Top 3 crypto tokens to buy as ETH targets record high

- Bonk prepares for a trend reversal as Safety Shot plans a $25 million BONK digital asset treasury.

- Floki’s bounce back from the 50-day EMA could lead to further gains.

- Ondo Finance could extend the Golden Cross-backed uptrend above $1.

Ethereum (ETH) based altcoins are gradually gaining momentum as the broader market sentiment improves, with Bitcoin (BTC) and the total crypto market capitalization reaching fresh record highs. The technical outlook for Solana-based meme coin Bonk (BONK), Ethereum-based Floki (FLOKI) and Ondo Finance (ONDO) suggests significant gains as the likelihood of a trend reversal increases.

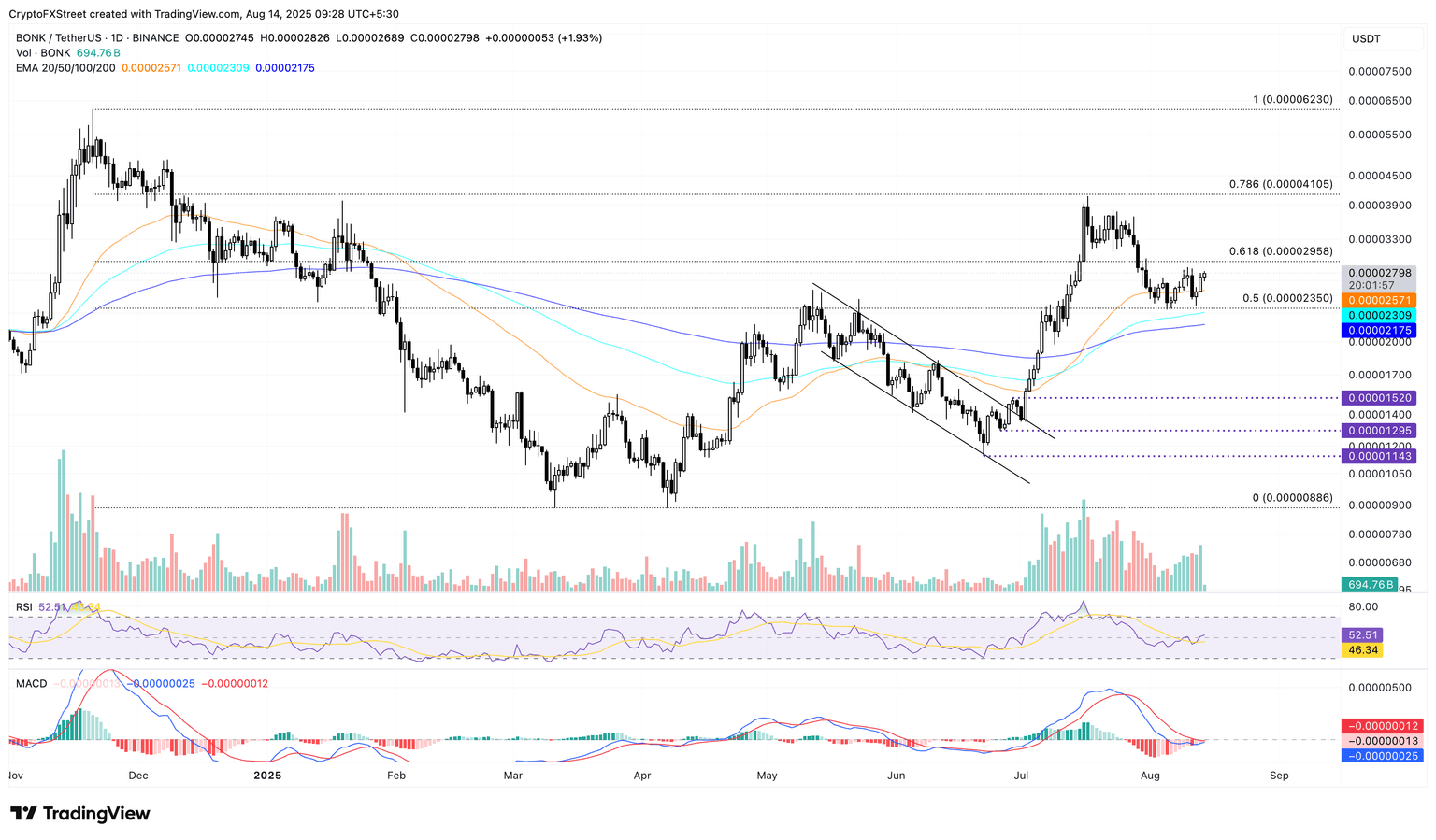

BONK eyes breaking out of the consolidation range

Bonk edges higher by 2% at press time on Thursday. extending the uptrend for the third consecutive day. The meme coin consolidates within the 50% retracement and 61.8% Fibonacci levels at $0.00002350 and $0.00002958, respectively, drawn from $0.00006230 on November 20 to $0.00000886 on April 7.

Safety Shot, a NASDAQ-listed company, has announced plans to establish a $25 million BONK digital asset. The institutional interest could boost the risk-on sentiment surrounding BONK among retail investors.

The uptrending 50-, 100-, and 200-day Exponential Moving Averages (EMAs) indicate a bullish trend and could serve as dynamic support levels in the event of a supply surge. If the uptrend marks a decisive close above the $0.00002958, BONK could extend the rally to the 78.6% Fibonacci level at $0.00004105. This breakout run would account for a 46% rise from the current market price.

Sidelined investors may consider the Moving Average Convergence Divergence (MACD) crossing above its signal line, a sign of trend reversal, as a potential buy opportunity.

The Relative Strength Index (RSI) reads 52 on the daily chart, as it hovers near the midpoint, indicating neutral trading activity. A spike in RSI could support the uptrend in BONK.

BONK/USDT daily price chart.

Looking down, the meme coin risks invalidating the uptrend if it drops below the 50% retracement level at $0.00002350.

