TRON price kick-starts 20% rally as TRX shatters vital trend line

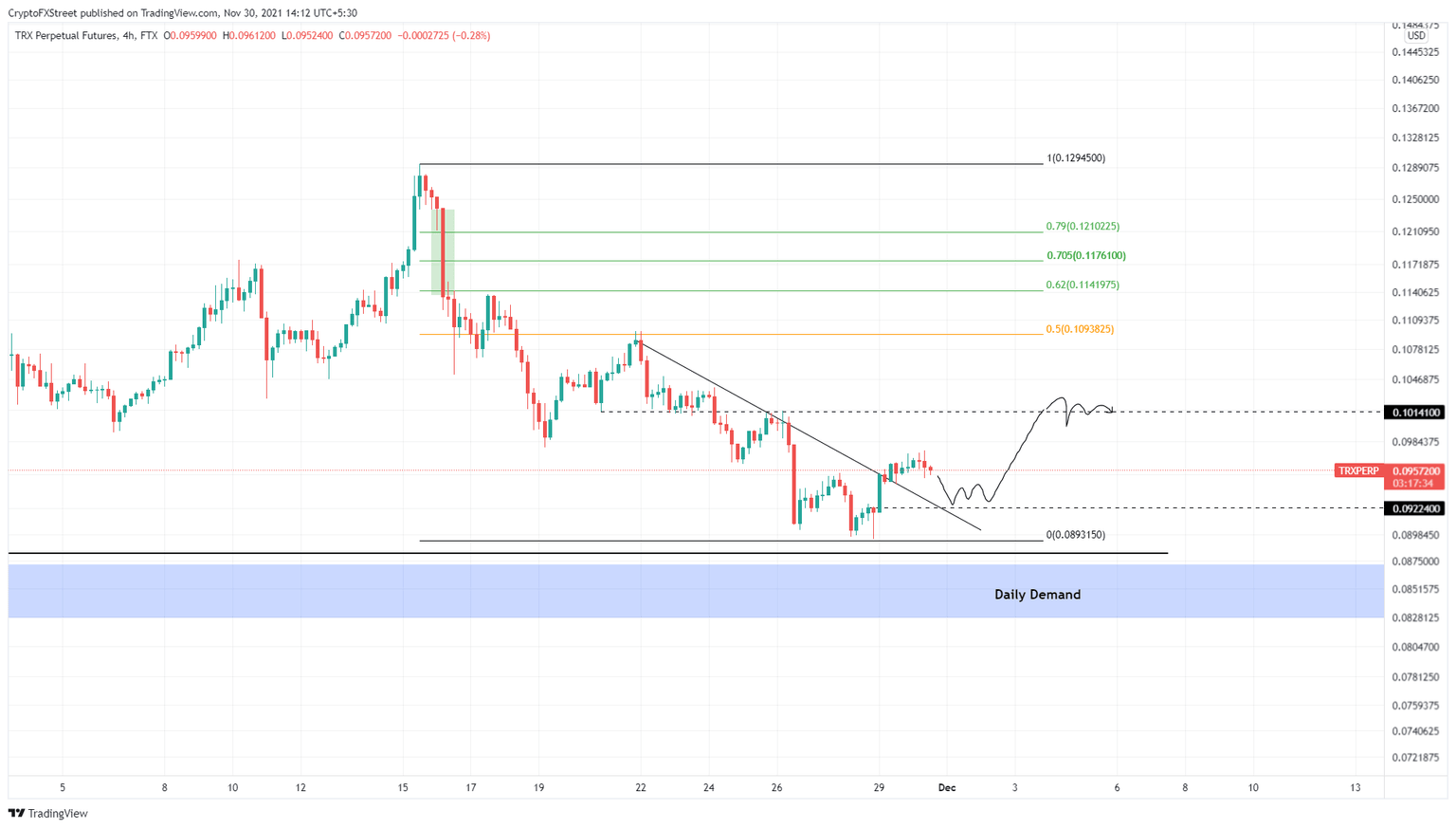

- TRON price breached through a declining trend line on November 29, signaling the start of a new uptrend.

- A minor downswing to $0.09 is likely before TRX rallies to $0.109.

- A daily close below the $0.082 to $0.087 demand zone will invalidate the bullish thesis.

TRON price experienced a two-week downswing that ended recently with an uptick in buying pressure. This move suggests that TRX has kick-started an uptrend and is likely to continue higher.

TRON price looks to set up higher highs

TRON price has corrected 30% over the past two weeks and set a swing low at $0.089. Connecting the swing highs between November 22 and November 29 using a trend line reveals a bear trend line and a declining resistance level. A potential increase in buying pressure reversed the trend and broke this hurdle, propelling TRX by 7.7% to where it currently trades - $0.096. Going forward, investors can expect TRON to head lower and retest the $0.092 support level before firmly launching.

The immediate resistance level at $0.10 is the first hurdle TRX will encounter after a 10% upswing. Clearing this barrier will allow TRON price to retest the 50% Fibonacci retracement level at $0.109. This move will indicate a 20% upswing from the current position and is likely where the upswing will face a decisive moment.

If the buying pressure continues to increase, investors can expect TRON price to retest the 62% Fibonacci retracement level at $0.11 or the following one at $0.12.

TRX/USDT 4-hour chart

TRON price needs to stay above the $0.92 support level, a failure to do so will indicate a lack of buying pressure and push TRX down to the daily demand zone, ranging from $0.082 to $0.087.

As long as TRX stays above this area of support, buyers can make a comeback. However, a daily close below $0.082 will create a lower low and invalidate the bullish thesis.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.