Bitcoin Cash, Loopring eye rebound amid broader crypto market correction

- Bitcoin Cash and Loopring suffered a decline as market participants shorted both tokens during the market wide correction.

- BCH and LRC prices are showing signs of a recovery, with Santiment experts saying short liquidations are likely to fuel a recovery.

- BCH and LRC observed $1.27 million and $141,990 in liquidations in the past 24 hours.

Bitcoin Cash (BCH) and Loopring (LRC) have recorded significant price declines since Monday amid the broader correction in crypto markets. However, experts from crypto intelligence tracker Santiment suggest that these two altcoins may be set for a price rebound even though investors are still opting for short positions.

Also read: Coinbase suggests US Treasury reconsider crypto mixing rules, says there is a regulatory gap

Bitcoin Cash and Loopring gear up for price recovery

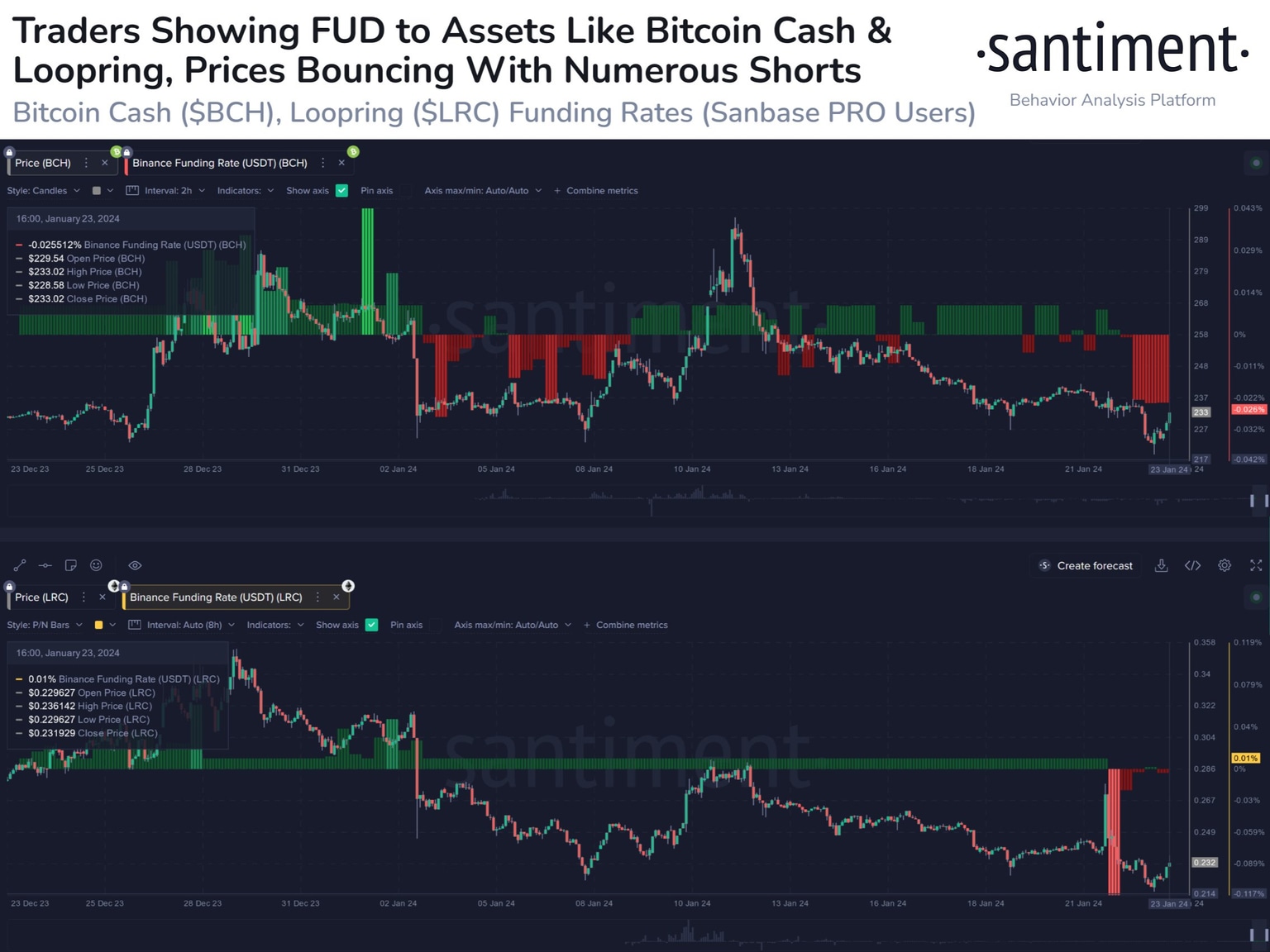

According to data from crypto intelligence tracker Santiment, derivatives traders are shorting BCH and LRC, among other assets on Binance. The crypto market bloodbath from earlier in the week influenced traders' heavy shorting activity.

Santiment analysts believe that BCH and LRC are showing signs of a bounce in their prices. If short positions get liquidated in large volumes, they could act as a catalyst to drive a recovery in BCH and LRC prices. Santiment analysts predict this based on the history of price recovery in assets facing a similar scenario.

Currently, there is a dominant bearish sentiment among crypto traders in the derivatives market, as evident by the negative funding rate in Bitcoin Cash and Loopring, seen in the Santiment chart below.

A negative funding rate implies short positions are dominant and traders are bearish on the asset’s price, expecting prices to decline further.

BCH and LRC are likely to see price recovery. Source: Santiment

Santiment’s analysis implies that BCH and LRC price recovery is likely and the first signs of recovery would be short liquidations in the two assets. In the past 24 hours, $117,700 and $10,500 in BCH and LRC short positions were liquidated, respectively. If this number climbs consistently, traders can expect a bounce in prices of the two assets, given this typically occurs .

At the time of writing, BCH price is $232.60, up nearly 2% on the day, and LRC price is $0.2303, up nearly 1% on the day.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.