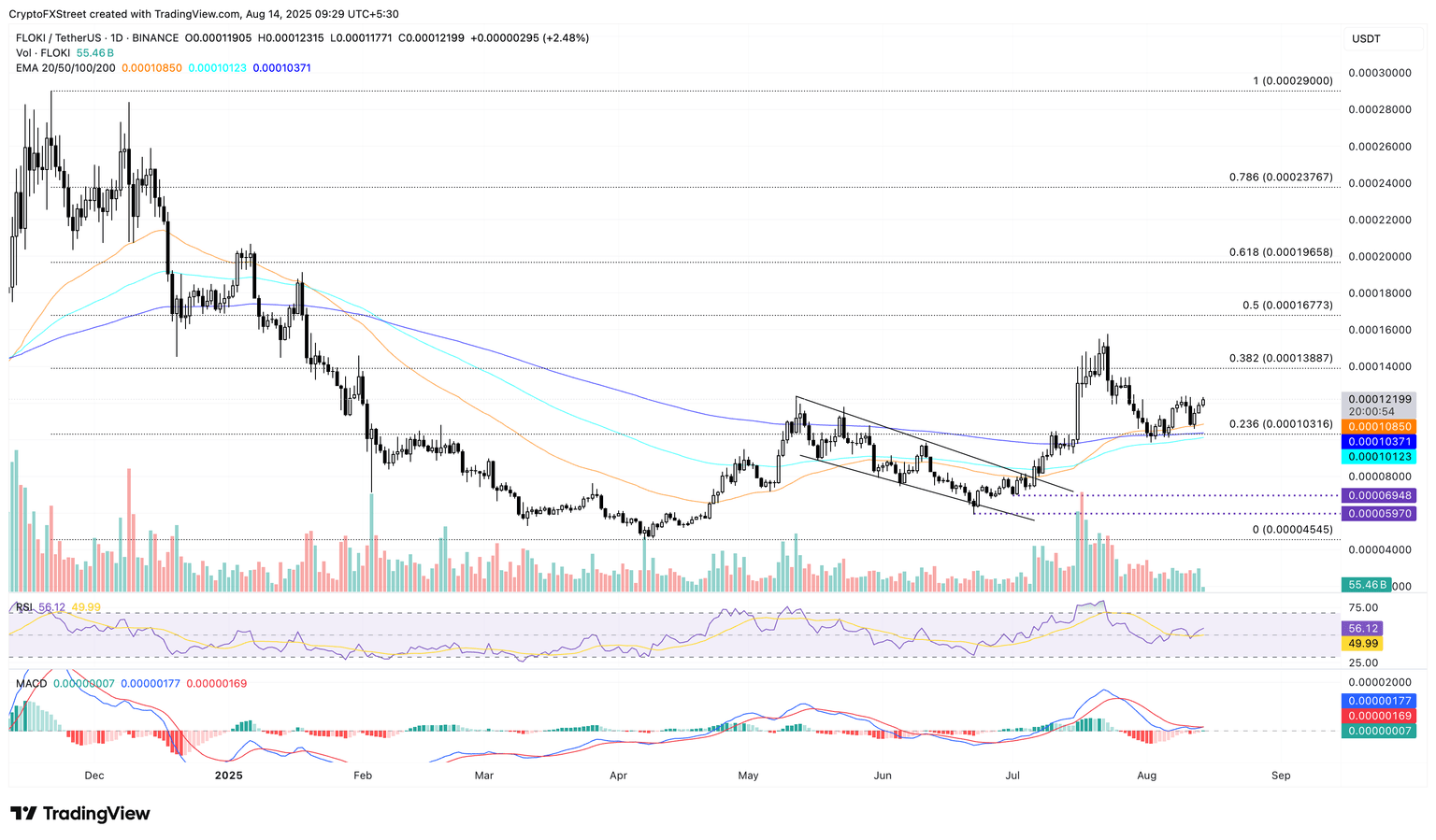

FLOKI’s rebound gains traction

Floki, one of the top-performing meme coins from the 2021 bull run, teases a bullish comeback. The meme coin edges higher by over 2% at the time of writing on Thursday, printing its third green candle as it bounced off the 50-day EMA.

FLOKI bulls sustain dominance over the 23.6% Fibonacci level at $0.0001031, which was retraced from $0.0002900 on November 21 to $0.0000454 on April 7, marking a short-term reversal. Furthermore, the uptrend increases the chances of a Golden Cross between the 100- and 200-day EMAs.

The Ethereum-based meme coin is targeting the 38.2% Fibonacci level at $0.0001388 as its primary resistance. A decisive close above this could test teh 50% retracement level at $0.0001677.

The momentum indicators suggest a high likelihood of a trend reversal. On the daily chart, the RSI, at 56, points upwards, suggesting room for growth as buying pressure increases. Additionally, the MACD line approaches its signal line for a crossover, which would signal a revival of bullish momentum.

FLOKI/USDT daily price chart.

On the contrary, a drop below the 200-day EMA near the $0.0001000 psychological level would invalidate upside chances.

