Two AI tokens to watch as BingX launches AI crypto strategist

- BingX exchange has launched AI Master, an AI-powered crypto trading strategist.

- AI Master tracks the top five digital investors, providing timely alerts, AI-driven backtesting and simplified execution.

- Bittensor and Near Protocol offer bullish signals as sentiment generally improves in the broader crypto market.

BingX, the 30th-largest cryptocurrency exchange with an average daily trading volume of $1.4 billion, has launched AI Master, describing it as the world’s first Artificial Intelligence (AI) strategist.

The launch of AI Master is part of the exchange’s goal of building tools and features that make digital assets trading more intelligent, accessible and user-focused.

BingX launches AI Master to make trading more intelligent

BingX stated on Wednesday that AI Master is an end-to-end system, capable of generating ideas, executing orders, and reviewing outcomes with full transparency.

The platform leverages the strategies of the top five digital investors, utilizing advanced AI optimization to ensure relevance for both novice and experienced traders. Key features of AI Masters include intelligent strategies, timely investment alerts, AI-driven backtesting, order execution and AI-guided reviews.

“BingX AI Master is not just a trading tool – it’s a trading strategist designed to bring clarity, discipline, and confidence to every user‘s journey,“ Vivien Lin, chief product officer at BingX, said.

Meanwhile, interest in AI tokens is gaining momentum, evidenced by the sector’s total market capitalization increasing over 2% in the last 24 hours to $31 billion. The launch of BingX’s AI Master could boost demand for tokens at the intersection of artificial intelligence and blockchain technology.

Near Protocol (NEAR) and Bittensor (TAO) are the largest AI tokens, boasting a market share of $3.3 billion and $3.2 billion, respectively.

Near Protocol, Bittensor offer bullish signals

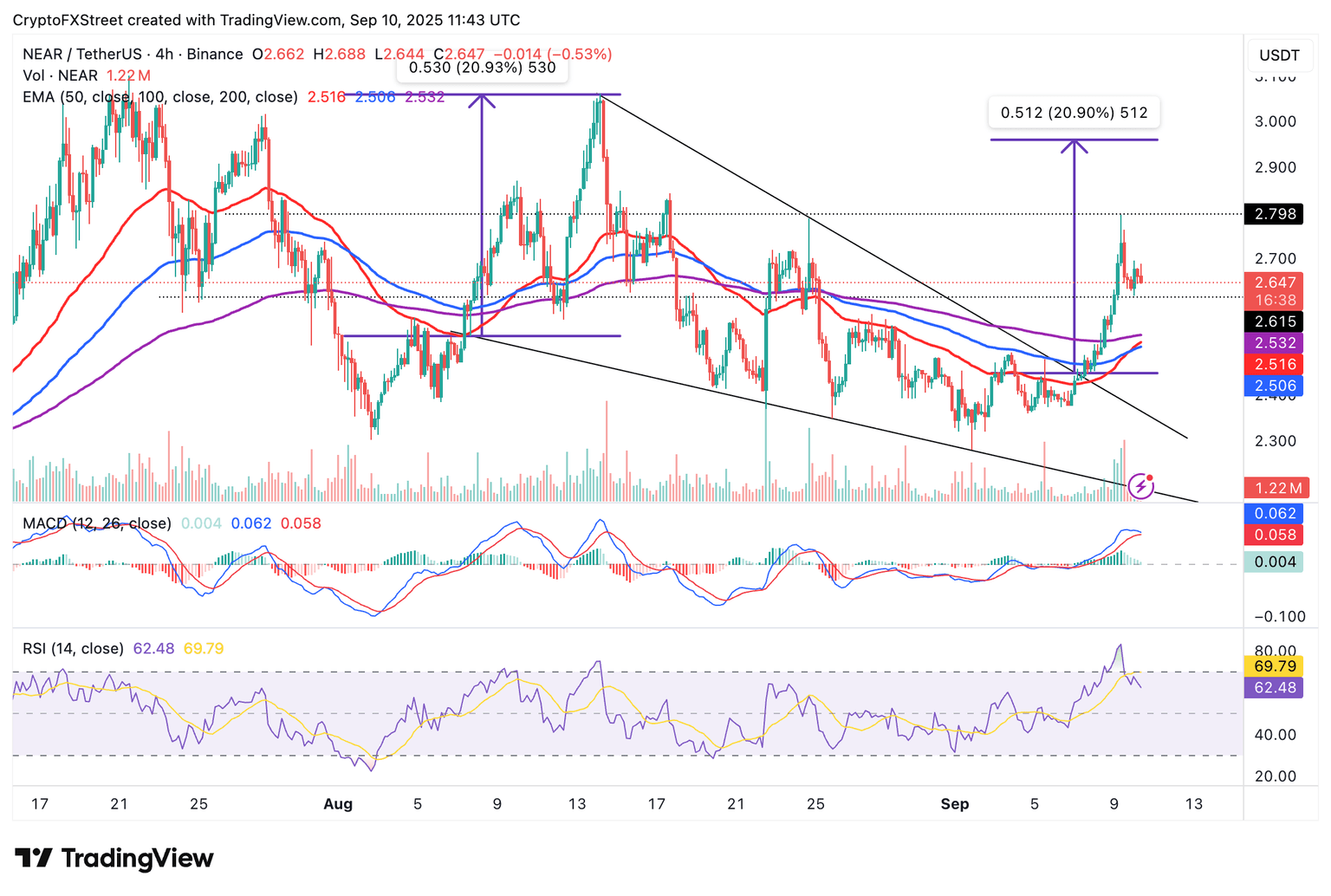

Near Protocol holds above support at $2.61 after facing a rejection due to the supply zone at $2.79. The brief correction followed a spike in volatility in the broader cryptocurrency market on Tuesday, which saw Bitcoin (BTC) trim its gains toward the $110,000 round-number support.

If the pullback extends below $2.60, the Moving Average Convergence Divergence (MACD) indicator could validate a sell signal as the blue line crosses below the red signal line.

A sharp decline in the Relative Strength Index (RSI) from 85 to 62, indicating cooling bullish momentum, suggests a shift from highly overbought conditions. Other key levels to monitor include the 200-period Exponential Moving Average (EMA) at $2.53 and the 100-period EMA at $2.50 on the 4-hour chart, all of which could serve as tentative support levels in case of an extended correction.

Still, traders should temper their bearish expectations considering a falling wedge pattern breakout, with a 21% target to $2.96. The presence of a Golden Cross pattern, formed when the 50-period EMA crossed above the 100-period EMA earlier in the day, supports a potential short-term rebound, which could reinforce the bullish outlook toward the $2.96 breakout target.

NEAR/USDT 4-hour chart

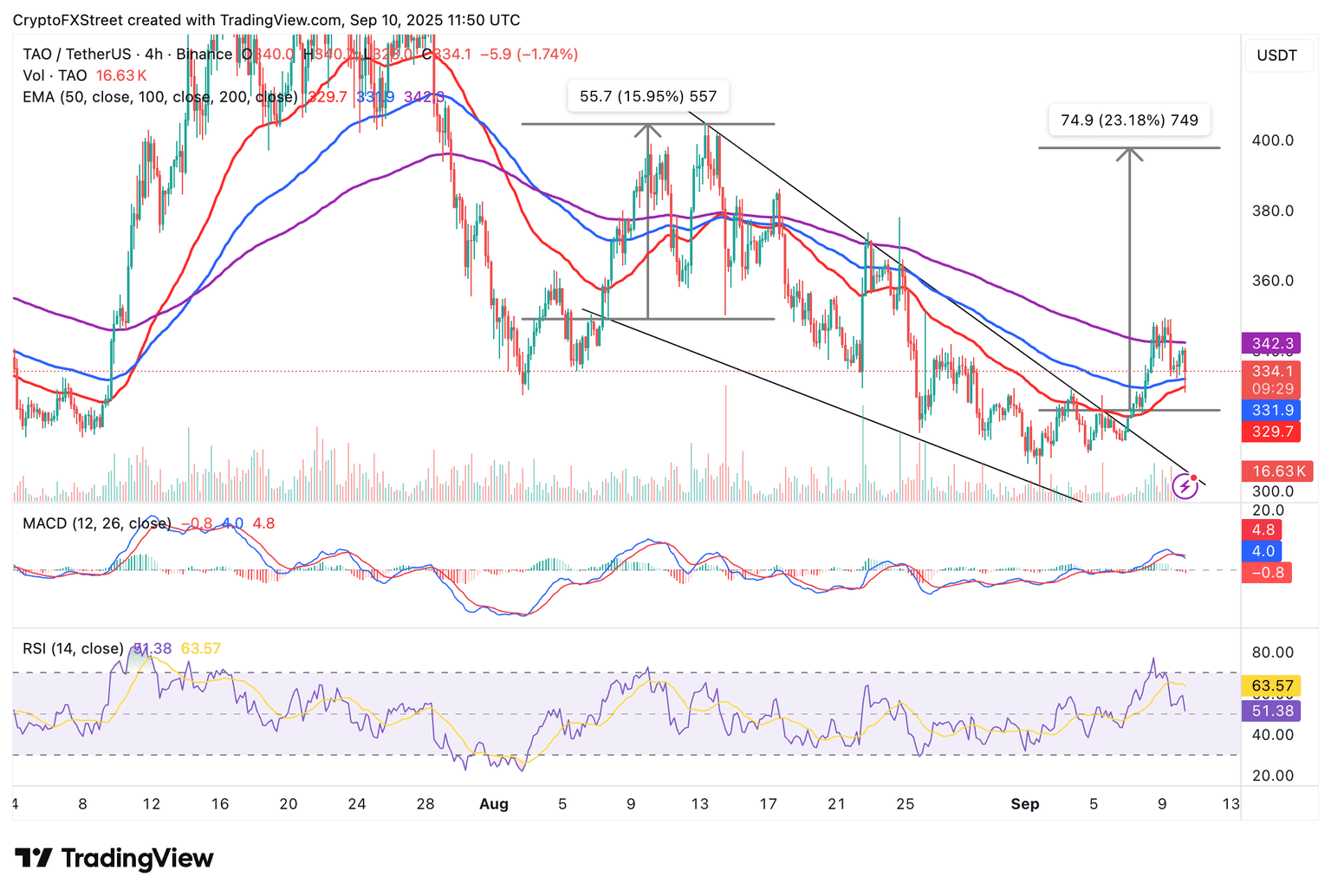

As for Bittensor, sellers have recently regained control, pushing the price below the 200-period EMA support-turned-resistance at $342. A falling wedge pattern breakout on Sunday had projected a 23% increase to $398. However, profit-taking and heightened volatility in the market have left TAO vulnerable to overhead pressure.

TAO/USDT daily chart

The 100-period EMA at $331 provides the immediate support backed by the 50-period EMA at $329. A breakout above the 200-period EMA resistance at $342 will go a long way to affirm the bullish grip and increase the probability of TAO rising to tag the falling wedge pattern breakout target at $398.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren