US Department of Justice moves 9,000 BTC seized from Silk Road

- The addresses that are assumed to be controlled by the US Department of Justice moved $270 million worth of BTC in three separate transactions.

- The same addresses also sold over 9,800 BTC back in March after moving 40,000 BTC worth over $1 billion.

- Even if these 9,000 BTC are to be sold by the government, Bitcoin price would not be impacted much as it only represents 2.1% of the daily trading volume.

The United States Department of Justice (DoJ) seems to be taking measures to move the Bitcoin it holds with a view to potentially selling it off. This is evidenced by the sudden move in the BTC held by them, which raised concerns among investors on Wednesday.

US DoJ moves Bitcoin, again

Back in November 2021, the DoJ seized about 50,000 BTC worth over $3 billion at the time. The BTC seized was affiliated with James Zhong, who was accused of stealing the digital assets by committing wire fraud back in September 2012.

Since seizing the BTC, the DoJ has sold off a substantial amount of the assets, one of which was the sale of 9,800 BTC in March worth about $300 million. This was followed by the federal department moving over 40,000 BTC worth more than $1.2 billion at the time, which resulted in high volatility in the crypto market as investors assumed the supply was being sold.

However, since March, the DoJ has not moved any of the Bitcoin obtained from the Silk Road robbery until July 12. Three confirmed transactions highlight that about 8,200 BTC worth over $250 million has been moved by the federal department, and another 824 BTC is in the queue waiting to be moved by the DoJ.

Bitcoin transactions highlighting the move

Bitcoin price at the time of writing can be seen hovering around $30,500, facing no impact from the news of the move. Furthermore, BTC price faces no threat at all, even if the Department of Justice decides to sell off its BTC.

BTC/USD 1-day chart

This is because the $300 million worth of BTC moved represents only 2.1% of the total volume traded in the last 24 hours by users. Thus a sale would not bear any negative effect on the price. This is backed by the fact that in the past 24 hours, almost 5,000 BTC worth $152.6 million has been sold, and yet Bitcoin price has noted no significant change.

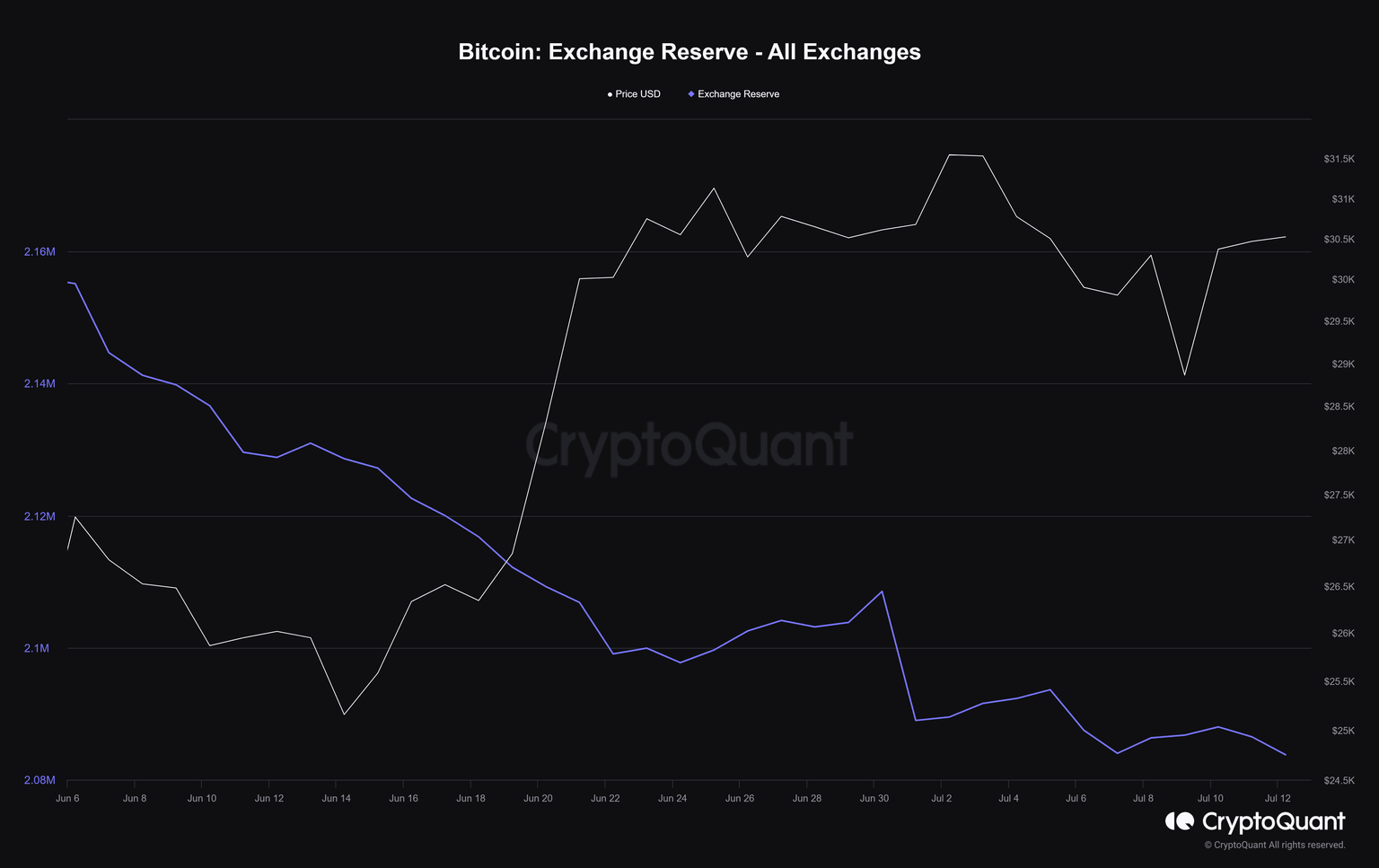

Bitcoin exchange reserves

Still trading at $30,500, the cryptocurrency is doing its best to breach the barrier at $31,000 and flip it into support to initiate a further recovery.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.