Two Bitcoin price prediction polls, same outcome: $10K BTC is coming

Bitcoin (BTC) investors in China plan to buy the dip despite an ongoing market correction and a nationwide crypto ban, a new survey shows.

Consensus sees Bitcoin at $10K

A survey of 2,200 people conducted on China-based social media platform Weibo found that 8% of would buy Bitcoin when its price hits $18,000, according to Wu Blockchain. While 26% of the respondents prefer to wait until BTC reaches $15,000.

But a majority anticipated the price to fall even further with 40% saying they would buy BTC at $10,000.

Chinese investors more cautious on Bitcoin than US

Interestingly, another survey conducted by Bloomberg MLIV Pulse earlier in July yielded a similar outcome: 60% of the net 950 respondents on Wall Street calling for a $10,000 Bitcoin price.

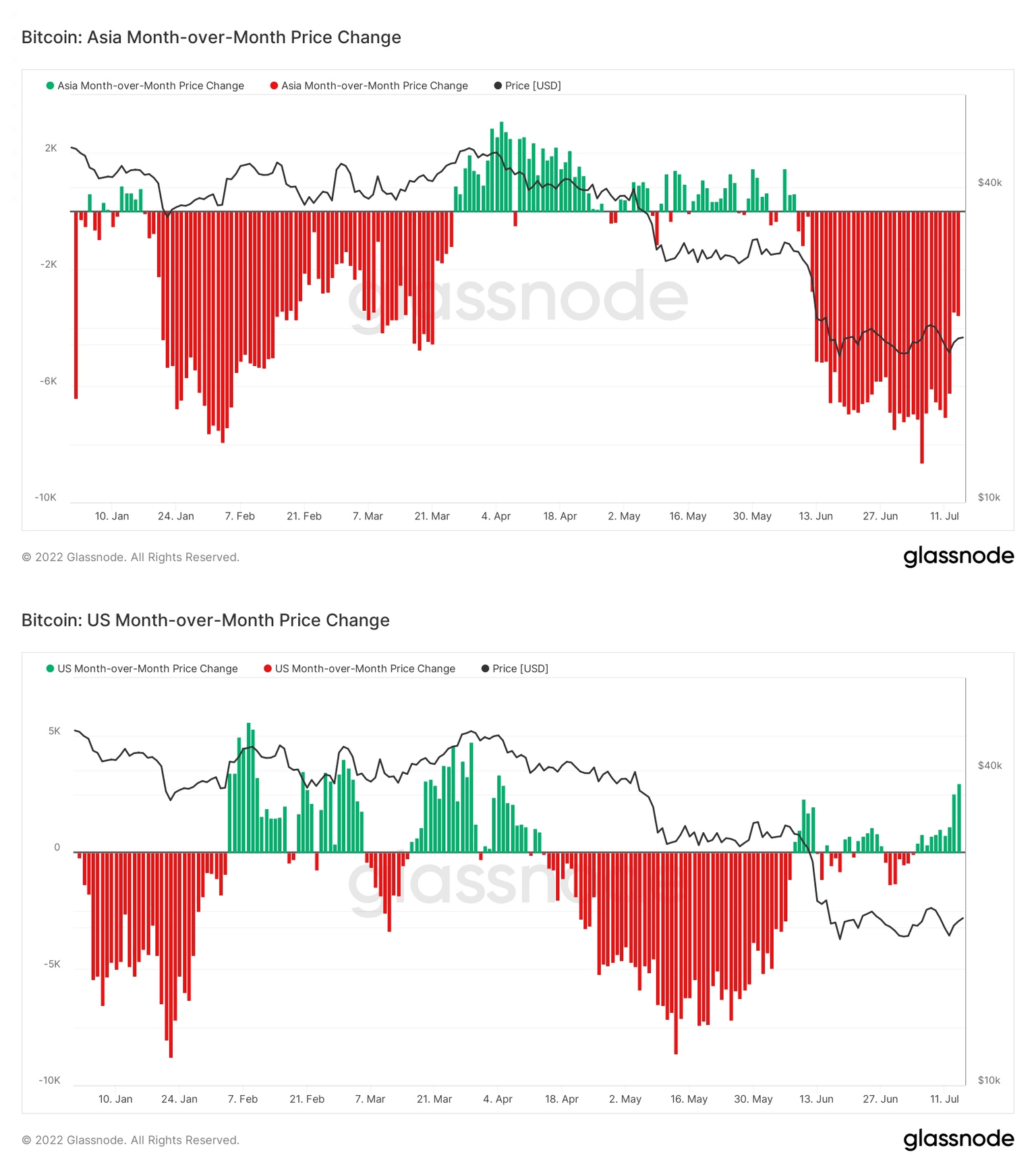

The two polls show a striking similarity in bearish sentiments of crypto speculators in the U.S. and China. Nonetheless, on-chain activity shows that investors in the U.S. have been more bullish on Bitcoin versus their Asian counterparts since June 2022.

In particular, Bitcoin's month-to-month price change, which tracks the 30-day change in the regional BTC price, has been positive only during U.S. sessions. Conversely, the metric has only been negative during Asian trading hours, data from Glassnode shows.

Bitcoin month-over-month price change. Source: Glassnode

Technical indicator hints at BTC price below $13K

Simultaneously, weakening technicals are also starting to support further downside, particularly on the larger three-day timeframe.

BTC/USD three-day price chart featuring "bear flag'"setup. Source: TradingView

Bitcoin has been forming a potential "bear flag" pattern that could result in a drop below $13,000 by September, as illustrated above.

As Cointelegraph reported, persistent macroeconomic headwinds for BTC/USD continue to fuel bearish arguments against increasing evidence of a possible price bottom.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.