Top 3 gainers Fartcoin, POL, DeepBook: Altcoins surge as Bitcoin nears $90,000

- Investors in select altcoins like Fartcoin, POL and DeepBook welcome double-digit gains.

- Bitcoin inches closer to $90,000, potentially waking up as digital Gold amid uncertainty in the macro environment.

- Farcoin's price rallies above $1.00, completing a 66% cup and handle breakout target.

- POL breaks out, signaling the potential for a massive rally, as DeepBook surges more than 40% on the day.

Fartcoin price extends gains above the $1.00 level at the time of writing on Tuesday after recovering from a dip triggered by profit-taking activity ahead of the weekend. POL, formerly known as MATIC, changed course, reversing the trend in favor of the bulls to trade at $0.2195 at the time of writing. On the other hand, DeepBook (DEEP) explodes in double-digit gains following the protocol's launch on the Sui Network.

Bitcoin price on the verge of hitting $90,000

The largest cryptocurrency by market capitalization, Bitcoin (BTC), popped up above $88,000 during the Asian session on Tuesday, tagging an intraday peak of $88,877. Spot Bitcoin Exchange Traded Funds (ETFs) recorded a total net inflow of $381 million on Monday, with none of the 12 licensed products posting net outflows, representing the return of institutional demand. This inflow surge underscores Bitcoin's role as a hedge during times of uncertainty in global markets, especially now with the US dollar (USD) sliding against major currencies.

US President Donald Trump's hostile gestures towards the Federal Reserve (Fed) shook the US dollar (USD), triggering a sharp drop on Monday as Trump criticized Fed Chair Jerome Powell for not cutting interest rates.

As FXStreet reported, "the US Dollar Index (DXY), which tracks the Greenback's value against six major currencies, hitting a three-year low, with markets interpreting the White House's direct attack on the Fed Chair Jerome Powell as threatening the central bank's independence."

Fartcoin price extends uptrend above $1

Fartcoin's price has worked its way above the psychological $1.00 level, increasing by over 10% on the day. At the time of writing, the meme coin exchanges hands at $1.06 after completing a cup and handle pattern's 66% breakout target, highlighted in previous analyses.

Fartcoin holds above the 50, 100 and 200 Exponential Moving Average (EMA) indicators on the 12-hour chart, signaling a strong bullish outlook toward the next target at $1.20, a resistance level tested in December and January.

The Relative Strength Index (RSI) indicator's move above 70 suggests buyers have the upper hand. However, entry into the overbought region introduces another risk of a potential pullback, especially if investors take profit.

FARTCOIN/USDT 12-hour chart

Traders would look for a 12-hour to a daily close above the immediate $1.00 support to ascertain the uptrend's strength. Declines below this level could cause a sharp price drop to the recent support level at $0.90 before extending the leg to $0.80 and $0.72.

