TRON Price Prediction: Can TRX trigger 30% breakout rally after multiple rejections?

- TRON price is at a crossroads as it approaches $0.0862 resistance level.

- A breakout could trigger a 30% move to the next key level at $0.1124.

- Another rejection could see TRX collect the sell-side liquidity below $0.0718, $0.0644 and $0.0548 levels.

TRON (TRX) price is attempting to overcome a resistance level for the third time this year. Another failure could prove costly for TRX holders, but a breakout could trigger a massive uptrend.

Also read: This short-term Bitcoin holder indicator forecasts another rally for BTC

TRON price faces tough decision

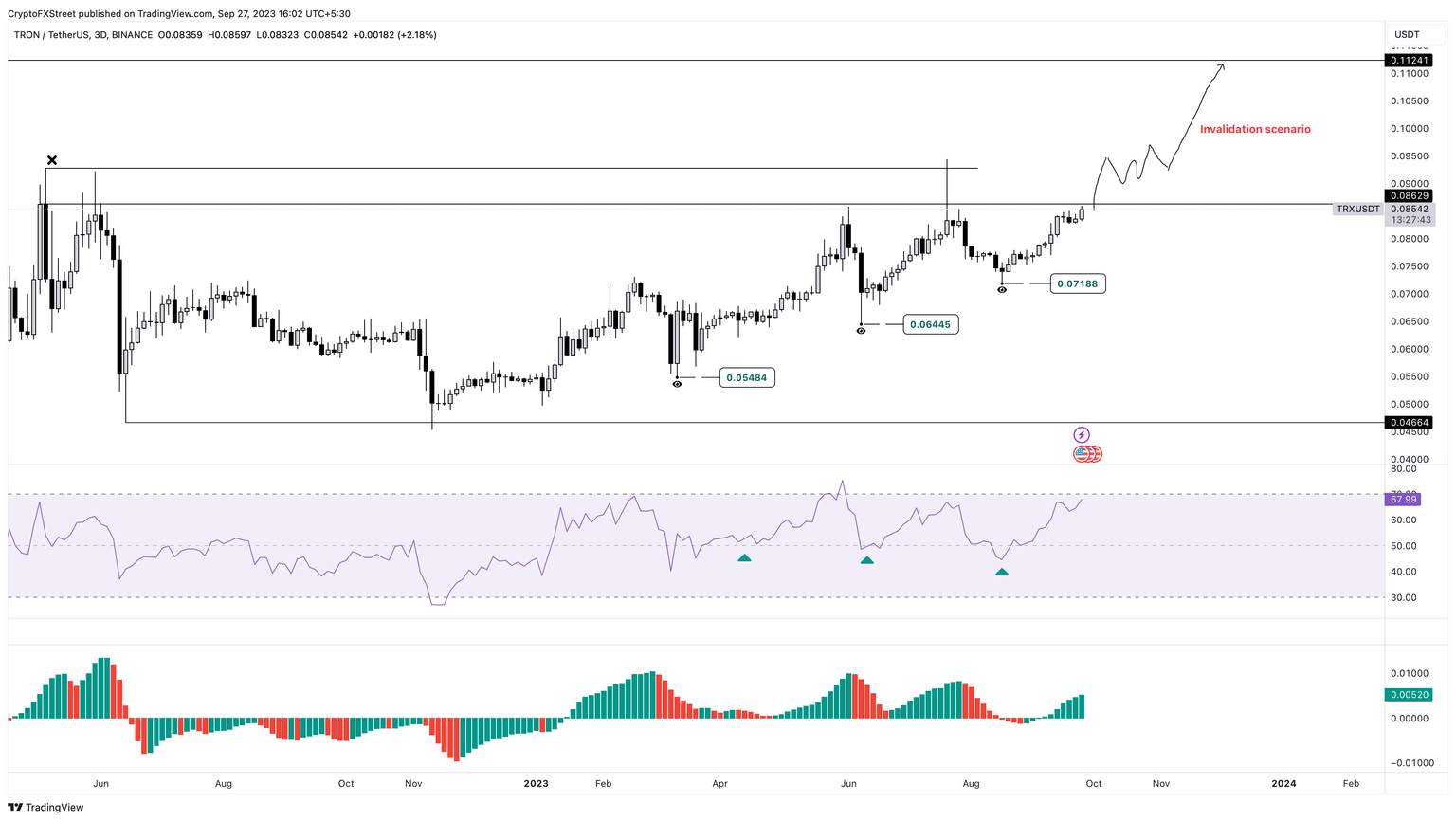

TRON price has created a range, extending from $0.0466 to $0.0862 in late May and early June 2022. Since then, TRX has attempted to overcome the range high twice in June and July 2023, but failed to do so. Rejection has led to steep correction both times.

Now, TRON price is approaching the $0.0862 level again with the Relative Strength Index (RSI) hovering just below the overbought level. The Awesome Oscillator (AO) shows bears’ failed attempt to take over as it hovers above the zero level.

Since both indicators are bullish, investors looking to short TRX should be cautious. Instead, traders need to wait for TRON price to make its move above $0.0862. A decisive flip of this hurdle into a support floor could set the stage for it to trigger a 30% rally to $0.1124 hurdle.

TRX/USDT 3-day chart

On the other hand, if TRON price faces rejection with RSI and AO producing divergence, it would signal waning bullish momentum. In such a case, TRX could eye the sell-side liquidity resting below August 17, June 9 and March 11 swing lows at $0.0718, $0.0644 and $0.0548, respectively.

Also read: Bitcoin's implied volatility gauge tops Ether for record 20 straight days

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.