The9 solidifies its Filecoin mining investment while FIL price hints at 17% drop

- A software company, The9, signed a deal to purchase $2 million worth of Filecoin mining machines.

- This move comes after The9 had previously signed a $10 million agreement with a Filecoin mining machine vendor.

- FIL price is getting squeezed in a rising wedge pattern, indicating a 17% drop shortly.

The development around Filecoin, its mining machines and hosting have caused FIL prices to climb violently in the last few days. However, this surge could be coming to an end as a bearish pattern looms.

The9 signs second Filecoin deal in under two months

On Tuesday, The9, a Shanghai-based online game operator, signed a $2 million Filecoin mining machine purchase and hosting agreement with a Filecoin mining service provider.

Filecoin has been growing increasingly popular among Chinese counterparts due to the mining incentives. Hence, The9’s investment deal makes sense. Additionally, the company is known to own and operate an independent node on the Filecoin blockchain.

Moreover, The9 also owned approximately 8 Pebibytes of effective storage mining power in the Filecoin network. This share has increased to 80 Pebibytes after the recent deal was struck.

The news of this caused the Filecoin price to skyrocket 25% in under 16 hours on March 30.

FIL price surge could face blockade

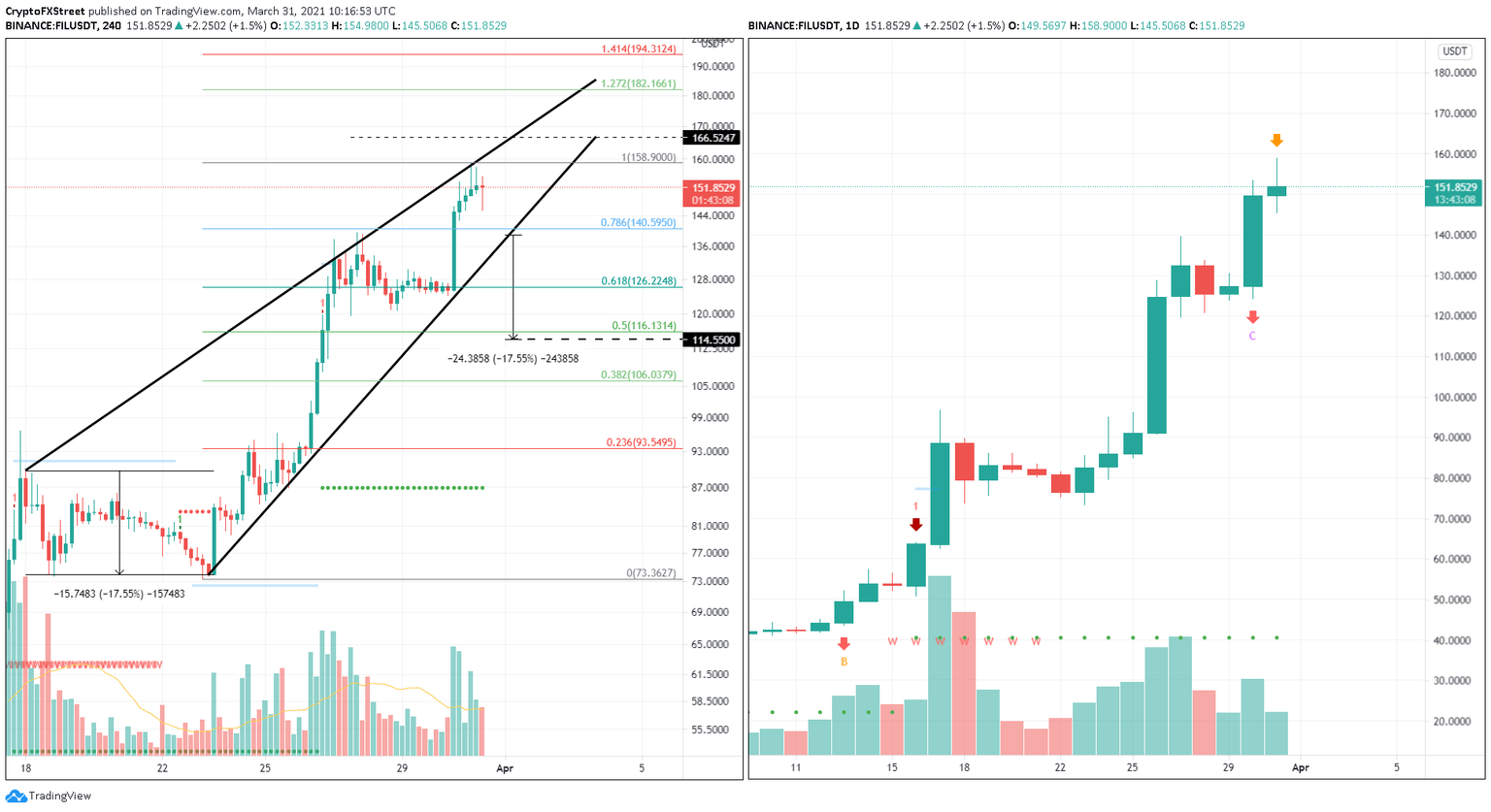

The FIL price has created three higher highs and lows in the last 13 days. A rising wedge pattern is formed when the swing points are joined using trend lines.

The technical formation has a bearish bias that is confirmed after a breakdown of the lower trend line. In Filecoin’s case, a breach of the $138.95 level will trigger a 17% crash, determined by measuring the distance between the swing high and low at the broadest part.

This target places the Filecoin price at $114.55.

Interestingly, the target is extremely close to the 50% Fibonacci retracement level at $116.13.

Adding credence to the bearish outlook is the preemptive cycle top signal portrayed by the Momentum Reversal Indicator (MRI) on the daily chart. This sign suggests that the Filecoin price might be due for a reversal toward its lower trendline.

Therefore, a breakdown of the rising wedge’s lower boundary could result in a 17% drop to $114.50.

FIL/USDT 4-hour, 1-day chart

On the other hand, a sudden spike in bullish momentum leading to a decisive close above the upper trend line at $158.90 could jeopardize the bearish thesis.

In such a scenario, the FIL price could surge nearly 5% to $166.52. This move would invalidate the bearish outlook. If the bullish momentum persists, then investors can expect a move toward the 127.2% Fibonacci extension level at $182.16.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.