Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC scales higher, taking altcoins with it

- Bitcoin price sliced through crucial barriers, eyeing a retest of $52,920.

- Ethereum price vies to climb higher as bulls lock in on $4,000.

- Ripple price manages to hold above $1.05 support as bulls resurface.

Bitcoin price exuded bullishness over the past week as it continued to rally without significant corrections. As a result, Ethereum, Ripple and other altcoins have followed suit. Although the entire market looks bullish at the time of writing, things could turn awry if BTC witnessed a September 7-style crash.

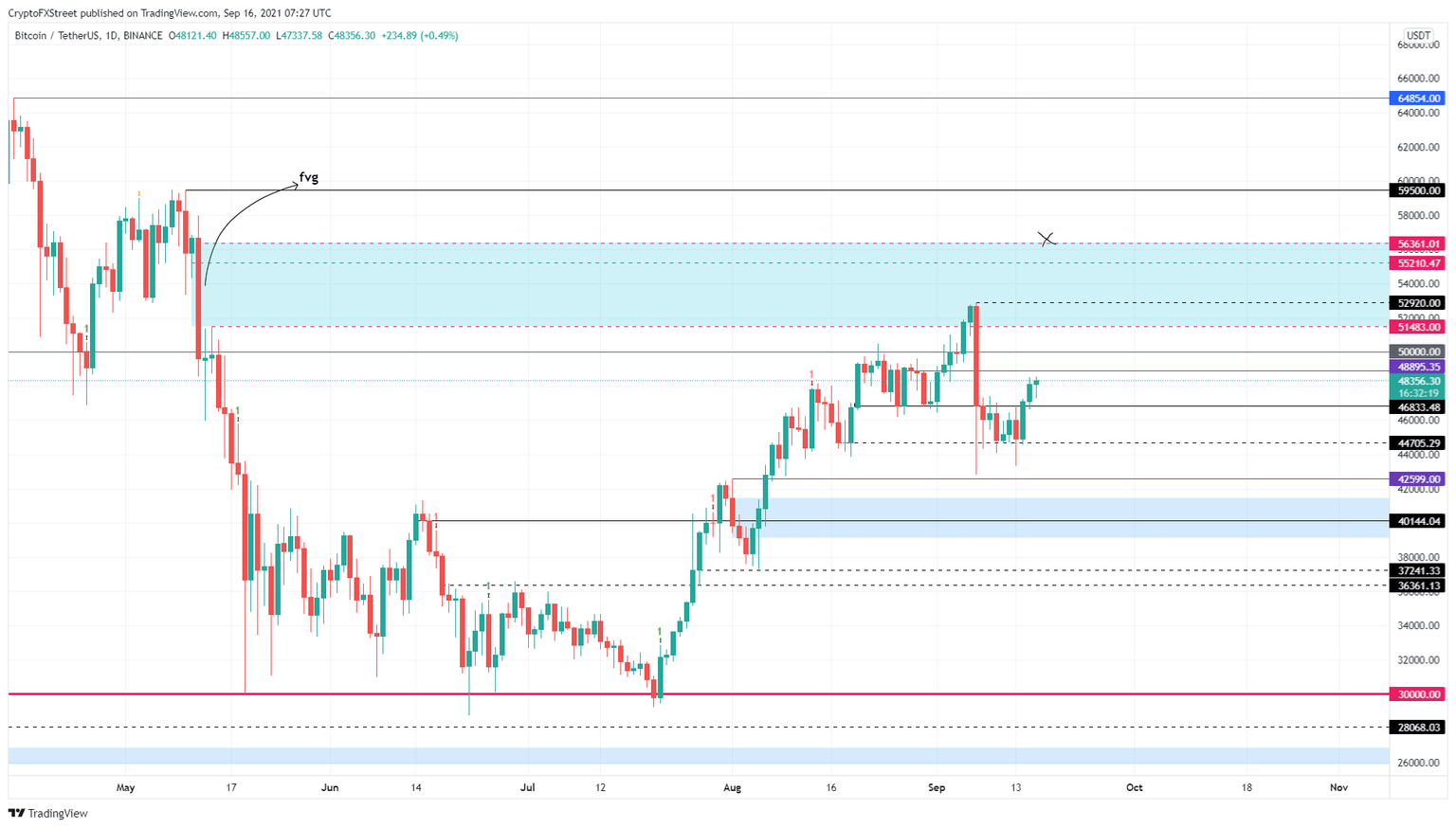

Bitcoin price approaches stiff resistance barrier

Bitcoin price rose 12% over the past three days and is currently trading around $48,380. The resistance levels at $48,895 and $50,000 are major hurdles in bulls’ path. Therefore, the bulls need enough momentum to flip these blockades into support platforms for a smooth recovery to September 6 levels.

This move will push BTC into the Fair Value Gap (FVG) and suggest that the buyers might be vying for a retest of this range’s upper limit at $56,361. If this development is complete, it will represent a 16% ascent from the current position.

