Three reasons why PancakeSwap CAKE is rallying 96% in seven days

- PancakeSwap native token, CAKE, surged 8% on Thursday, inches close to $3.

- CAKE ranked first in 7-day trading volume and recorded $99.8 billion in 30-day trading activity.

- Former Binance CEO CZ’s comments on the BNB ecosystem catalyzed price rallies in several tokens, including CAKE.

PancakeSwap’s native token CAKE extended gains by 8% on Thursday, inching closer to the $3 level. The DEX token hit several key milestones in the last 30 days, according to an official update shared on X.

Binance’s former Chief Executive Officer (CEO) Changpeng Zhao (CZ) recently commented on the Binance Coin (BNB) ecosystem, catalyzing gains in several tokens on the chain, CAKE included.

Why CAKE rallied 96% in seven days

PancakeSwap listed its milestones in a recent tweet on X, sharing that the decentralized exchange ranked first in 24-hour trade volume and captured a 21.87% market share. The DEX also tops the list in seven-day trade volume and hit a milestone of $99.9 billion in 30-day trade volume.

Guess who’s back?

— PancakeSwap (@PancakeSwap) February 13, 2025

PancakeSwap in a nutshell across all chains & DEXs:

No. 1 in 24hr Trading Volume (21.87% market share)

No. 1 in 7-day Trading Volume

Hit $99.9B in 30-day Trading Volume

Source https://t.co/xHIaNW4r4f pic.twitter.com/cuLPrQCzgF

Another key market mover is Binance’s former CEO CZ’s insights on the BNB ecosystem and its 2025 roadmap. CZ shared a list of the Binance Chain’s feats in 2025, including sub-second block finality, gasless and 100 million transactions a day, and other features like wallet, AI and memes on the blockchain.

BNB Chain in 2025:

— CZ BNB (@cz_binance) February 11, 2025

Sub-second block finality

100 million tx per day

Gasless tx

Smart wallet

AI

Memes

Dev tools

Also:

DeSci

DePIN

RWA

Gov efficiency

And more...

So much to build! https://t.co/Hgbp0tvygr

Data from TradingView shows CAKE rallied 96% in seven days and added 6% to its value on the day.

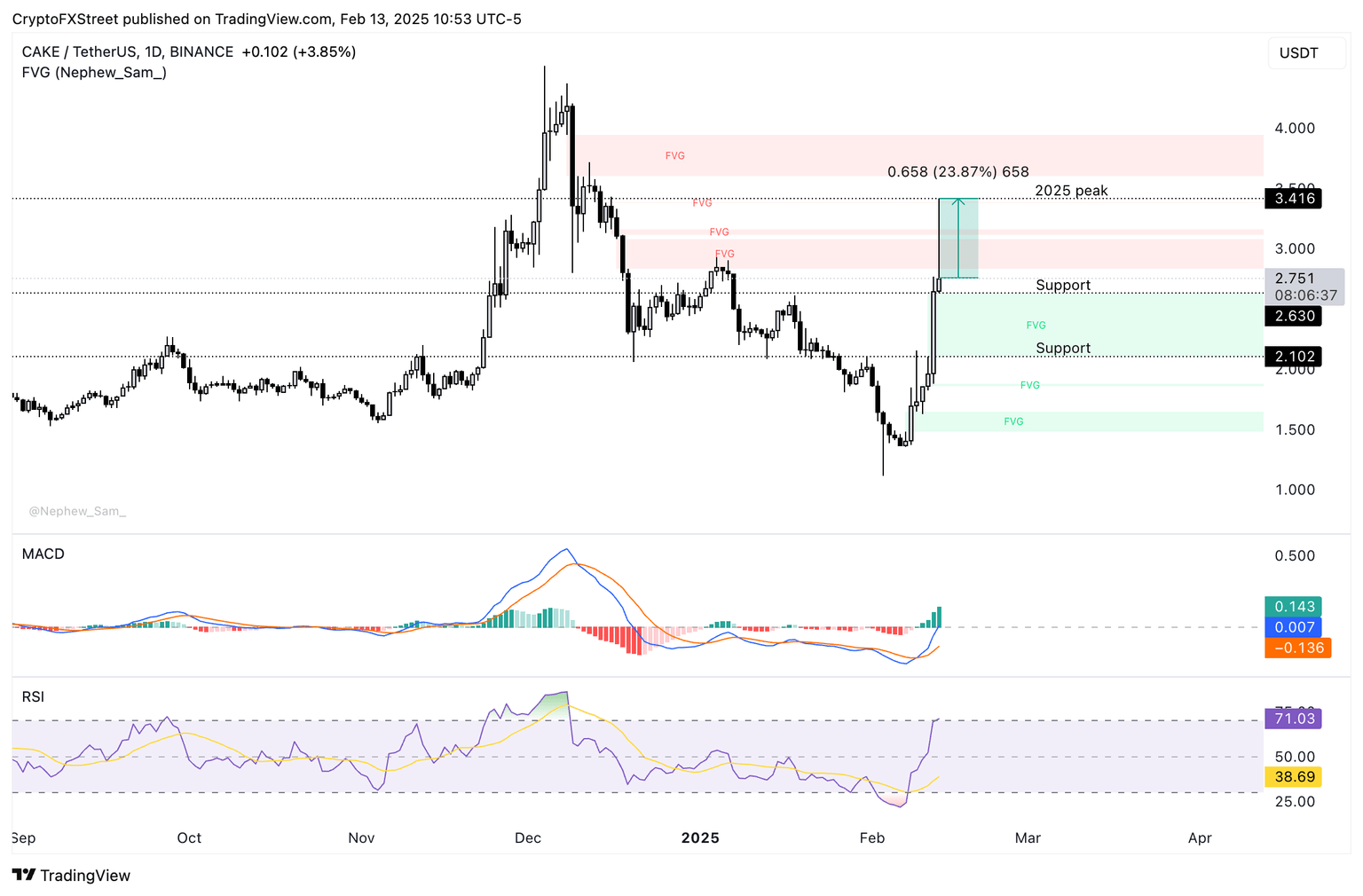

CAKE is trading 23% below its 2025 peak of $3.416. The native token of the DEX could find support at the lower and upper boundaries of the imbalance zone between $2.630 and $2.102, as seen on the daily price chart.

The Moving Average Convergence Divergence (MACD) indicator flashes consecutively taller green histogram bars above the neutral line, signaling positive underlying momentum in the CAKE price trend.

Relative Strength Index (RSI) generates a sell signal on the daily timeframe as the indicator crosses into the overvalued zone above 70. Traders need to keep their eyes peeled for a correction in CAKE price.

CAKE/USDT daily price chart

CAKE could revisit its 2025 peak, in the event of a correction, the DEX token could slip to the closest support before attempting a recovery.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.