Uniswap Price Forecast: UNI eyes $7 breakout amid Spark integration, rising whale activity

- Uniswap posts a third consecutive day of gains so far this week, with rising momentum and technical triggers.

- The protocol's growth, facilitated by the integration of Spark Finance, supports the ongoing uptrend.

- Increasing whale activity reflects support from large investors.

Uniswap (UNI) edges higher by over 2% at press time on Wednesday after Spark Finance goes live on Unichain, deploying sUSDC stable yield for users. UNI bounces off a crucial support level, while increasing whale activity adds to the bullish potential.

Spark brings native stablecoin yields for Uniswap users

In a recent tweet, Uniswap announced a new feature of native yield on USDC – a stablecoin pegged to the US Dollar issued by Circle – as Spark goes live on Unichain, Uniswap’s layer-2, powered by Optimism’s OP stack.

Spark Finance is also live on Optimism and offers a yield for sUSDS issued by Sky. The generated yield and the coins could be used across Decentralized Exchanges (DEXs) and available lending markets.

Whales resurface as UNI rallies

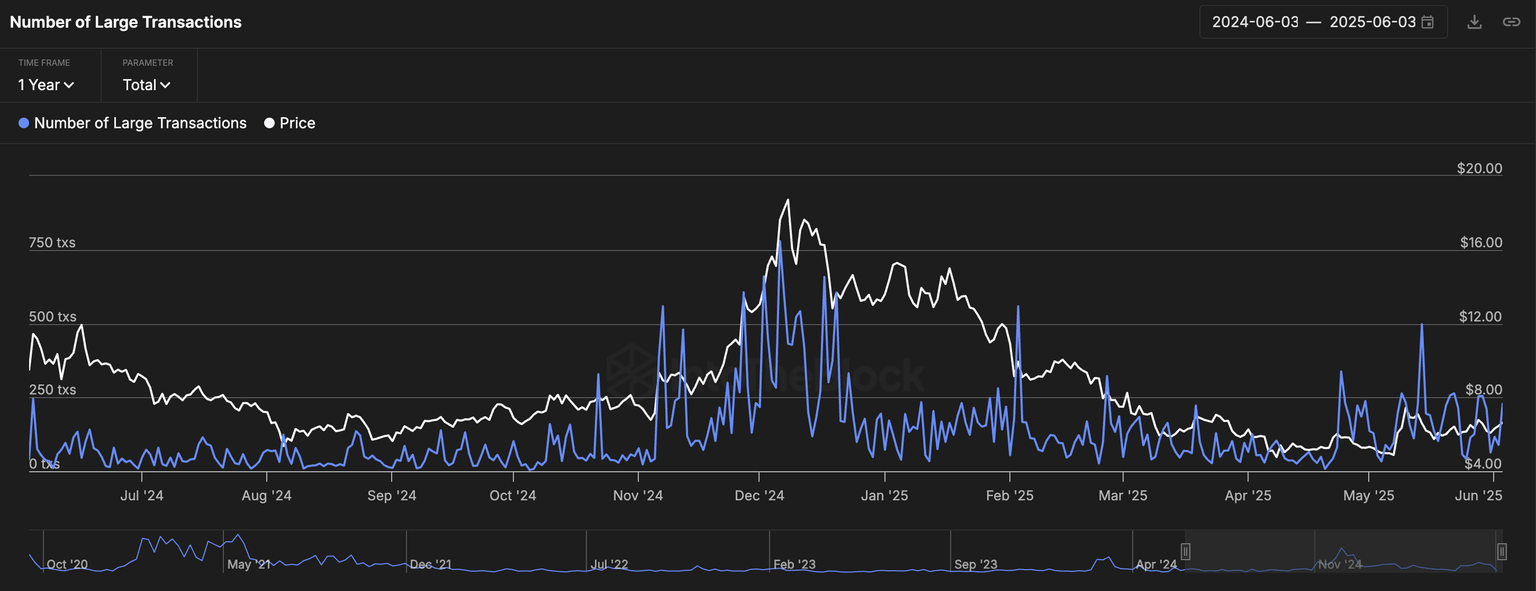

IntoTheBlock’s data shows that the number of large transactions, those of over $100,000, has increased significantly in the last month. Since such a large trading volume is not readily available for retail investors, it is generally considered an institutional-level movement.

Number of large UNI transactions. Source: IntoTheBlock

Typically, a surge in the number of such transactions during consolidation phases relates to the accumulation of assets by large investors, while a spike in numbers after a rally could indicate a cycle top. As Uniswap attempts a bullish comeback to conclude the sideways trend since May, the increased large-volume transactions suggest increased interest from whales.