BTC/USDT 1-day chart

On the other hand, if BTC fails to maintain its buying pressure, a retracement to $46,833 seems likely. However, a breakdown of $44,705 will invalidate the bullish thesis.

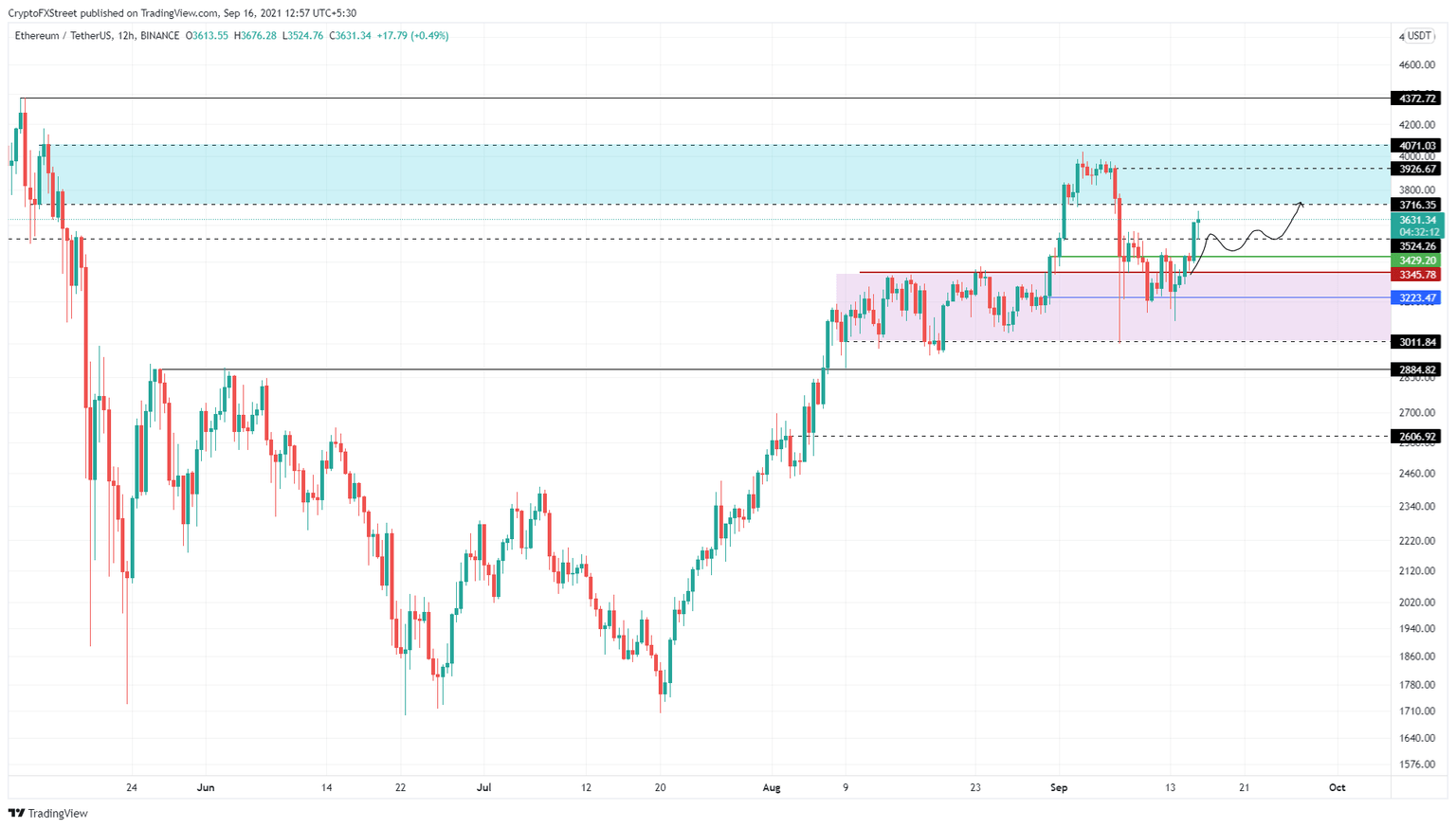

Ethereum price remains strong

Ethereum price consolidated between the $3,015 to $3,338 level for almost a month before it flew away from it and tagged the $4,000 psychological barrier. While this move was impressive, it was followed by the September 7 crash, undoing all the gains. However, the congestion seen between $3,015 to $3,338 helped limit the sell-off and kept ETH afloat.

Due to the recent uptick in big crypto’s price, Ethereum price seems to be heading close to the FVG, ranging from $3,716 to $4,071. Investors can assume the smart contract token will retest the $4,000 level if the current bullishness remains.

In a highly bullish case, a flip of the $4,071 supply barrier into the demand floor will hint at a move toward an all-time high at $4,372.

ETH/USDT 12-hour chart

Regardless of the bullishness Ethereum price exudes, if the big crypto takes a tumble, investors can expect ETH to follow suit promptly. While breaching below the $3,345 might trigger another consolidation, it would not invalidate the bullish thesis.

