Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Levels to watch after the massive sell-off?

- Cryptocurrencies have suffered a massive sell-off after reaching for the moon.

- For some, the correction may bring bargain-seekers, while for others it is not over yet.

- Here are the next levels to watch according to the Confluence Detector.

Some rocket launches fail – and that is what happened to cryptocurrencies after the immense rally that brought Bitcoin to near $42,000 and Etehreum to top $1,300. While the surge around the New Year was confirmed by higher volume in the first full working week of 2021, the collapse came afterward.

Are digital coins suffering from a repeat of the December 2017 rise and fall? Probably not. The recent increase is backed by institutional investors – and may be further boosted by the most powerful institution, the US government. President-elect Joe Biden is readying a stimulus plan reportedly worth some $3 trillion, with some funds trickling to cryptos.

At the current juncture, digital assets are licking their wounds. How are they technically positioned?

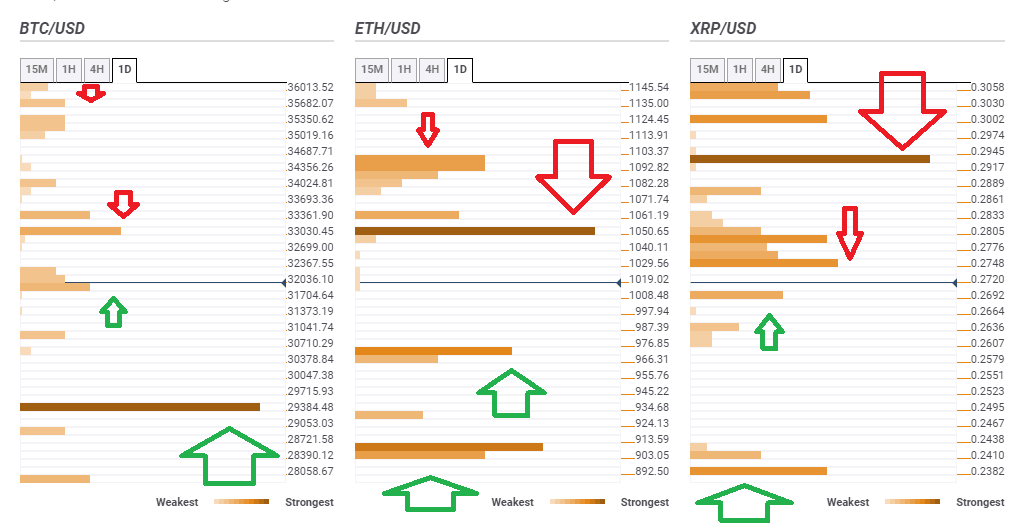

This is what the Crypto Confluence Detector shows in its latest update:

BTC/USD has a floor in sight

Bitcoin experienced a peak-to-trough fall of over $10,000, but there are hopes for some stability. Some support awaits at around $31,700, which is the convergence of the Pivot Point one-week Support 1 and the PP one-day S2.

The floor awaits at around $29,300, which is where 2020 high and the PP one-day S3 meet.

BTC/USD faces some resistance at around $33,000, which is the confluence of the Fibonacci 61.8% one-week and the PP one-month R1.

Holders of the granddaddy of cryptocurrencies may target $35,700, which is where the 10-day Simple Moving Average hits the price.

ETH/USD needs to surpass $1,050 to advance

Ethereum is suffering from worse positioning according to the Confluence Detector. Vitalik Buterin's brainchild is capped at $1,050, which is a juncture of lines including the previous 4h-low, the Bollinger Band 15min-Middle and the PP one-month R3.

Further above, the next cap is $1,100, which is where the Fibonacci 38.2% one-week and the the10-day SMA converge.

Support awaits at $970, which is a cluster including the BB 15min-Lower, the Fibonacci 61.8% one-week, and the BB 1h-Lower.

ETH/USD has another cushion at around $910, which is where the PP one-month R2 and the PP one-week S1 meet.

XRP/USD may tumble below $0.24

Ripple's XRP token is under pressure – from legal issues – and on the technical graph. It faces initial resistance at around $0.2750, which is where the SMA 5-15m, the SMA 10-15m, and the Fibonacci 61.8% one-week all hit the price.

Even stronger resistance awaits XRP/USD at $0.2930, which is the confluence of the Fibonacci 23.6% one-month and the SMA 5-4h.

Significant support awaits Ripple only at $0.2382, which is where the PP one-week S1 hits the price.

See all the cryptocurrency technical levels.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.