Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Ethereum outperforms as crypto bulls dominate

- Bulls return on Sunday as altcoins continue to find demand.

- Bitcoin range play intact but poised for additional upside.

- Ethereum leads the advance amongst the top 3 crypto coins.

The most favorite crypto coin, Bitcoin, is looking to extend the bullish momentum while trading around the $11,600, with eyes set on the $11,800 mark. Ethereum is the top performer among the top three cryptocurrencies on Sunday. Ripple is on its way to regain the $0.28 barrier, having found solid support at $0.2741. The total market capitalization of the top 20 cryptocurrencies now stands at $368.26 billion, as cited by CoinMarketCap.

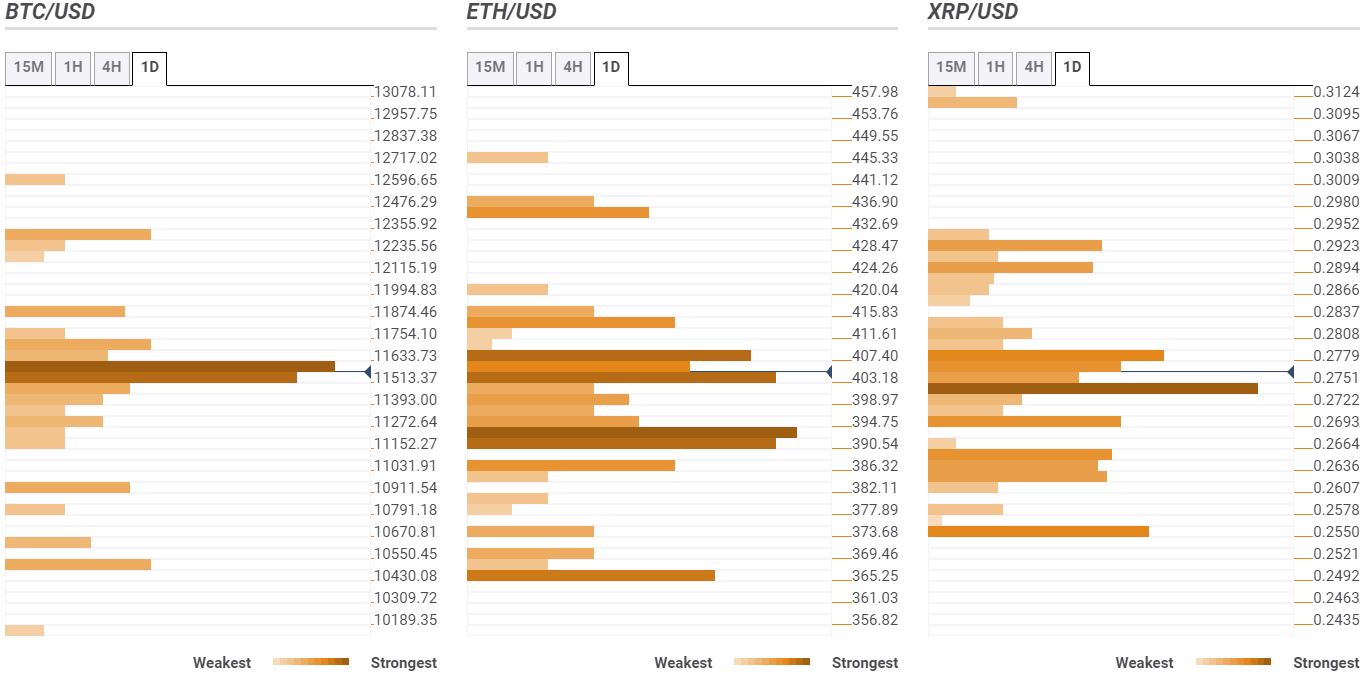

The top 3 most favorite digital assets are trading on the front foot while heading into a fresh week. Let’s look at FXStreet’s Confluence Detector tool in order to see how they are positioned on the technical charts.

BTC/USD: $11,800 on the buyers’ radar

Bitcoin extends its range play below the fierce resistance at $11,633, the confluence of SMA10 1D, Fib 61.8% 1D and 1W.

On a break above the latter, the bulls could meet minor resistance at $11,700, where the Bollinger Band 1D Middle and Fib 161.8% 1D coincide. The next soft cap is seen at $11,830, the previous week high.

On the contrary, sellers aim at the immediate downside target at $11,513, the intersection of the previous month high, Fib 23.6% 1D and Bollinger Band 1H Middle.

The convergence of the Pivot Point 1D S3 and Bollinger Band 1D Lower at $11,250 will be the next cushion. Selling pressure will intensify below the latter, opening floors for a test of $10,900, the Fib 23.6% 1M.

ETH/USD: Acceptance above $409.50 critical for the bulls

Ethereum is heading towards the robust resistance at $409.50, which the intersection of the previous day high, Pivot Point 1D R1 and SMA100 4H.

A decisive break above the aforesaid hurdle will call for a test of $413, the previous week high and Pivot Point 1D R2. The next upside target is aligned at $434.50, which is the Pivot Point 1M R2.

To the downside, the immediate cushion awaits at $405, where the SMA10 4H, Fib 23.6% 1W and 1D meet. A bunch of soft support levels is aligned below the latter, around $398 levels, the convergence of the Fib 61.8% 1D and Fib 38.2% 1W.

The confluence area of the SMA200 1H, previous day low and Pivot Point 1D S1 at $392 will be the level to beat for the ETH bears.

XRP/USD: Bullish bias intact while above $0.2740

Ripple trades with moderate gains on Sunday, with the immediate upside barrier aligned at $0.2800, the intersection of the previous day high, Fib 61.8% 1W and SMA200 1H.

The next significant hurdle is placed at $0.2823, which is SMA10 1D. The buyer interest will pick up pace above the latter, with the $0.2894 target straight in sight. That level is the confluence of the Pivot Point 1M R1 and Bollinger Band 1D Middle.

The XRP bulls are likely to remain in charge so long as the spot holds above the solid $0.2740 support, where the intraday low, SMA5 1D and SMA100 1H coincide.

Acceptance below that critical support, the $0.2693 level (Fib 38.2% 1W) could guard the further downside.

See all the cryptocurrency technical levels.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.