However, creating a lower low below $3,223 will put an end to the optimism around ETH.

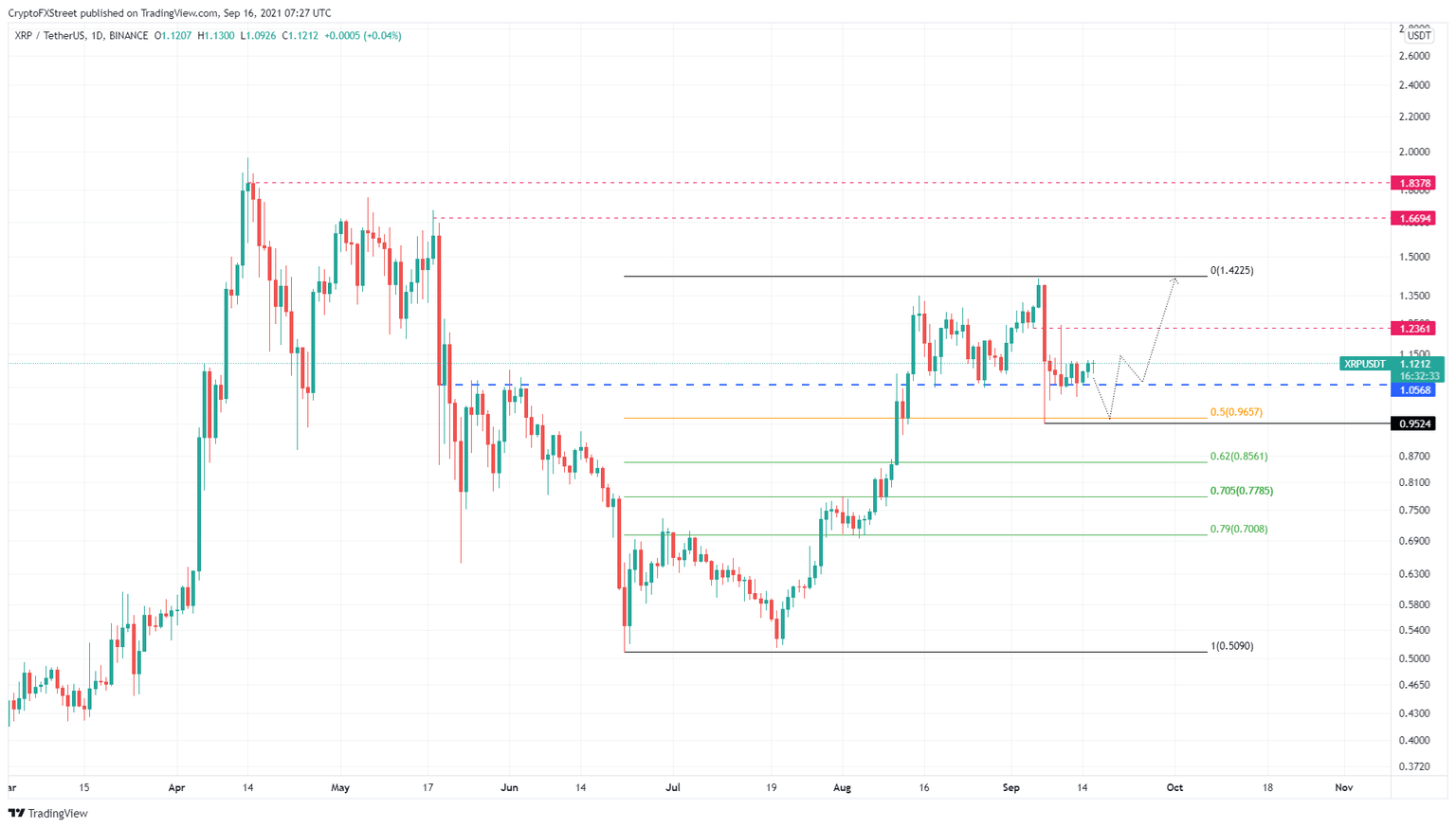

Ripple price makes a move

Ripple price set up a swing high on September 6 at $1.42 but failed to sustain the level as it was followed by a market-wide crash the next day. Due to this sell-off, XRP lost 25% of its value but managed to stay above the $1.05 support floor.

After a few days of consolidation, XRP price managed to bounce off this barrier and kick-start an uptrend. A 10% upswing from its current position will push Ripple to encounter the $1.23 resistance level.

Flipping this hurdle into a support level will open the remittance token’s path to the range high at $1.42. In a highly bullish case, XRP price might extend the ascent to retest the $1.66 and $1.83 ceilings.

XRP/USDT 1-day chart

While things seem to be going well for Ripple, a breakdown of the $1.05 support floor will invalidate the bullish thesis and scare the investors. This move will set up a lower low and might induce a sell-off to the subsequent demand barrier at $0.96.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.