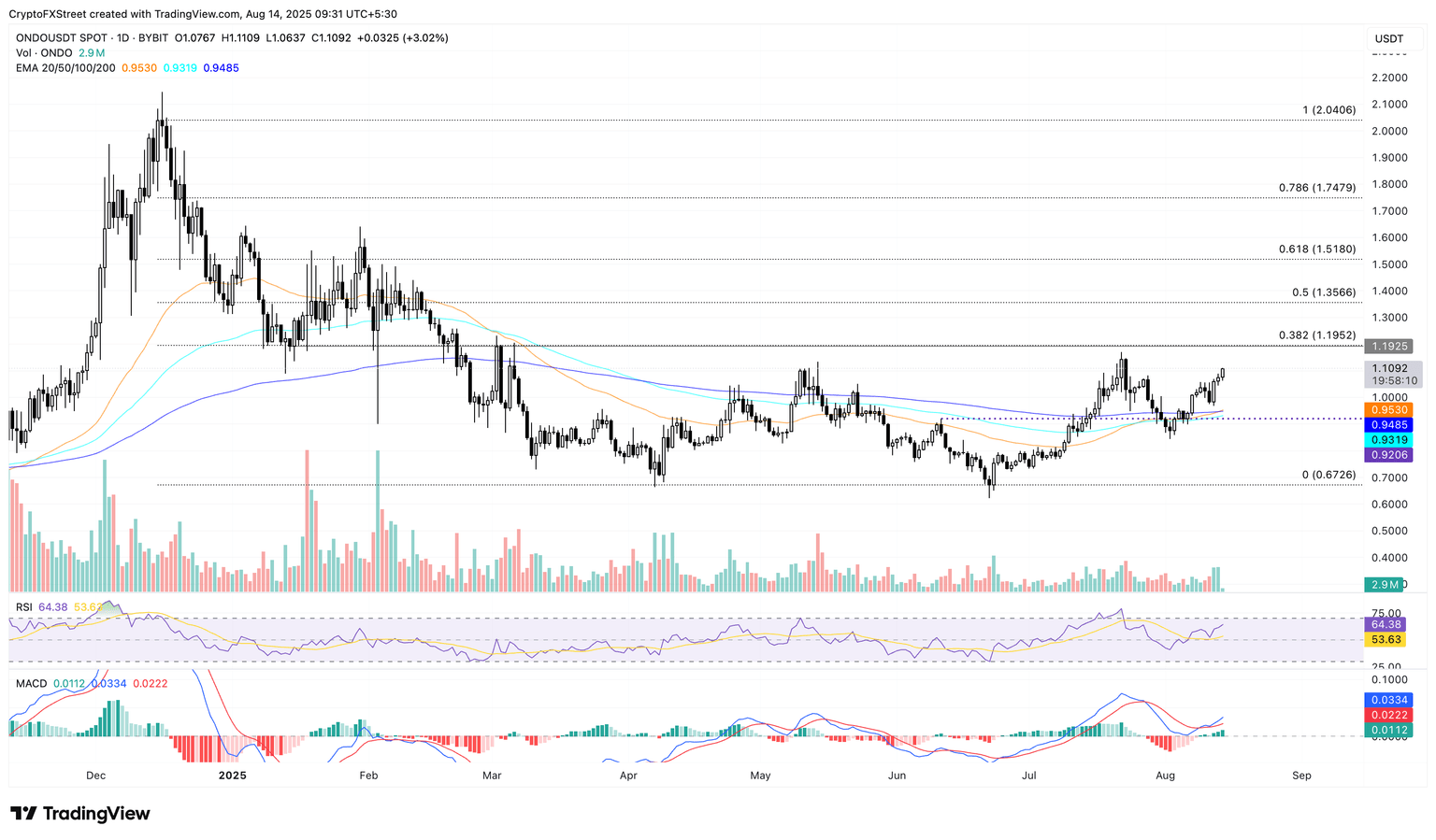

ONDO targets higher amid a Golden Cross

Ondo Finance, an Ethereum-based Real World Asset (RWA) tokenization project, has appreciated by 3% at press time on Thursday, targeting the 38.2% Fibonacci level at $1.195, which is drawn from $2.040 on December 15 to $0.672 on June 22.

The bullish run in ONDO results in a Golden Cross between the 50- and 200-day EMAs signaling a trend reversal. Furthermore, the momentum indicators tilt bullish as the RSI, at 64, inches closer to the overbought boundary, and the MACD trend higher with its signal line and rising green histograms.

ONDO/USDT daily price chart.

A clean push above the $1.195 level could extend the made in America token rally towards $1.355, aligning with the 50% retracement level.

(This story was corrected on August 14 at 17:54 GMT to say in the second line that BONK is a Solana-based meme coin, not on the Ethereum blockchain).

Author

Vishal Dixit

FXStreet

Vishal Dixit holds a B.Sc. in Chemistry from Wilson College but found his true calling in the world of crypto.