Theta price confuses forecasts, as THETA battles key resistance

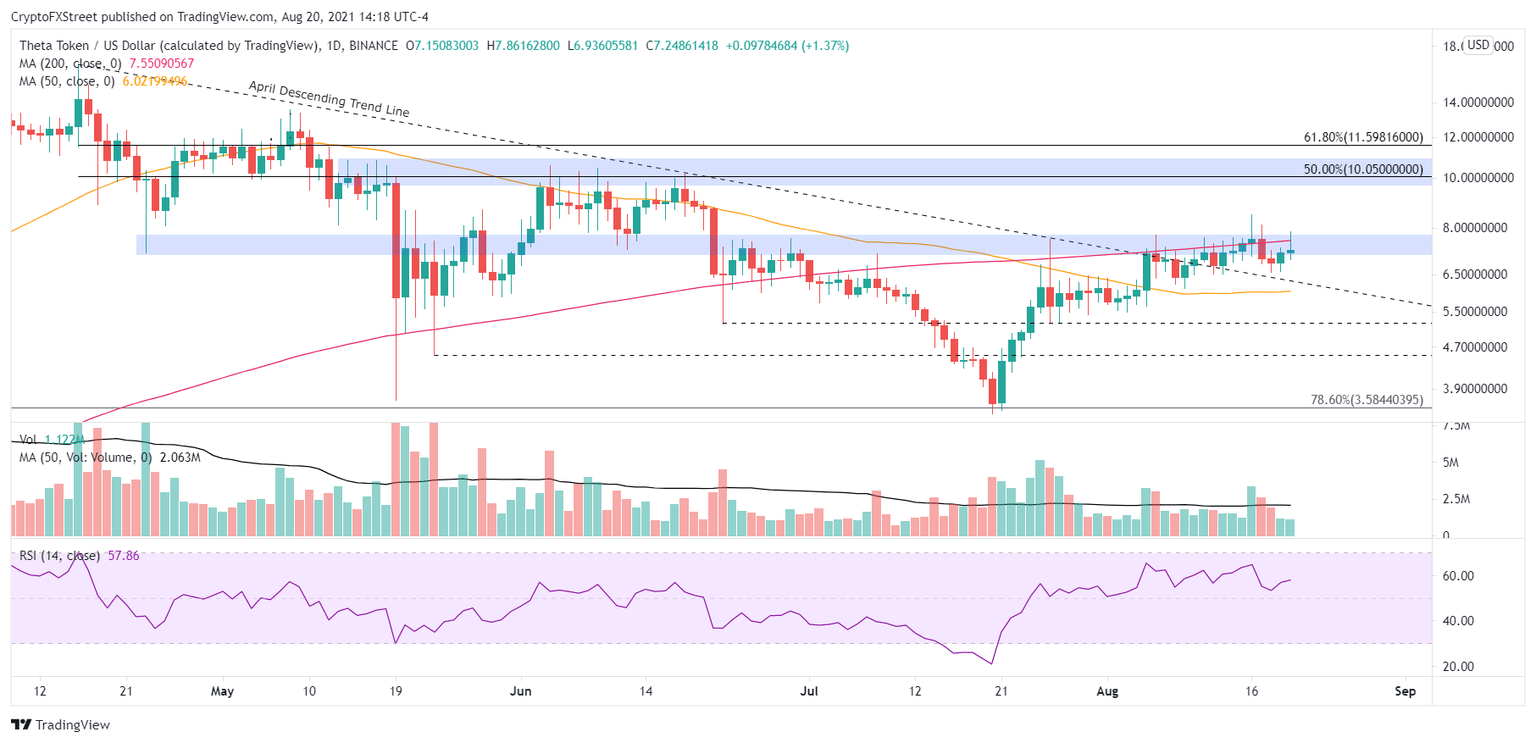

- Theta price fails to overcome the 200-day simple moving average (SMA) resistance, condemning the altcoin to a mild wedge higher.

- THETA breaks above the April descending trend, creating a new level of support to contain potential weakness.

- The daily Relative Strength Index (RSI) is not overbought, providing room for Theta price to rally if resistance is broken.

Theta price enjoyed an impulsive rally for the first six days after bottoming on July 20, climbing over 100% at the July 26 peak of $7.60. THETA has not recorded a daily close above $7.60 since as the 200-day SMA magnet effect has contained price progress. Until the digital coin can record a daily close above $7.75, it is doomed to further fluctuation along the 200-day SMA or a pullback to the rising 50-day SMA.

Theta price in search of catalyst, despite strong market

At the July 20 low, Theta price recorded an extreme oversold condition on the daily RSI, providing the foundation for the remarkable 100% gain over the next six days. However, THETA has failed to capitalize on the initial momentum and the broad market strength to strike higher prices. As a result, the altcoin has been frustrated by 200-day SMA and the April descending trend line.

A second barrier to improved Theta price action is the robust resistance established by a range of price congestion between $7.10 and $7.75, extending back to the April low of $7.16. THETA attempted to breach the range on August 6, August 16, August 17 and today but could not register a daily close above.

If Theta price does close above $7.75, it should spark a 26% rally to another formidable range of resistance between $9.75 and $10.80, outlined by a large number of highs in May and early June. The range is bolstered by the 50% retracement of the April-July correction at $10.05

THETA/USD daily chart

To conclude, THETA is in search of a catalyst to bust the resistance and clarify the forecasts. Without a daily close above $7.75, speculators should not contemplate allocating capital. With that said, the one redeeming technical point for Theta price is the existence of nearby support that includes the April descending trend line at $6.30 and then the 50-day SMA at $6.02, enhancing confidence if the price congestion is overcome.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.