US White House CEA calls for more stringent tax on crypto mining; this is how much they want

- The Biden administration wants crypto miners to pay an amount equal to 30% of their energy costs in tax.

- The president has cited the "harms they impose on society" to justify the punitive demand.

- Such an unusual industry-specific penalty would significantly threaten miners' profits and activity in general.

- Reduced mining activities may lead to fluctuations in BTC’s value, causing market instability and uncertainty among investors.

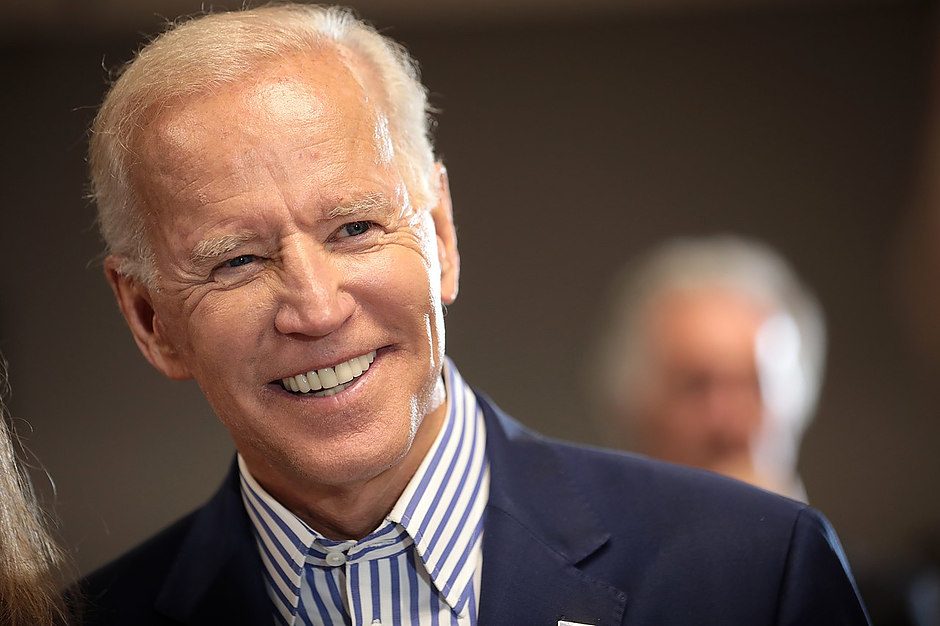

The United States White House, led by President Joe Biden, wants to impose a more severe tax on cryptocurrency mining operations, citing "harms they impose on society." In an official blog titled The DAME Tax: Making Cryptominers Pay for Costs They Impose on Others, the White House Council of Economic Advisers (CEA) made a case for a US tax equivalent to 30% of the energy costs a mining firm uses.

These companies would also be required to report how much electricity they use and what type of power was tapped.

CEA arguments to justify the punitive penalty

A paragraph in the CEA's argument to defend the levy under the Digital Asset Mining Energy tax proposal reads:

Currently, crypto mining firms do not have to pay for the full cost they impose on others, in the form of local environmental pollution, higher energy prices, and the impacts of increased greenhouse gas emissions on the climate.

The 30% figure is an unusual industry–specific penalty and will undoubtedly impact the concerned business's profit margins significantly.

Cognizant that other energy-intensive industries would not be burdened with such a hefty tax, the CEA echoes, "Crypto mining does not generate the local and national economic benefits typically associated with businesses using similar amounts of electricity."

Further justifying the punitive penalty, the CEA detailed its broader concerns for the industry, highlighting the possible economic implications as one of the issues. These entail the potential for pollution and the cost to local communities of having mining firms around. According to the CEA, even mining companies using clean energy could raise the neighboring communities' overall energy costs and usage.

As shown in the chart, the amount of electricity used in crypto mining in the US in 2022 almost matched what was used to power the country’s home computers or residential lighting.

Positive and negative outlook of 30% tax on Bitcoin

On a negative note, there is no way around this excise tax. The inevitable outcome could be a strong pattern of failures among high-profile Bitcoin miners already suffering tough times. The new 30% tax could be a death toll for most mining operations.

Most importantly, reduced mining activities may lead to fluctuations in Bitcoin’s value, causing market instability and uncertainty among investors.

On a positive note, crypto miners would have the chance to conform to the new tax regime, given it will be phased in procedurally in three phases of 10% each over three years. In this respect, possible choices will be either to:

- Move to a new crypto-friendly jurisdiction overseas, or,

- Go all-in on clean energy sources consuming a minimum level of electricity.

The same happened in China after the 2019 ban, causing BTC miners to relocate their operations to countries with abundant energy resources, like Canada, Kazakhstan, and the US. Other big Bitcoin mining operations transformed to operate relatively green on energy consumption metrics.

Also Read: Biden budget plan would close crypto tax loss harvesting loophole

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.