Uniswap eyes a bullish reversal to the 200-day EMA

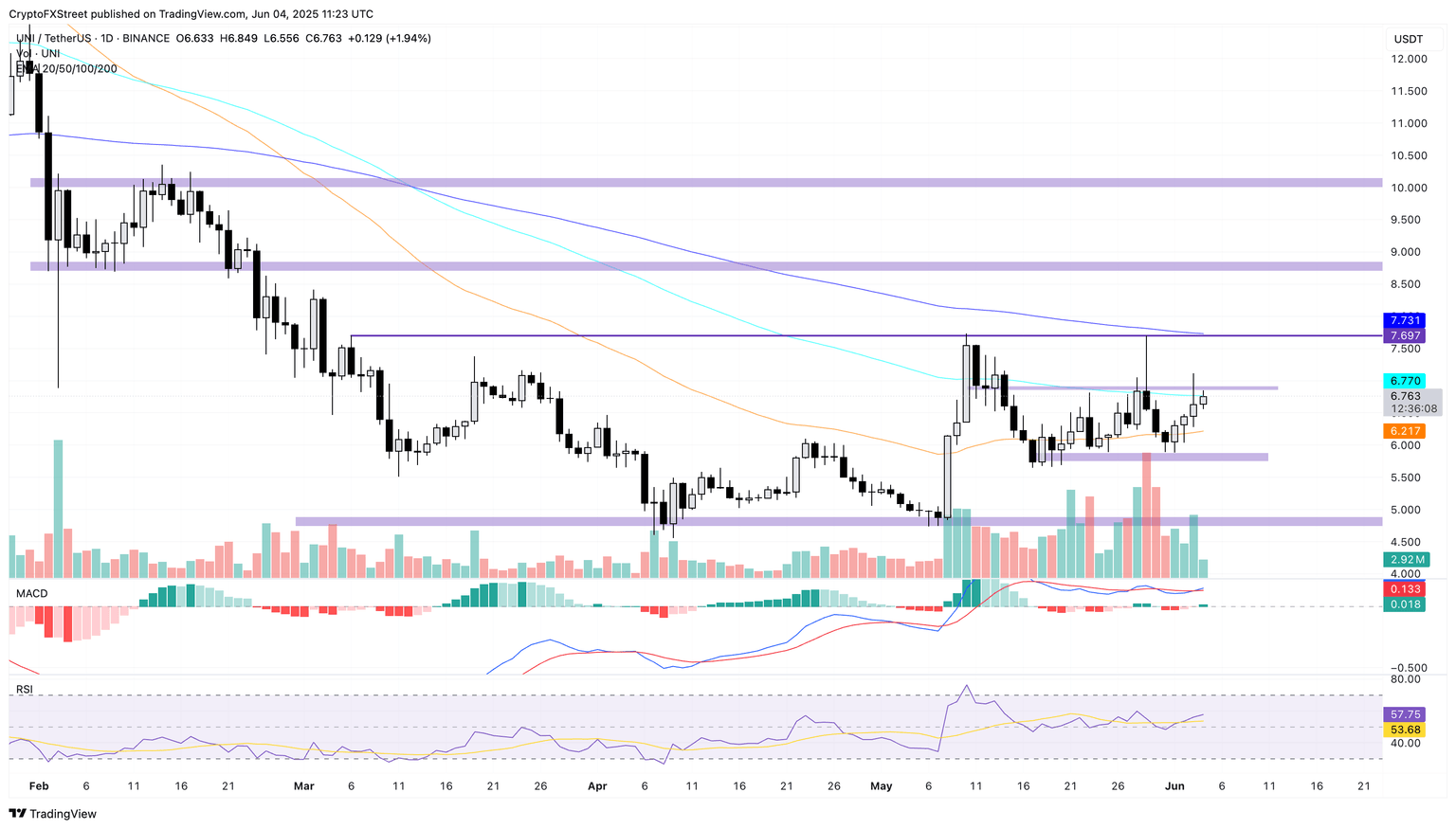

Uniswap forms a crucial support floor at the $5.88 zone as it takes a second bounce back to challenge the $6.88 resistance. Since March, Uniswap has maintained a price band between the $8.85 supply zone and the $4.80 demand zone.

At the time of writing, Uniswap trades at $6.76, challenging the 100-day Exponential Moving Average (EMA) at $6.77. Investors could find a decisive daily closing above $6.88 as an entry opportunity, with the next resistance at the 200-day EMA at $7.69.

The Moving Average Convergence/Divergence (MACD) indicator remains indecisive due to multiple crossovers between its two lines in the last couple of weeks. Currently, it indicates a bullish crossover, supporting the breakout chances.

The Relative Strength Index (RSI) at 57 takes off from the halfway line, signaling an increase in bullish momentum, while leaving enough room for growth before reaching overbought conditions.

UNI/USDT daily price chart. Source: Tradingview

Conversely, a reversal in Uniswap could retest the $5.88 support floor. Sideline investors looking to short UNI might find a closing price below $5.88 as a selling opportunity, targeting the next support at $4.89, with an early exit feasible at the $5 psychological support.

Author

Vishal Dixit

FXStreet

Vishal Dixit holds a B.Sc. in Chemistry from Wilson College but found his true calling in the world of crypto.