VeChain investors must take profit at $0.15 before VET price pulls back

- VET reentered the upward trend channel.

- Price action to the upside looks muted with a double cap on price action.

- On the downside, small support is present, but the range trade seems more likely to be unfolding in the coming days.

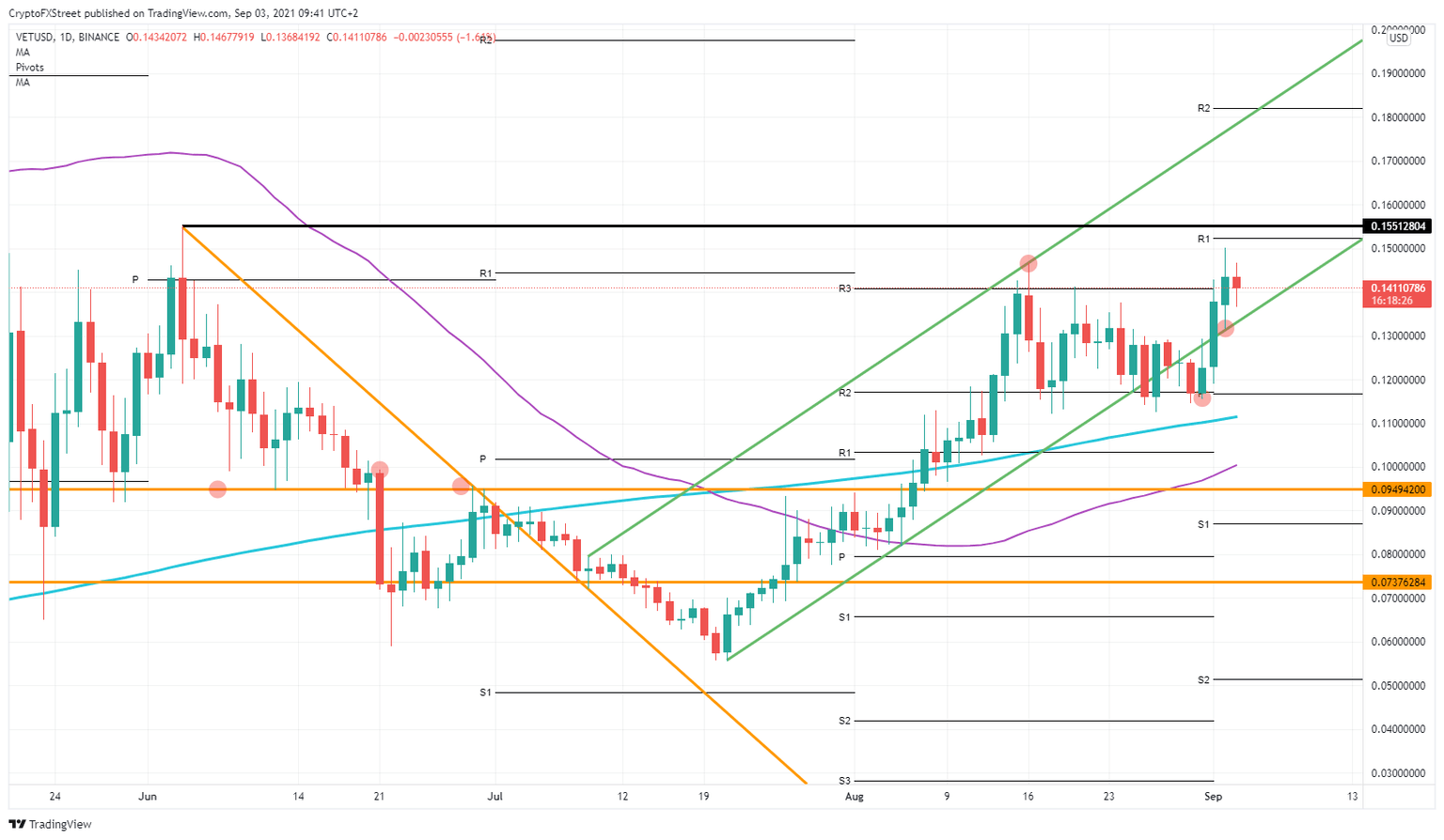

VeChain price (VET) has reentered the upward green trend channel formed at the beginning of July. With only one test on the channel's upside, a second would be suitable for proof of relevance. Instead, VeChain price action dipped and even broke the lower band of the trend channel. VET broke lower and bounced off $0.11 a couple of times in the past few days.

Sentiment changed a little bit, and buyers pushed VET back up into the trend channel. Further upside or a retest of that upper band looks difficult with clouds hanging above the price action.

VeChain needs a catalyst to break out either way

To the upside, the monthly R1 resistance level comes in at $0.15 with just above the top from June 4. This is hanging above any further upward potential as sellers will have these two elements lined up for a fade-in short trade. Price action does not give much conviction as yesterday VET price action was not able to tip its toe into $0.15 but instead got rejected.

VET/USD daily chart

A dip or correction back to the lower band of the trend channel looks to be the outcome in the next couple of hours or days. It is important to watch if this trend channel will hold. If not, then VET has no interest in it anymore, and the trend channel trade can be erased from the whiteboard of possible trade setups.

Instead of a range-trading setup to the downside, expect a double floor as well, with the monthly pivot coming in at $0.11, just below the proven support from previous days originating from August 8. For now, a catalyst seems to be missing to get the price action of VeChain out of this range.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.