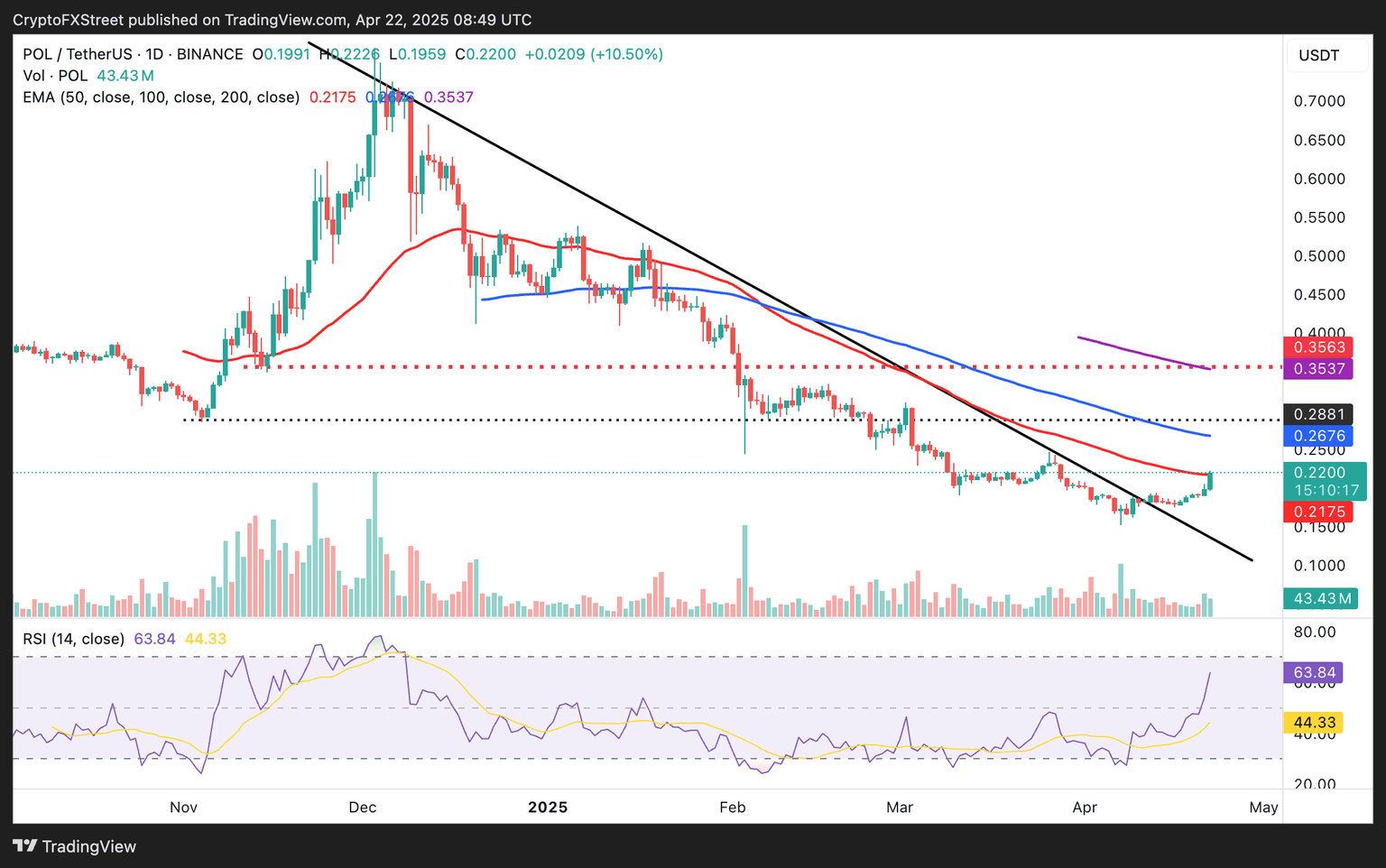

POL price breaks long-term descending trendline resistance

POL's price increases by nearly 10% to hover at $0.2195 at the time of writing on Tuesday. The token appears to have bottomed out at $0.1519, following the widespread crash in the crypto market on April 7.

The upward-pointing RSI indicator at 63.52 suggests strong bullish momentum and that POL may continue to move higher in the coming sessions and days.

Higher support is anticipated above the 50-day EMA around $0.2175, which may play a huge role in POL's ability to extend the uptrend to key targets at the 100 EMA holding $0.2676 and the 200-day EMA at $ 0.3537.

POL/USDT daily chart

On the flip side, if POL cannot hold above the 50-day EMA, some traders may choose to reduce exposure, anticipating a drop to the year-to-date low at $0.1519.

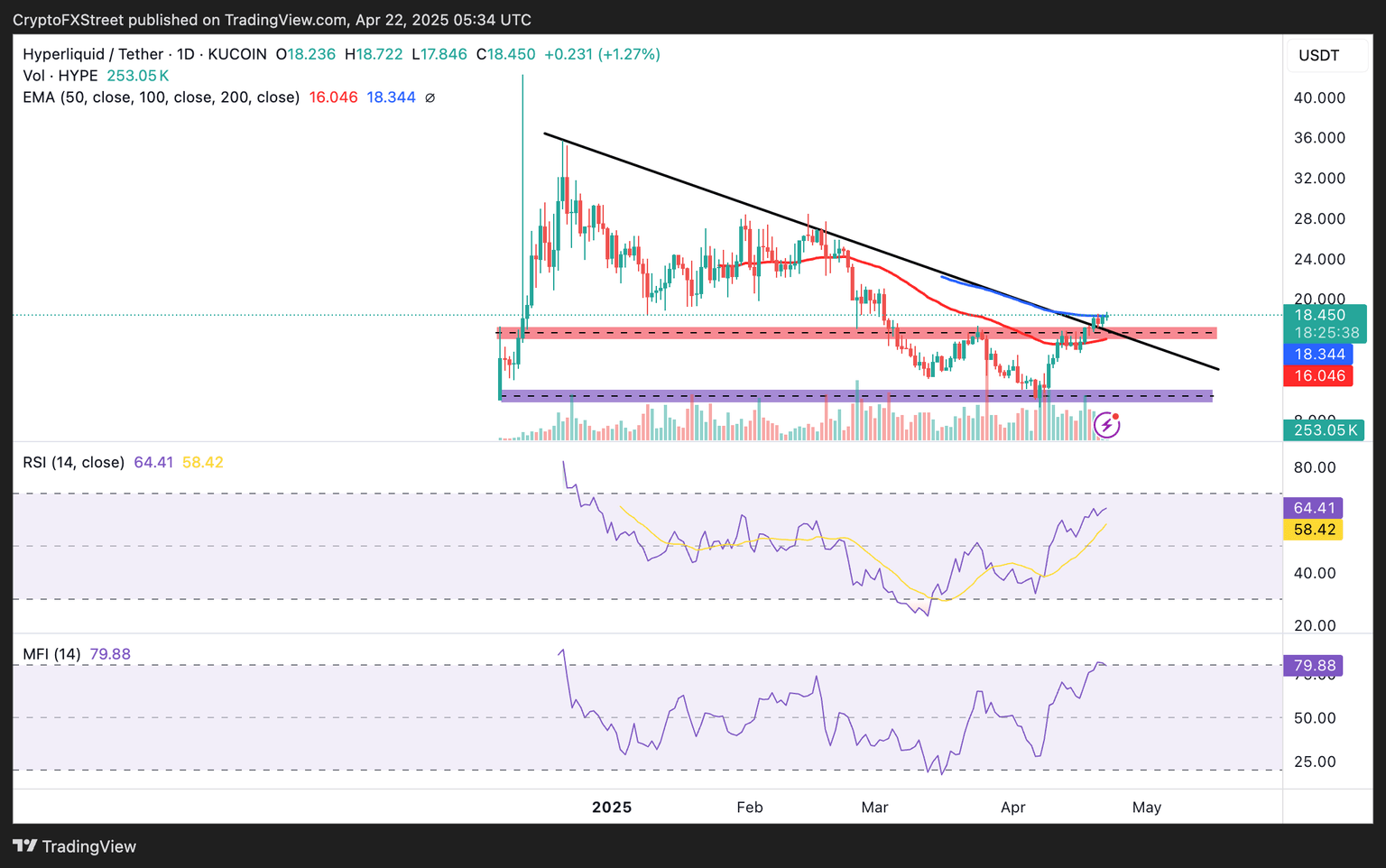

DeepBook’s massive rally could break the downtrend

DeepBook's launch on Sui Network on April 16 continues to positively impact the performance of DEEP, which tagged $0.1991, its highest level since mid-February. Despite the token surging by more than 40% on Tuesday, it has pulled back from the intraday high and currently hovers at $0.1256 at the time of writing.

DEEP/USDT daily chart

It is unclear whether the rally will continue, considering the RSI indicator is overbought at 75.90. If investors liquidate for profit, sell-side pressure could claw back the accrued gains. Traders may seek support at the 100-day EMA ($0.1026) and the 50-day EMA ($0.0901).

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren