to survive and continues trading inside an uptrend.

Vechain price needs to defend crucial support level to see another leg up

On the 4-hour chart, Vechain has been trading inside a robust uptrend since January 11. The digital asset has established an ascending wedge with a support trendline located at $0.03. This level must be defended by the bulls in order to avoid a stronger pullback.

VET/USD 4-hour chart

A rebound from the $0.03 support level would push Vechain price back to the top of the pattern at $0.035. A breakout above this significant resistance level can drive VET to a new high of $0.048.

However, a breakdown below the $0.03 support level would also push Vechain price down by 37% and slightly below the psychological level at $0.02. Considering the entire crypto market has seen a massive sell-off in the past 24 hours, Vechain could be next.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.